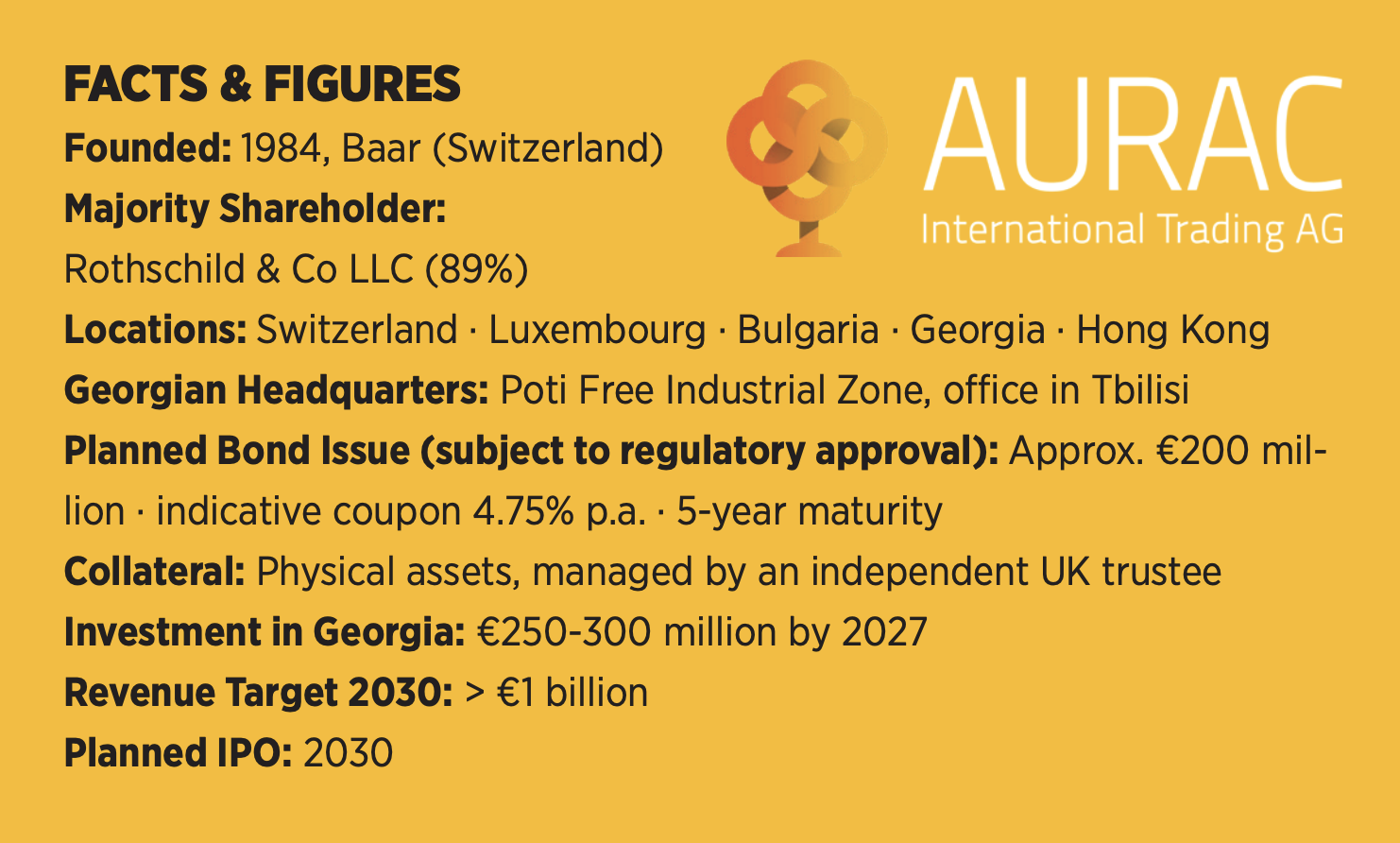

Karlheinz Dobnigg, President of the Board and CEO of Switzerland’s AURAC AG, is steering €250-300 million into Georgia’s mineral sector over the next three years, building a bridge between Europe and the Caucasus that positions the country as a strategic commodities hub. With Rothschild & Co LLC holding 89% of AURAC and a €200 million corporate bond under regulatory review, Dobnigg sees the country not as an emerging market experiment, but as the cornerstone of a €1 billion revenue target by 2030.

Author: Anina Tepnadze

Mr. Dobnigg, AURAC AG has become increasingly associated with international commodities trading, responsible value creation, and significant investments. How did it all begin, and where is your vision heading today?

Karlheinz Dobnigg: The story of AURAC AG began in 1984 in Switzerland, with a clear idea: to create real value by combining resources, trade, and responsibility. Today, more than four decades later, AURAC has grown into an international trading and industrial group specializing in precious metals, copper, and critical minerals: materials essential for the energy and technology transition of our time.

I have the honor of serving as President of the Board of Directors and CEO. Rothschild & Co LLC holds an 89% majority stake in AURAC AG, providing us with an exceptionally strong capital base and a truly global network. This partnership enables us to think beyond borders and invest in regions with the potential to shape the economic growth of an entire generation.

Today, the AURAC Group operates in Switzerland, Luxembourg, Bulgaria, Georgia, and Hong Kong, developing an international trade and investment network that combines sustainable growth with economic responsibility.

How is the AURAC Group positioned in Georgia, and what role does the country play in your global strategy?

Karlheinz Dobnigg: In 2024, we founded AURAC Group LLC in the Poti Free Industrial Zone, which now serves as our main base in Georgia. We also operate an office in Tbilisi, which coordinates our international trading and financial operations. AURAC Group is much more than a regional entity. It is the hub of our global commodities operations.

From Georgia, we connect the markets of Europe, Asia, Africa, and the Middle East. In 2025, we also established AURAC Mining Ghaghvi LLC, dedicated to the exploration and development of Georgian mineral deposits. Over the next two to three years, we plan to invest between €250 and €300 million in infrastructure to build sustainable value creation on the ground, from exploration to processing.

What makes Georgia particularly attractive to us is its investor-friendly environment and excellent business climate. The country has become one of the region’s most dynamic markets in recent years, offering legal and planning security as well as efficient administration. Equally impressive is the large number of young, highly skilled, and motivated people in Georgia with whom we work every day. They bring energy, innovation, and commitment to our projects, demonstrating the incredible potential this country holds for the future.

Georgia presents itself as a bridge between Europe and Asia. How does this strategic position influence your decision to make the country a hub for AURAC?

Karlheinz Dobnigg: Geography matters. Georgia sits at the crossroads of the Black Sea, the South Caucasus, and the wider Eurasian region. For a trading and industrial group like AURAC, this means efficient access to European markets on the one side and to Asia, the Middle East, and Africa on the other.

Our presence in the Poti Free Industrial Zone gives us direct access to port infrastructure and logistics corridors, which are essential for moving raw materials and processed products quickly and reliably. Combined with Georgia’s free-trade agreements and open economic policies, this creates a platform for serving multiple markets with a single integrated strategy.

In simple terms, Georgia allows us to think globally while operating very concretely and efficiently on the ground.

You operate across Switzerland, Luxembourg, Bulgaria, Georgia, and Hong Kong. What makes Georgia uniquely competitive compared to other emerging markets where AURAC could have chosen to invest €250-300 million?

Karlheinz Dobnigg: When you invest at that scale, you are not choosing a “project,” you are selecting an operating environment for the next decade. Georgia is competitive because it supports a full business model: it can host trading, logistics, and industrial development in a single integrated location, rather than forcing companies to split those functions across multiple jurisdictions.

What differentiates Georgia from many emerging markets is its practical execution: decisions can be made, implemented, and supervised with the clarity essential to regulated industries and long-cycle investments. In short, it’s a place where you can build, not just enter.

AURAC specializes in precious metals, copper, and critical minerals. How do you see Georgia’s mineral resources positioning the country within the global energy and technology transition, and which specific materials hold the most promise?

Karlheinz Dobnigg: The transition is being shaped by a very practical question: who can supply essential materials reliably, transparently, and at scale? Georgia has a chance to be part of that answer, not by trying to outcompete the biggest producers, but by positioning itself as a dependable, well-connected supply platform that can meet rising requirements around traceability and responsible production.

In terms of materials, copper is the spine of electrification: grids, renewables, data centers, and transport all pull demand in the same direction. Beyond copper, the most promising materials will be those where Georgia can prove competitive deposits and develop them responsibly; that’s exactly why we built a dedicated exploration and development vehicle in the country.

You mentioned substantial investments in exploration and infrastructure. What concrete impact do you expect these investments to have on Georgia’s economy and local communities?

Karlheinz Dobnigg: Our investment plan of between €250 and €300 million in Georgia is designed with a long-term perspective. It is not about short-term extraction, but about building an industrial foundation that can last for decades. This includes developing infrastructure, processing capacity, and logistics, all of which create jobs and add value locally.

We expect to create high-quality jobs both in urban centers such as Tbilisi and in the regions where exploration and processing take place. Beyond direct employment, local suppliers, service providers, and transport companies benefit from our presence. Our goal is to ensure that as much of the value chain as possible remains in the country, so that Georgia does not only export raw materials, but also know-how, technology, and processed products.

At the same time, we are committed to supporting education and training initiatives that help young people in Georgia acquire skills relevant to modern industry, from engineering and geology to finance and risk management.

You’ve emphasized that Georgia should not only export raw materials but also know-how and processed products. What does the complete value chain look like in your Georgian operations, from exploration to final product?

Karlheinz Dobnigg: We think of the value chain less as a slogan and more as a discipline: turning geology into an industrial product that meets international standards. That begins with exploration and resource definition, followed by metallurgical testing and process design, because “what’s in the ground” only matters once you know what you can produce efficiently and responsibly.

From there, it’s about building the operational capabilities that create real value locally: processing where it makes economic and environmental sense, quality systems, traceability, and local talent that can run these assets over time. The endpoint is not just about concentrates or metals; it is capabilities: products, know-how, and a workforce that can compete internationally.

How important is Georgian talent to AURAC’s future in the country, and how do you integrate local professionals into your organization?

Karlheinz Dobnigg: Georgian talent is absolutely central to our strategy. We are not here to run everything from abroad; we are here to build a strong local team that drives the business forward. Georgia has a remarkable pool of young, well-educated professionals, including engineers, IT specialists, and finance and legal experts.

Our approach is to combine international experience with local expertise. That means competitive career opportunities, training programs, and the chance to work on projects of truly global scope. Over time, we want more and more key positions in Georgia to be held by Georgian professionals who know the country, the culture, and our business equally well.

For us, success in Georgia is not just measured in euros of investment, but also in the number of people who grow with us and shape the future of the AURAC Group from within the country.

Mining and infrastructure projects are often closely scrutinized for their environmental and social impacts. How do you ensure that your projects in Georgia meet high standards in this respect?

Karlheinz Dobnigg: Responsibility is not a marketing term for us. It is a guiding principle. When we invest in exploration and infrastructure in Georgia, we follow clear environmental and social criteria from the very beginning. That starts with careful studies and assessments, continues with transparent dialogue with local communities and authorities, and extends to the daily operations of our projects.

We aim to work with international best practices in environmental management, occupational safety, and community engagement. This includes modern technologies that reduce emissions and waste, as well as clear rules for land use, rehabilitation, and biodiversity protection.

Equally important is the social dimension: we listen to local communities, involve them in decision-making where appropriate, and seek solutions that create shared value. Long-term success is only possible if our projects are accepted and supported by the people who live in the regions where we operate.

You mentioned modern technologies that reduce emissions and waste. What specific technological innovations or best practices is AURAC bringing to Georgia’s mining and processing sector?

Karlheinz Dobnigg: In mining, innovation is often less about a single breakthrough and more about raising the operating standard across the entire lifecycle. The biggest gains typically come from smarter process design, tighter monitoring, and a culture of measurable performance: energy use, water management, waste handling, and rehabilitation planning from day one rather than at the end.

We aim to implement international best practices and operate with technologies and routines that reduce emissions and waste, and to do it in a way that is auditable, not just aspirational.

How would you describe your cooperation with Georgian authorities and local partners so far?

Karlheinz Dobnigg: Our experience has been very positive. We find that Georgian authorities are professional, accessible, and solution oriented. There is a clear understanding that sustainable investment requires both legal certainty and pragmatic problem-solving. That combination is one of the reasons why we decided to make Georgia a cornerstone of our international strategy.

Local partners, whether from business, finance, or civil society, also play a crucial role. They help us understand regional dynamics, regulatory nuances, and community expectations. We see this not as a one-off interaction, but as a long-term partnership. Our objective is to be a reliable counterpart: when we make commitments, we follow through.

You are preparing a major corporate bond issuance for the European market. At what stage are you currently, and what can you already share about it?

Karlheinz Dobnigg: We are currently in the regulatory approval process for a new AURAC corporate bond with a planned volume of €200 million. This means that the competent authorities are reviewing all key terms and documentation, and nothing is final until this process is completed. Subject to required approvals, the bond is expected to have a fixed annual coupon of approximately 4.75%, a five-year maturity, and to be secured by physical assets. The management of these assets is intended to be entrusted to an independent trustee based in the United Kingdom to ensure a high level of security and transparency for investors.

To implement this capital markets strategy, we have established AURAC Capital S.à r.l. in Luxembourg, which will focus on financial products and capital market instruments within the AURAC Group. Once the approval process has been successfully completed, detailed information about the bond will be made available, including on our website, in the form of the approved prospectus and related documentation. Until then, everything we discuss remains indicative and may still be subject to change.

The envisaged use of proceeds is to support the expansion of our commodities trading activities and to finance exploration and infrastructure projects in Georgia, thereby strengthening the country’s role within our global value chain. For us, this planned bond is not just a financing instrument; it is intended to underline our long-term commitment to Georgia and to our industrial strategy as a whole.

Those who invest in an AURAC bond in the future, once all approvals are in place, will ideally be joining a story built on tangible assets, responsibility, and sustainable growth.

Operating in international commodities trading involves navigating a range of risks, from price volatility to geopolitical factors. How does AURAC’s approach to risk management specifically apply to your Georgian operations?

Karlheinz Dobnigg: We treat risk management as three separate problems, not one. First, project risk: we stage commitments and make sure technical and permitting work is robust before stepping up capital intensity. Second, market risk: we avoid building business cases that depend on a single price scenario; in commodities, you need structures that can withstand cycles. Third, country and counterparty risk: diversification and transparency matter, especially when you are building investor trust over years, not months.

That thinking also informs how we approach financing. For example, our planned bond is in regulatory review and, subject to approval, is designed with security and governance features intended to give investors clarity and protection.

What role does Rothschild & Co LLC play in your international expansion?

Karlheinz Dobnigg: Rothschild & Co LLC is not only our main shareholder but also a strategic partner that supports us with its global network. This partnership gives us access to new markets, institutional investors, and innovative financing opportunities. Our rapid growth in recent years would have been impossible without the support of Rothschild & Co LLC.

Together, we are pursuing the goal of strengthening AURAC as a European brand with global reach and advancing sustainable industrial projects worldwide.

What would you say to other European institutional investors or family offices who may be hesitant about investing in the Caucasus region? What has your experience taught you that might surprise them?

Karlheinz Dobnigg: I would tell them to separate “region” from “jurisdiction.” The Caucasus is not one investment environment, and the right approach is classical risk discipline: governance, documentation, reputable partners, and a structure that matches the realities of long-cycle assets.

What tends to surprise European investors is that Georgia can be straightforward and business-like in its dealings with serious long-term capital. And there is a second surprise: the depth of young professional talent. It changes the perception from “can we manage this remotely?” to “can we build a local engine that operates to international standards?”

Where do you see AURAC by the year 2030?

Karlheinz Dobnigg: By 2030, we aim to increase our revenue to over €1 billion. By then, we will have established a fully integrated trading, logistics, and exploration infrastructure, positioning AURAC as a leading European industrial and commodities company. Georgia will play a central role in this development, as a location, a partner, and a symbol of how international cooperation can create shared prosperity.

We are also considering an IPO in 2030 to expand our growth capital and give new investors access to our success. Our ambition is to position AURAC as a bridge between European investors and the Georgian economy: a company that creates real value, builds trust, and shapes the future.

After four decades since AURAC’s founding, what does it mean to you personally to see the company establish such deep roots in Georgia? What aspect of this Georgian chapter excites you most?

Karlheinz Dobnigg: What’s meaningful about Georgia is that it allows us to build something enduring: not a transactional presence, but an ecosystem. Teams, capabilities, and long-term partnerships that stay in place through cycles. That is what “roots” means in our sector.

The part that excites me most is building a platform where Georgian professionals take real responsibility in a business with international reach. If we do our work properly, the headline isn’t only investment numbers. It’s the competence and confidence that remain in the country long after the first projects are running.