Almost a decade has passed since China set to create a diversified network of transportation routes to connect the country with western markets – its ambitious Belt and Road Initiative. Ever since Beijing launched the project, Central Asia has been seen as playing a key role. Infrastructure projects are predicated on the notion of the region’s importance as a transit hub between China and Europe. While most attention has been focused on Kazakhstan, both Kyrgyzstan and Uzbekistan have also been enthusiastic about their role as Chinese transportation and trade routes, eyeing opportunities for their economies.

The China-Kyrgyzstan-Uzbekistan corridor, often referred to as CKU, has been at the centre of their focus. A project to connect the three countries by railway predates the Belt and Rod Initiative, going back to 1997. It nevertheless remained dormant – mainly due to internal political instability in Kyrgyzstan between 2005 and 2010. However, after then Kyrgyz President Almazbek Atambayev made an official visit to Beijing in June 2012, the project was revitalised. Uzbekistan also reaffirmed its interest in seeing the project implemented.

The importance of the route increases amid the current Russian aggression in Ukraine and a plethora of tough sanctions imposed by the US and EU over the Kremlin. The Northern Corridor via Russia, which has long dominated transit between East and West is bound to lose its importance. This significantly increases the prominence of the corridor crossing Central Asia and the South Caucasus – the Middle Corridor – which has a real advantage to emerge as a competitive route and become one of the main transit corridors allowing goods to arrive in Europe from Asia.

The Middle Corridor is the shortest way between the two continents and can allow cargo to be transported in 15 days. However, the infrastructure issues, the absence of a deep-sea port in Georgia and other issues have impeded the importance of the route. Now, as Russia and Belarus are severely sanctioned and isolated, the Middle Corridor could be effectively exploited by the EU along with China and other East Asian countries as the main alternative route.

A Missing Piece

The China-Kyrgyzstan-Uzbekistan railway (CKU) has been under discussion for almost 25 years. Despite numerous high-level meetings the three countries have failed to reach a consensus on the route, railway tracks and sources of funding, as well as to address ecological, geopolitical and national security concerns.

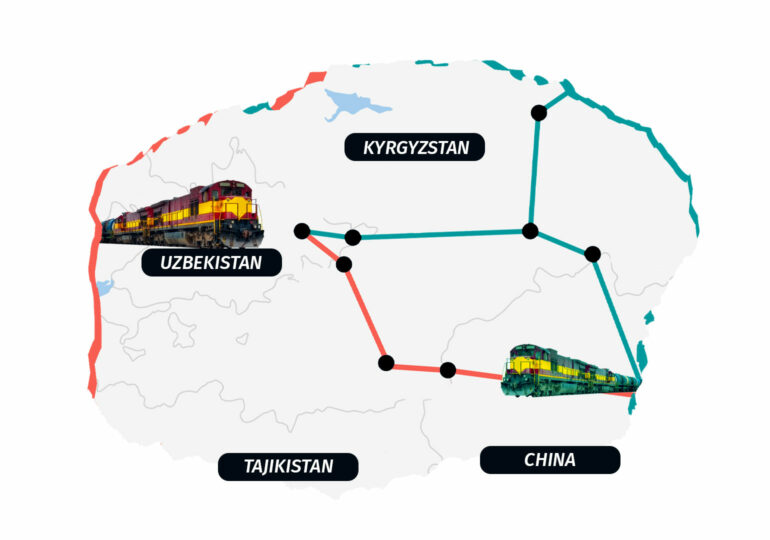

The launch of China’s ambitious Belt and Road Initiative gave the project further impetus. In 2016, Uzbekistan received financial assistance from Beijing in order to complete the Angren-Pap tunnel to connect with a railroad in Kyrgyzstan, a railway which has, however, yet to be built. As such, the current CKU corridor is mere as a multimodal transport route as no through-rail connection exists directly linking China and Uzbekistan. Its total length reaches 4,380 kilometres and connects the Chinese city of Lanzhou to Uzbekistan’s capital Tashkent.

On its inauguration in June 2020, 230 tons of cargo worth 2.6 million US dollars was transported from Lanzhou by rail to the Kyrgyz border, where it was reloaded onto trucks and driven via Kyrgyzstan to the town of Osh, after which it was carried once again by rail to Uzbekistan. The route is intended to transport consumer goods from China to Central Asia and take food products, minerals, and oil exports the other way. It is seen as a win-win opportunity for all participants as it has the potential to directly link the region to Western Europe through the South Caucasus and Turkey.

Uzbekistan is already connected to Turkmenistan and Iran, and once the Kyrgyz section of the railway is completed, the CKU railway will become one of the shortest routes between China and Western Europe, making Uzbekistan and Kyrgyzstan key transit countries for Chinese exports. The corridor would offer Bishkek transit fees and new employment opportunities which could help the country’s economy – riddled with foreign debt – recover.

Even though Uzbekistan already has a rail connection with China via Kazakhstan, it is on average 20 per cent more expensive than the route through Kyrgyzstan, even though cargo currently needs to be carried by trucks. Transportation of goods on a hybrid rail-road route takes from a full week to 10 days in a single direction. A railroad connection between Tashkent and Lanzhou, however, would require much less time and could boost the importance and attractiveness of the corridor.

The leaders of Kyrgyzstan and Uzbekistan frequently emphasise the need to complete the CKU railroad. On August 6, 2021, at a meeting of Central Asia’s heads of state in Turkmenistan, Uzbek President Shavkat Mirziyoyev said that the route would help create “an extensive and integrated transport system” capable of becoming a key transit hub on the Eurasian continent. Yet the positive hype and never-ending negotiations remain the only achievements of the railway project so far.

Destined To Fail?

While the transportation corridor could present myriad opportunities for participant states and the region at large, especially when the future of the Northern Corridor seems to be vague, it is doubtful that the construction of the railroad can be completed soon. Major issues hindering railway construction include political instability, underdeveloped transport infrastructure and above all financial issues in Kyrgyzstan.

The Kyrgyz authorities have for years been promising to complete the railroad, albeit without ever securing the required financial resources. China has long been seen as the only participant that could resolve the funding issue. However, Kyrgyzstan’s foreign debt reached 4.8 billion US dollars in 2021 and around 40 per cent of that – 1.8 billion US dollars is owed to the Export-Import Bank of China. Afraid of falling into a “debt trap”, Bishkek appears to have stopped viewing Beijing as a potential funding source for the railway. In a June 2020 statement, the executive director of the Kyrgyz National Railway Company did not mention China among the funding partners for the project, only Uzbekistan and Russia.

Nevertheless, Uzbekistan might not be capable of substantially contributing to the project, estimated at 4.5 billion US dollars. Tashkent has declared its readiness to participate in the construction of “certain sections” of the railway, but it might not be sufficient for the full, multibillion construction. Moreover, the Uzbek authorities still need to seek international financial assistance to partially fund the project and work out with the Kyrgyz government ways of implementing transit fees to pay back the construction.

The future of the Middle Corridor largely depends on the CKU corridor and could be effectively exploited by the EU along with China and other East Asian countries as the main alternative route. It would be in Beijing’s interest to promote alternative routes of BRI as well. Therefore, it would be reasonable if the EU along with China actively revitalizes its intentions to cooperate with Central Asia and the South Caucasus with regard to further investments in the development of free and sustainable transit along the corridor. Considering energy resources in Azerbaijan and Central Asia, the EU could also diversify its energy supplies and decrease its dependence on Russian gas, which according to statements of EU officials at the Versailles Summit, has become a new priority for the EU in the wake of the Russian invasion of Ukraine.