A foreign subsidiary of Berkshire Hathaway appears to have violated US sanctions on Iran, the Treasury Department said Tuesday.

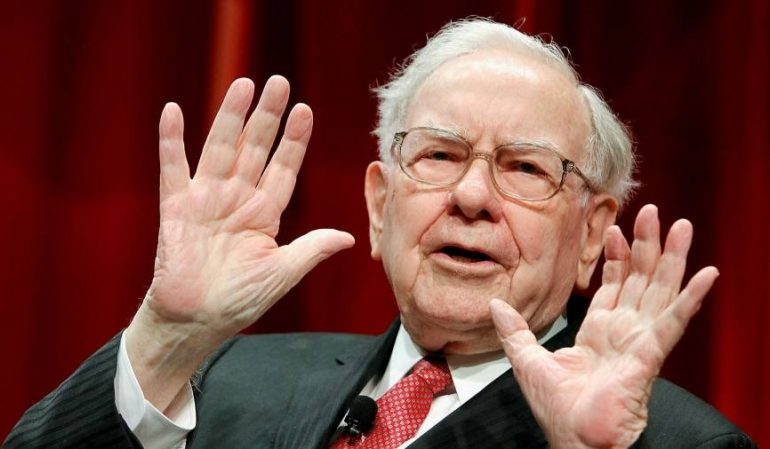

Berkshire (BRKA), the conglomerate run by the legendary investor Warren Buffett, voluntarily disclosed the conduct and agreed to pay $4.1 million to settle its potential civil liability over the matter.

The Treasury Department said that between late 2012 and early 2016, Iscar Turkey, the Berkshire subsidiary, “knowingly engaged” in transactions with people subject to US sanctions on Iran, calling it an “egregious case.”

Senior management at the Turkish subsidiary “sought out business” in Iran with the “express purpose of building a foothold” in the market when it was prohibited from doing so, Treasury said.

To hide its dealings with Iran, Iscar Turkey allegedly accepted payments in Euro-denominated cash, instructed employees to use private email accounts, employed “false invoices” and even used a “fake name” for a “non-existent company” to mask the ultimate buyers.

Iscar Turkey appears to have hid its conduct from Omaha, Nebraska,-based Berkshire Hathaway, Treasury said.

The alleged actions would go against US sanctions that prohibited entities owned or controlled by Americans from doing business directly or indirectly with the government of Iran or people subject to the jurisdiction of the government of Iran. The sanctions were designed to pressure Iran to give up its nuclear ambitions. Specifically, regulators said Iscar Turkey sold metal-cutting tools and related disposable inserts to two Turkish companies despite knowing that the goods would later get supplied to an Iranian distributor. From there, the goods were sent to entities later identified by Berkshire as meeting the definition of the government of Iran, according to the settlement.

Iscar Turkey sold 144 orders of goods that were eventually resold and shipped to Iran, with a value of $383,443, Treasury alleged. The settlement said that Iscar Turkey also bought goods that were produced by other Berkshire subsidiaries to fill orders destined for Iran.

The sales had the effect of “undermining US leverage” in negotiations with Iran, the settlement said.

Anonymous tip prompted investigation

Berkshire Hathaway, based in Omaha, Nebraska, appears not to have been aware of the conduct by its Turkish business, Treasury said.

“Iscar Turkey took steps to obfuscate its dealings with Iran, including concealing these activities from Berkshire,” the settlement alleged.”Iscar Turkey’s conduct in this matter…represents particularly serious apparent violations of the law calling for a strong enforcement action.”

Moreover, the settlement said that the violations happened despite “repeated communications and policies” sent by Berkshire to Iscar Turkey on the Iran sanctions.

Executives at Iscar Turkey sought to “capitalize” on their belief that sanctions on Iran would eventually get lifted by establishing a small-volume commercial relationship with an Iranian distributor, the settlement said.

The subsidiary “demonstrated a pattern of conduct by knowingly engaging in prohibited dealings for approximately three years,” the Treasury Department alleged.

The Treasury Department gave Berkshire credit for “voluntarily” disclosing the apparent violations in May 2016 after receiving an anonymous tip four months earlier. Officials also credited Berkshire with cooperating with the investigation and “replacing personnel complicit” in the conduct.

But the settlement also said that certain Berkshire subsidiaries “knew or had reason to know” that some products they sent Iscar Turkey were “intended for Iran.”

The Turkish business is part of IMC International Metalworking Cos., which Berkshire acquired an 80% stake in for $4 billion in 2006. Then, in 2013, Berkshire spent more than $2 billion to buy the rest of the company.

Berkshire did not immediately respond to a request for comment.

Buffett, whose net worth Forbes pegs at nearly $80 billion, is not mentioned by name in the settlement.

დატოვე კომენტარი