Deputy CEO, is currently responsible for innovative development at SOCAR PETROLEUM, distribution subsidiary of SOCAR in Azerbaijan. Certified Fraud Examiner, a member of ACFE.

Payment cards today: prospects and safety use

- პერსონალური ბლოგი

- ოქტომბერი 2, 2020

- 12:26 pm

“…it’s about 4000 times easier to steal your identity today than it was previously…”

Frank Abagnale

It is difficult to imagine our everyday life without bank payment cards. For banks – issuance of payment cards is a mix of image-making and commercial project, while for users – it is a convenient payment method with a number of advantages. We talked about trends and prospects, pros and cons of payment cards, as well related safety use issues with Elnur Mustafayev, general director deputy on innovations at SOCAR PETROLEUM, certified fraud examiner, member of ACFE.

What role do payment cards play in the banking business today, how important is this market segment for banks? Sometimes, cards are being offered for nominal fees or even free of charge. It may seem that card business is a brand awareness activity than a commercial project, is this true?

The total number of payment cards issued globally exceeds 22 billion1, while annual volume of card transactions exceeds US$ 40 trillion2. On average there are three cards per inhabitant in the world. In the United States only credit cards’ number exceeds a billion or three credit cards per inhabitant on average, that is about a third of total credit cards’ number globally3.

Today, payment cards oriented banks should realistically assess related business opportunities and take into account higher competition, from both card issuers as well as providers of alternative payment methods (“APM”). Declining margins of “plastic” operations, on one hand, and consistent needs for investments into technology and personnel competencies, on the other, make business conditions more complicated.

The segment’s leading banks earn a significant portion of income from card transactions. In 2019, Bank of America’s card revenue was US$ 5.8 billion, or 18% of its pre-tax profit4. Sberbank of Russia, Russian card market leader, earned about US$ 2.7 billion from plastic transactions, or 16% of its pre-tax profit5.

Corresponding revenues of Kapital Bank, the leader of card market in Azerbaijan, amounted to about US$ 35 million or 24% of its profit before tax6.

Cards’ business performance substantially depends on volumes, and therefore product’s scalability is critical. Accordingly, precision of strategic positioning and assessment of the target audience, as well as effectiveness of marketing actions and operational work are key success factors of payment card projects.

What are pros and cons of payment cards for users as compared to cash money?

Convenience of use, speed of processing and no need for change the money in particular, is clearly beneficial for users. An important advantage also is the opportunity to earn bonuses and get other benefits. Mobile banking has expanded payment cards functionality, turning them into an even more convenient payment method. Disadvantages include the risk of funds’ losses, which sometimes is underestimated. Also, card payments do not let users get feeling of “parting with the money”, which may lead to excessive expenses.

What can you tell us about current trends, innovations and competing offers on the payment segment?

At the present, payment cards providing users with benefits, bonuses and “cash-back” functions, have certain growth potential. It should be noted, however, that during the anti-pandemic quarantine and the post-pandemic period, the opportunities for financing of such card products at the cost of retailers’ margin is likely to be considerably limited.

On the regional market, as a whole, credit cards’ potential is mainly unrealized. Payment cards of this type account for only 8%7 of the total number of cards issued in Georgia (15 credit cards per 100 inhabitants), 11%8 – in Azerbaijan (nine credit cards per 100 inhabitants), 13%9- in Russia (26 credit cards per 100 inhabitants) and in Kazakhstan (28 credit cards per 100 inhabitants), and 28%10- in Ukraine (24 credit cards per 100 inhabitants). In the meantime, the world’s average is 3711 credit cards for every hundred inhabitants. In the first half of 2019, 56% of total card transactions globally were paid by credit cards, and the growth of these transactions made 13%12. In the context of this global trend, it would be reasonable to expect some developments of credit cards subsegment on the regional market.

From the view of processing, EMV cards, better known as chip cards, have some considerable advantages. Chip technology made contactless payments possible, this function became even more demanded during the anti-pandemic quarantine. EMV cards have an increased level of security, however still cannot be considered as completely protected from unauthorized copying (“cloning”) due to the magnetic stripe they continue to contain.

Biometric authentication based on biometric data such as voice, face, eyes or fingerprint is innovative solution that helps to improve card transactions’ security. Biometric authentication is conveniently protecting digital personal data and representing another global trend.

APM, such as internet banking, e-wallets and others are putting serious pressure on the payment cards segment. Fully digital solution, accessibility, user friendly interface and lower processing costs are main advantages. According to experts, in 2021, more than 50%13 of all online payments are forecasted to be transacted using APM. APM market development is a firm trend of the global payment industry having direct impact to issuance, dynamics of operations and processing costs of payment cards, which still remain a main mean of non-cash payments.

What can you tell us about the current stage of card business in our region?

According to World Cash Report 2018, in terms of the number of cards South Korea is at the first place per capita having more than five cards (5.1) per inhabitant, China and Paraguay are the second – about five (4.4), the USA – is the third having more than four cards (4.1), while global average is about three cards per capita14. In the meantime, card issuers have stronger growth opportunities at the developing markets. Today, there are about 290 million payment cards in circulation in Russia, that is approximately two cards per one inhabitant (1.97)15. In Georgia, this number is also approaching two cards per capita (1.81)16, and in Kazakhstan it exceeds this level (2.20)17. In 2020, the number of cards in Azerbaijan and Ukraine exceeded 8 ½ million and 25 ½ million, accordingly, or less than one card per one inhabitant (0.8718 and 0.8619, accordingly). Accordingly, in the foreseeable future, based on the global average, an additional issue of payment cards in Georgia may comprise 4 million, in Kazakhstan – 15 million, in Azerbaijan – 20 million cards, in Ukraine – 89 million and in Russia – 150 million20.

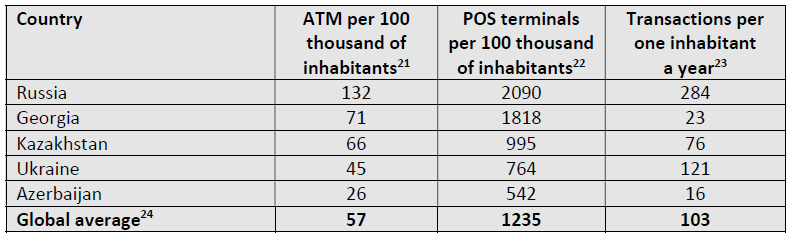

In the meanwhile, card processing infrastructure is rather differently developed among the region’s countries. Some countries are above global average while others have to improve considerably.

How significant is card fraud today?

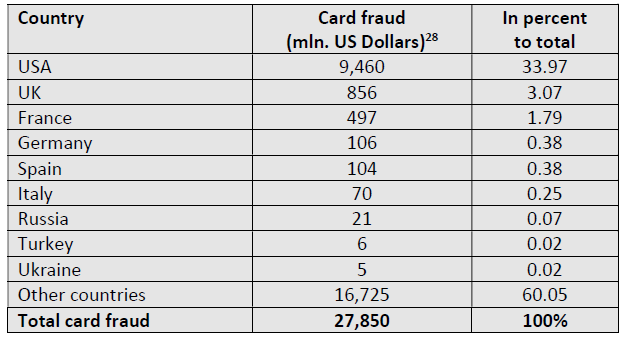

The cumulative global volume of card transactions, including payments for goods and services as well as cash withdrawals, exceeded US$ 40 trillion in 2018 and is expected to exceed US$ 47 trillion in 202025. At the same time in 2018 the volume of card fraud losses, amounted to almost US$ 28 billion, that is 6.86 cents for every US$ 100 of total volume26. This value is forecasted to decline to 5.68 cents for every US$ 100, while in absolute terms the total amount of card fraud will increase to US$ 41 billion by 202727. This indicates that card fraud is a highly significant global problem, that is likely to remain to be an issue going forward.

Card fraud is a crime that, as a rule, is committed with the use of cyberattacks and other elements of cybercrime, social engineering methods, and other forms of fraud.

Theft of funds using stolen cards details (“card not-present fraud” or “CNP fraud”) comprises unauthorized and illegal online payments, accounted for 54% of the total losses, while CNP purchases volume amounts to less than 15%29 of all purchases volume worldwide. This emphasizes once again that data security is a key for safety use of payment cards. Other categories of card fraud include lost or stolen cards, counterfeited (“cloned”) cards, ID theft or theft of personally identifiable information (“ID/PII theft”) with the subsequent opening of accounts or taking control over existing accounts with the purpose to steal funds, as well as other illegal actions with payment cards.

What actions may be relevant in our region to effectively resist card fraud?

It would be relevant to undertake appropriate legal reforms to provide card users with an appropriate legal protection against losses due to fraud, theft and other fraudulent activities with payment cards.

Such legal protection is a common practice on the international market place. For example, the Fair Credit Billing Act of 1974 and the Electronic Funds Transfer Act of 1978 in the United States as well as the Consumer Credit Act of 1974 in the United Kingdom, are legislative acts limiting card users’ losses due to card fraud.

Following the global and regional best practices, the below legislative initiatives, reforms and related efforts are priority:

a. Legislative initiatives and reforms aiming to:

- provision of legal protection limiting card users’ losses due to unauthorized payments, theft and fraudulent activities;

- ensuring security of personally identifiable information.

b. Criminalization of card fraud and related illegal activities, including thefts of funds, fraudulent actions associated with cyberattacks, use of malicious software, Internet and e-commerce fraud.

c. Setting up a task force responsible for monitoring of and responding to card fraud cases and potential threats, in particular establishment of an effective platform to respond to inquiries of card fraud victims.

d. Information exchange among financial market participants, law enforcement agencies, providers and telecom operators, system integrators, anti-virus software developers and other companies engaged in the field of information security.

e. Investments into advanced technologies and staff competences focusing to:

- Application of biometric authentication, strengthening of transactions approval requirements, regular monitoring of IT systems for vulnerabilities;

- Continuous improvement of personnel qualification in the context of the rapid growth of customers’ base and technology changes.

f. Regular and accessible propaganda as a part of the general public financial literacy improvement.

What would you advise to our readers to assist them in ensuring safety of their daily card transactions?

To begin with, card users should take into account that their funds in a bank can be stolen, just like the money from pocket or wallet. Further, people should definitely take care of their financial literacy by getting basic knowledge about everyday financial transactions and related technologies.

As for the more practical advice, these are recommendations that cover almost all areas of cards transactions. By adhering to these recommendations, card users can reduce the likelihood of card fraud cases and related risks of losses.

——————————————————————————————————————————————————————————-

1 https://www.statista.com/statistics/1080756/number-payment-cards-in-circulation-worldwide.

2 THE NILSON REPORT, NOVEMBER 2019/ISSUE 1164; page 1.

3 Credit card statistics 2020: 65+ facts for Europe, UK, and US; page 2.

4 BANK OF AMERICA, Annual Report 2019; page 45; percent ratio is calculated as card income divided to pre-tax profit.

5 Consolidated Financial Statements Sberbank of Russia and its subsidiaries for the year ended 31 December 2019; pages 2, 68; percent

ratio is calculated as card income divided to pre-tax profit, revenues in Russian roubles translated to US dollars at average rate during the

corresponding period.

6 “Kapital Bank” ASC Consolidated Financial Statements for the year ended 31 December 2019; pages 2, 44; percent ratio is calculated as

card income divided to pre-tax profit, revenues in Azerbaijani manats translated to US dollars at average rate during the corresponding

period.

7 Calculated based on data of Central Bank of Georgia as of 01.07.2020.

8 Calculated based on data of Central Bank of Azerbaijan Republic as of 01.07.2020.

9 Calculated based on data of Central Bank of Russia for the first quarter of 2020 года and data of National Bank of the Republic of

Kazakhstan as of 01.07.2020.

10 Calculated based on data of Central Bank of Ukraine for the month of May 2020.

11 Calculated based on data published at «Credit card statistics 2020: 65+ facts for Europe, UK, and US» (page 2) and the number of global

population in 2018.

12 THE NILSON REPORT, NOVEMBER 2019/ISSUE 1164; page 9.

13 Top Trends in Payments: 2020; page 10.

14 Calculated based on the number of cards issued and the number of global population in 2018.

15 Calculated based on data of Central Bank of Russia for the first quarter of 2020 and the number of population of Russia.

16 Calculated based on data of Central Bank of Georgia as of 01.07.2020 and the number of population of Georgia.

17 Calculated based on data of National Bank of the Republic of Kazakhstan as of 01.07.2020 and the number of population of Kazakhstan.

18 Calculated based on data of Central Bank of Azerbaijan as of 01.07.2020 and the number of population of Azerbaijan.

19 Calculated based on data of Central Bank of Ukraine for the month of May 2020 and the number of population of Ukraine.

20 Calculated as difference between factual number of cards based on the data of central banks of the countries indicated in the analysis

and global average number of payment cards.

21 Calculated based on data of central banks and the number of population of the countries (Azerbaijan, Georgia, Kazakhstan – as of

01.07.2020; Russia – for the first quarter of 2020; Ukraine – for the month of May 2020).

22 Calculated based on data of central banks and the number of population of the countries (Azerbaijan, Georgia, Kazakhstan – as of

01.07.2020; Russia – for the first quarter of 2020; Ukraine – for the month of May 2020).

23 Calculated based on data of central banks and the number of population of the countries (Azerbaijan, Georgia, Kazakhstan – as of

01.07.2020; Russia – for the first quarter of 2020; Ukraine – for the month of May 2020).

24 World Cash Report 2018; pages 23, 24, 37.

25 THE NILSON REPORT, NOVEMBER 2019/ISSUE 1164; page 7.

26 THE NILSON REPORT, NOVEMBER 2019/ISSUE 1164; page 1.

27 THE NILSON REPORT, NOVEMBER 2019/ISSUE 1164; page 7.

28 https://www.fico.com/europeanfraud.

29 THE NILSON REPORT, NOVEMBER 2019/ISSUE 1164; page 8.

გააზიარე

ავტორის სხვა მასალა

- on ოქტომბერი 2, 2020

- on ივნისი 10, 2020