Photo courtesy of Prop Firm Match

The allure of proprietary trading is undeniable. For many aspiring traders, using a firm’s resources to trade and share profits is a dream come true. Yet, for every success story, stories of scams, unethical practices, and opaque systems leave traders worried. Unscrupulous firms often overshadow the excitement of entering the prop trading world with fear.

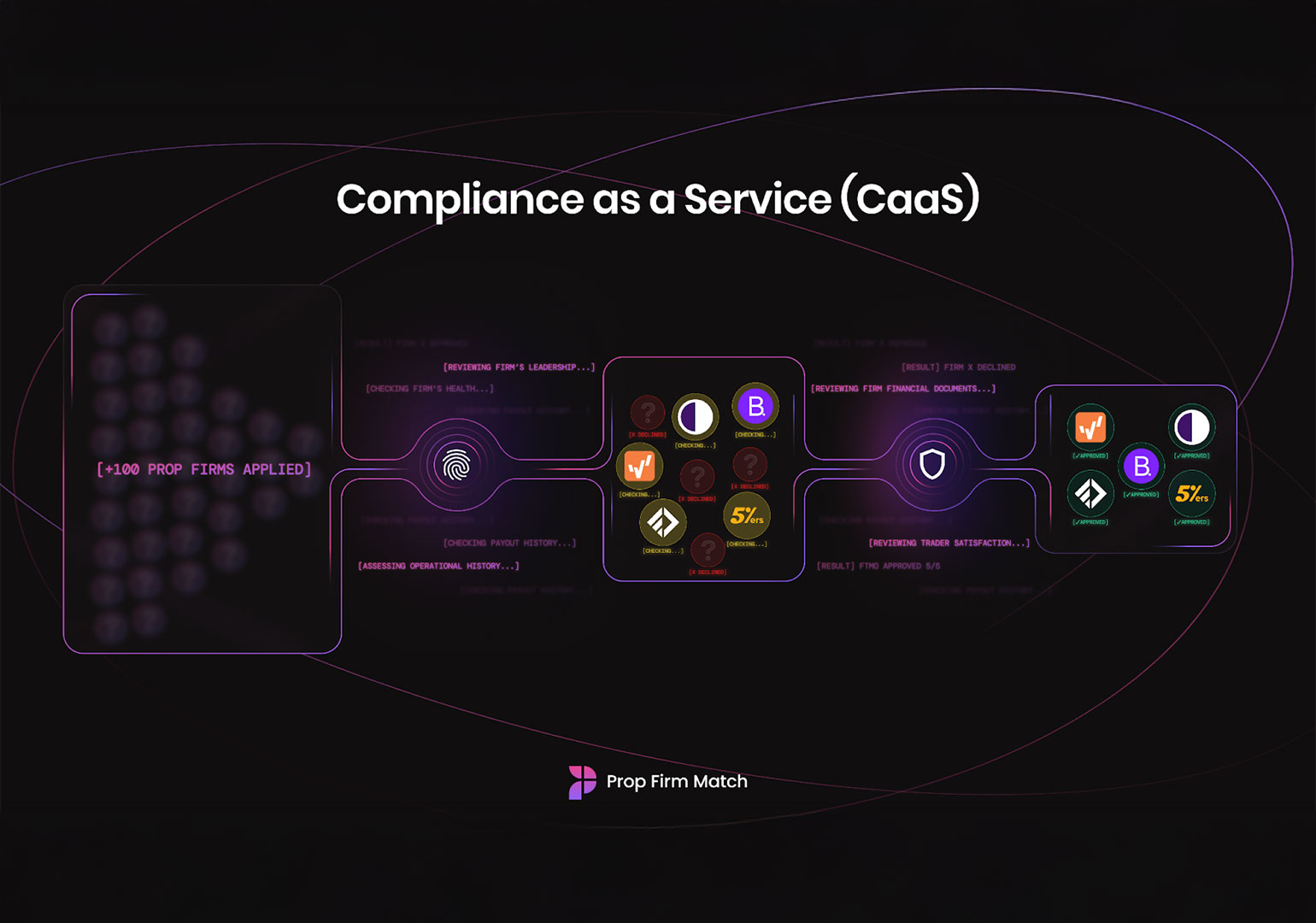

Prop Firm Match (PFM) understands this dilemma and introduces its unique “Compliance as a Service” model. This model sets out to change the prop trading field by establishing fairness, transparency, and trust for traders worldwide.

The Prop Firm Match Approach in PropTrading:

Proprietary trading, often referred to as “prop trading,” is a financial practice facilitated by prop firms where traders are given access to simulated capital to participate in a challenge. In this challenge, traders must showcase effective risk management and consistent profitability across multiple stages (typically two). If the trader successfully passes all stages, they are granted access to a funded account and can request payouts once their profits exceed a specified threshold (usually over $100). This approach differs from traditional client-based trading, where institutions earn commissions by executing trades on behalf of clients.

Instead, traders share a percentage of their profits with the firm. This model offers immense potential for those who lack personal capital but possess the aptitude to navigate volatile markets.

However, the industry’s rapid growth has also led to challenges. Many traders face difficulties in identifying reputable firms amidst a sea of options. The prevalence of biased review sites and firms engaging in unethical practices further complicates decision-making. Misleading rankings or opaque terms often trap traders, jeopardizing their investments and trust.

Prop Firm Match’s compliance standards aim to solve this challenge. Founded by Martin Jensen and John Ramos, the platform is a comprehensive marketplace featuring only the most reputable prop firms that have passed a rigorous vetting process.

“We understood the hesitation many traders felt when considering prop trading,” explains Martin Jensen. “Our mission was clear from the start: to create a transparent ecosystem where traders could confidently explore and engage with legitimate prop firms.”

“Compliance as a Service” Model: A Game-Changing Innovation

At the heart of Prop Firm Match’s success is its innovative “Compliance as a Service” model. This method goes beyond simply listing prop firms; it continuously vets, monitors, and certifies that listed firms maintain the highest standards of ethical business practices.

The “Compliance as a Service” model is multifaceted. It includes initial vetting, where Prop Firm Match thoroughly examines a firm’s business practices, financial stability, and trader satisfaction before being listed on the platform. Jensen and Ramos share that this evaluation is strict. “In 2024, out of over 140 prop firms that applied for listing, only six made the cut, demonstrating our platform’s commitment to quality over quantity,” they mention.

John Ramos explains that once in, Prop Firm Match continuously assesses the performance and practices of listed firms, making certain they maintain the standards required for inclusion. Unlike traditional review sites, which often operate on a pay-to-play model, PFM only displays reviews from traders who have participated in a prop firm’s challenge, certifying genuine, experience-based feedback.

Going Beyond Compliance

Beyond its compliance standards, Prop Firm Match also emphasizes transparency and empowers traders with the insights they need to make informed decisions. Central to this mission is its innovative multi-comparer tool. This allows users to evaluate prop firms based on various criteria, including account sizes, profit splits, challenge requirements, and customer reviews.

This feature allows traders to quickly identify firms that align with their goals and trading styles, eliminating much of the guesswork and risk of choosing a prop firm. PFM also provides comprehensive regular reports and updates to traders who sign in, highlighting changes in firm policies, performance metrics, or compliance status.

Ramos mentions, “We simplify decision-making and foster confidence among traders navigating an often opaque industry by consolidating critical data into one accessible platform. Our multi-comparer tool cuts through the unnecessary and often dangerous information and gives traders the exact data they need to make informed decisions.”

In addition to its comparison tool, PFM enhances the trading experience through initiatives like its loyalty program and social media forums. The loyalty program rewards traders with points for purchases made through the platform, which can later be redeemed for free challenge accounts—offering tangible value for their engagement.

Meanwhile, social media forums allow traders to discuss industry trends, share experiences, and gain new insights that can refine their strategies. Through this, PFM bridges the gap between opportunity and trust in the prop trading world, confirming traders can focus on their growth without fear of exploitation or misinformation.

A Promising Future for PFM

Though relatively new, Prop Firm Match’s transparency-first technique has achieved significant milestones. Since its launch, the platform has grown exponentially, with over 12 million website visits, over 100,000 registered users in just over a year, and numerous 5-star reviews.

More importantly, this growth has brought about a shift in the broader prop trading industry. Firms not listed on Prop Firm Match have begun to reevaluate their practices, striving to meet the platform’s new standards of transparency and trader-centric policies.

“What we’re seeing is a fundamental shift in prop trading,” Jensen notes. “Traders are no longer willing to accept lack of transparency and uncertainty. They demand transparency, and firms that can’t provide it are being left behind.”

As Prop Firm Match continuously grows and expands its portfolio, Jensen believes their transparency standards will be their most significant edge. He shares, “We’ve accelerated the adoption of prop trading by building trust. It’s a win-win for traders and ethical firms alike.”

Please visit Prop Firm Match’s website to learn more about its trading process.

S