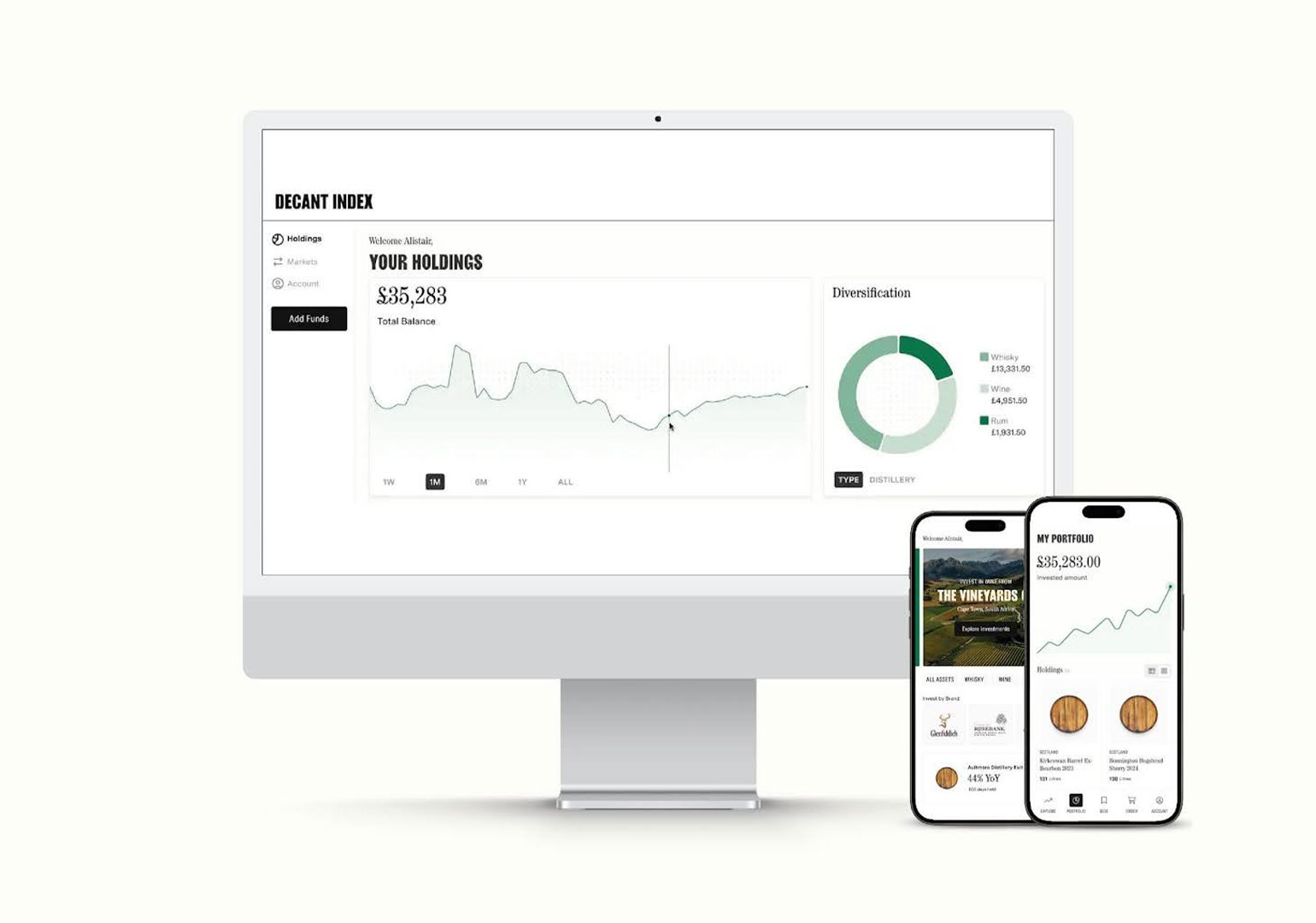

Photo Courtesy of Decant Group

Author: Gerome Alvarez

Decant Group has risen as a notable force in the collectables world by turning whisky, wine and rum into liquid gold for investors and collectors, showing strong results in a market dominated by conventional options. Operating under Decant Index the company has traded over £100 million since its inception just 5 years ago, with over 43,000 users on its collectables platform, revealing widespread interest in spirit-based collectables.

Alistair Moncrieff, Founder of Decant Group, states:

“We have invested 7 figures in technology ensuring our customer experience is at the forefront of what we do. Sub par user experiences are simply no longer acceptable when customers are entering into a new market, we believe our success has come from the fact we understand what the customer expects to see and how they want to be spoken to.”

“Our digital marketplace (Decant Index) is a momentous step forward in making collectables more accessible,” said Alistair Moncrieff. “We have implemented advanced technology to create a platform that simplifies the purchase process while delivering real-time data and portfolio insights to clients.”

Opening Up Whisky Collectables

Unlike other Whisky collectable companies, Decant Group have chosen not to go down the fractional route. Moncrief noted “We do not believe a physical asset such as Whisky and Wine should be split into fractions with multiple owners of the same asset. This is why we opted to ensure we only sell single assets to single individuals on our platform, but in order to keep the barrier to entry affordable we needed to make sure we had an in-depth catalog of assets to offer our users.”

Decant Group ensured they purchased all their collectable and investment grade whisky and wine before launching their platform to ensure this diversification. Since the inception of Decant Index, over £7m of stock has been exited via its marketplace from users directly.

Technology Advancement in Traditional Markets

Decant Index’s future progress aims to carefully blend technology with fine wine and spirit collection. The company is planning to put substantial resources into digital tools to improve investor and collector experience, creating systems that deliver clear market insights.

Moncrieff noted, “We combine centuries-old traditions with current investment methods,” Moncrieff says. “Our platform goes beyond basic transactions to teach investors about whisky and wine production, aging, and market movements.”

In the near future, Decant Index will track and value fine wine and spirit collectables in real time, marking a new milestone in the industry. “We have seen many alternative assets adopt technology, unfortunately that cannot be said about the fine wine and whisky market,” Moncrieff says. “We have seen a number of platforms in the space over complicate the purchase process, making it for a city professional. Our aim is to make it as simple to purchase fine wine or whisky as it is when purchasing a new Rolex from the likes of Chrono24 and then after purchase to track the growth of your asset.”

Physical Growth

Decant Group announced a seven-figure investment in a new bonded warehouse in Scotland, which opened June 2024. This expansion advanced the company’s plan to streamline operations and boost transparency by directly controlling storage facilities.

“Running our own warehouse ensures total control over client assets’ storage and management,” Moncrieff says. “This investment in infrastructure is a testament to Decant Group’s focus on delivering premium security and service to investors.”

The new facility featured modern monitoring systems and climate controls, maintaining ideal conditions for whisky maturation while continuously updating investors about storage conditions.

Decant Group also opened their office in the heart of Mayfair in 2024, which features a private lounge bar which they frequently use for client exclusive events.

International Development

Decant Index plans to enter the U.S. market amid growing worldwide demand for premium and ultra-premium whiskies. Despite pandemic challenges, the Distilled Spirits Council reports that super-premium American whiskey brand sales rose by 17.8% in 2020.

Market data supports the growth potential in international whisky collectables. According to Knight Frank’s Luxury Investment Index, rare whisky has emerged as one of the strongest-performing alternative assets, with values appreciating significantly over the past decade.

“We’re excited to bring our expertise and technology to the U.S. market,” said Alistair Moncrieff. “We believe the US is our biggest opportunity yet. We will be heavily focused on educating the market of the pros and cons of purchasing whisky and fine wine under bond in the UK and how that can help retain value.”

Decant Group is in a strong position for future expansion, especially now that it is set to refine its offerings while providing investors with a unique mix of traditional and modern portfolio methods.

Rum in the US

With aged and limited-edition rums gaining recognition as valuable collectibles in the U.S., Decant Index also plan to focus on rum collectibles as part of their US expansion. While still in its early stages compared to Europe, the U.S. rum collectables landscape is gaining traction as investors recognize its potential for long-term value appreciation.

Wine Cellar Plan

Decant Index recently launched their wine cellar plan, a subscription plan for wine collectables, tailored to the individual’s tastes, budget, and goals. Subscriptions will start from £250 per month, and help investors build their wine portfolio with ease.

S