Introduction

There’s a hidden gem in Europe that could transform your business, especially if Western market taxes are holding your growth. Georgia is a country with stunning landscapes and a unique history. But, it’s also a place where you can scale your business – thanks to lower taxes, a talented workforce, and the potential to tap into new markets.

Georgia is a rising economic star on the global stage, offering a business-friendly environment to help companies optimize their finances. This positions Georgia as a smart alternative to traditional business hubs for operating a tax-burden-free company.

At the forefront of this movement is Gegidze. Since 2017, we have showcased Georgia’s potential to the world. We helped 150+ European and U.S. companies hire top Georgian talent. Here is what we have noticed.

Our clients faced tax burdens back home, limiting their ability to expand and innovate even more. They saw Georgia’s potential for tax reduction, streamlined financial services, and even full-scale business relocation.

So, When our clients spoke, we listened. We expanded our services to provide top-tier financial optimization solutions.

Financial Services

Our services are all about helping businesses make the most of Georgia’s tax benefits and planning proactively – so they can save money and stay ahead of the competition.

Tax Accounting & Bookkeeping Services

At Gegidze, our Tax Accounting & Bookkeeping Services are designed to align with your business’s unique needs, enabling you to maximize savings while maintaining adherence to Georgian regulations. Our experts are here to guide you through every step, including:

- Advising on corporate structuring;

- Leveraging relevant tax treaties;

- Identifying applicable incentive programs;

Banking Management

We ensure our client’s employees are paid accurately and on time while staying fully compliant with Georgian labor laws.

Focus on your core business; avoid daily operations tasks. Simply provide payment instructions, and our Banking Management team will handle the rest, ensuring that your employees are paid accurately and on time while staying fully compliant with Georgian labor laws.

- Onboard employees with ease;

- Get accurate, on-time pay calculations;

- Stay compliant with Georgian tax and labor laws;

- Focus on your core business, not paperwork;

Payroll Management

Gegidze’s payroll management services help businesses streamline their operations and ensure compliance with Georgian labor laws. This includes:

- Handling employee onboarding;

- Calculating and processing payroll;

- Managing tax withholdings and reporting requirements;

Financial Modeling

Turn future uncertainties into clear insights with Gegidze’s Financial Modeling services. Our expert analysts work with you to create robust financial models that enable strategic decision-making and support your business objectives by:

- Projecting financial outcomes with precision;

- Assisting in budget preparation and financial planning;

- Enabling scenario analysis for informed decision-making;

Business Valuation

Determine the economic value of your business with our comprehensive Business Valuation services. We combine industry expertise with meticulous analysis to provide accurate valuations, essential for:

- Strategic planning for mergers, acquisitions, or sales;

- Fundraising and investor presentations;

- Determining the fair value of your business assets;

Tax Optimization

Refine your fiscal strategy with our advanced Tax Optimization services. Gegidze’s seasoned tax professionals are dedicated to formulating strategies that enhance your savings and align with compliance standards by:

- Consulting on sophisticated tax planning;

- Maximizing tax incentive and relief opportunities;

- Ensuring meticulous compliance with ever-evolving tax laws;

Georgia – a Country with one of the Lowest Taxes in the World

Taxes can be a major drain on resources and a source of constant frustration for business owners. Georgia, however, takes a refreshingly different approach. With a tax system designed for simplicity and competitiveness, it offers foreign businesses a haven for optimizing their financial operations.

Georgia’s remarkably low tax rates and business-friendly policies make it a top destination for companies seeking to minimize their tax burden and maximize profitability.

This commitment to streamlining processes is reflected in the 7th place ranking for ease of doing business by the World Bank.

| Tax Type | U.S. Average | Western Europe Average | Georgia (General) | Georgia (Virtual Zone Status) | Georgia (International Company Status) |

| Corporate Tax Rate | 21% | 25-30% | 15% on distributed profits | 0% on IT services/products delivered outside Georgia | 5% on distributed profits |

| Personal Income Tax Rate | 10-37% | 35-50% | 20% | 20% (with exceptions for IT professionals and qualifications) | 5% on employee income |

| Capital Gains Tax Rate | 0-20% | 18-28% | 0-5%* | 5% on dividends | 5% on dividends |

| Dividend Tax Rate | 0-23.8% | 20-30% | 5% | 5% (applicable during distribution to shareholders) | 0% |

| VAT | N/A | 15-27% | 18% | 0% on products/services delivered outside Georgia | Standard VAT rules apply, with potential exemptions for B2B services |

If your business earns €100K, you save a minimum € 16,000 in taxes

Georgia could be the key to unlocking increased profitability and fueling growth for businesses struggling with high taxes in traditional European markets.

Georgia has a special tax system that could save your business tons of money compared to the EU and the US. This means you can keep more profits and grow your business faster.

Say your company earns €100,000 in profit. In the EU, you might pay €32,000 to €35,000 in taxes. In Georgia, you could potentially see that amount reduced to at least €16,000 – €17,500.

But, you only pay tax on profits you distribute. If you reinvest profits back into the company, you will pay 0%.

In Georgia, both resident and non-resident enterprises are subject to Corporate Income Tax (CIT) on their income at a flat rate of 15%. For LLCs and other legal entities within Georgia, CIT applies only when profits are distributed. This means that profits reinvested into the company remain untaxed.

Meet the Leaders of Gegidze

Meet Zurab and Valerian, the creators of financial services, whose combined vision has helped countless businesses unlock Georgia’s potential.

Zurab Aitsuradze

Zurab: “I see Georgia becoming the new go-to destination for smart finance and tax optimization. But, businesses need more than just tax breaks to thrive in Georgia. They need a partner who understands the local regulations and can customize solutions to their needs. And that’s where we come in.”

With over 15 years in finance, tax, and operations, he brings a wealth of practical experience. His ACCA qualification proves his dedication to the field and deep understanding of the complex accounting field. Zurab has worked with businesses across various countries, giving him unique insight into how companies can overcome financial challenges when expanding into new markets. He’s passionate about helping businesses reach their full potential in this growing economy.

Zurab: “My international education and work experience in a global, top-tier consulting company exposed me to different business cultures and the importance of adaptability. That’s essential for our clients, who are often operating across multiple countries.”

Valerian Gegidze

Valerian Gegidze is a serial entrepreneur and angel investor driven by a passion for fueling Georgia’s economic growth and shaping the future of work. His diverse background gives him a unique perspective on the challenges and opportunities facing businesses in the region. Valerian is committed to building bridges between Georgian talent and the global market, creating a thriving ecosystem of innovation and investment.

Zurab: “Valerian understands the global market in a way few people do. He saw something special in Georgia that most people were overlooking.”

Valerian: “Our vision is for Georgia to be recognized not just as a tax haven, but as a dynamic hub for business growth and innovation.”

Conclusion

For businesses looking to optimize their operations and unlock the full potential of Georgia’s business-friendly environment, Gegidze’s new financial services offer a compelling solution.

With its proven track record, deep expertise, and unwavering commitment to client success, Gegidze is the strategic partner companies need to navigate Georgia’s tax landscape and achieve their growth objectives

Additional Resources

For more detailed insights into navigating Georgia’s financial landscape, explore our specialized guides:

- Top Georgian Banks for Expats: Full Guide 2024 – Your essential resource for understanding banking options in Georgia.

- How to Open a Bank Account Remotely in Georgia: Full Guide 2024 – Learn the steps to easily set up a bank account from anywhere.

- Guide to Taxes in Georgia 2024: Income, Corporate, VAT, and More – A comprehensive look at the tax obligations and benefits for businesses operating in Georgia.

Gegidze’s HR & Staffing Services

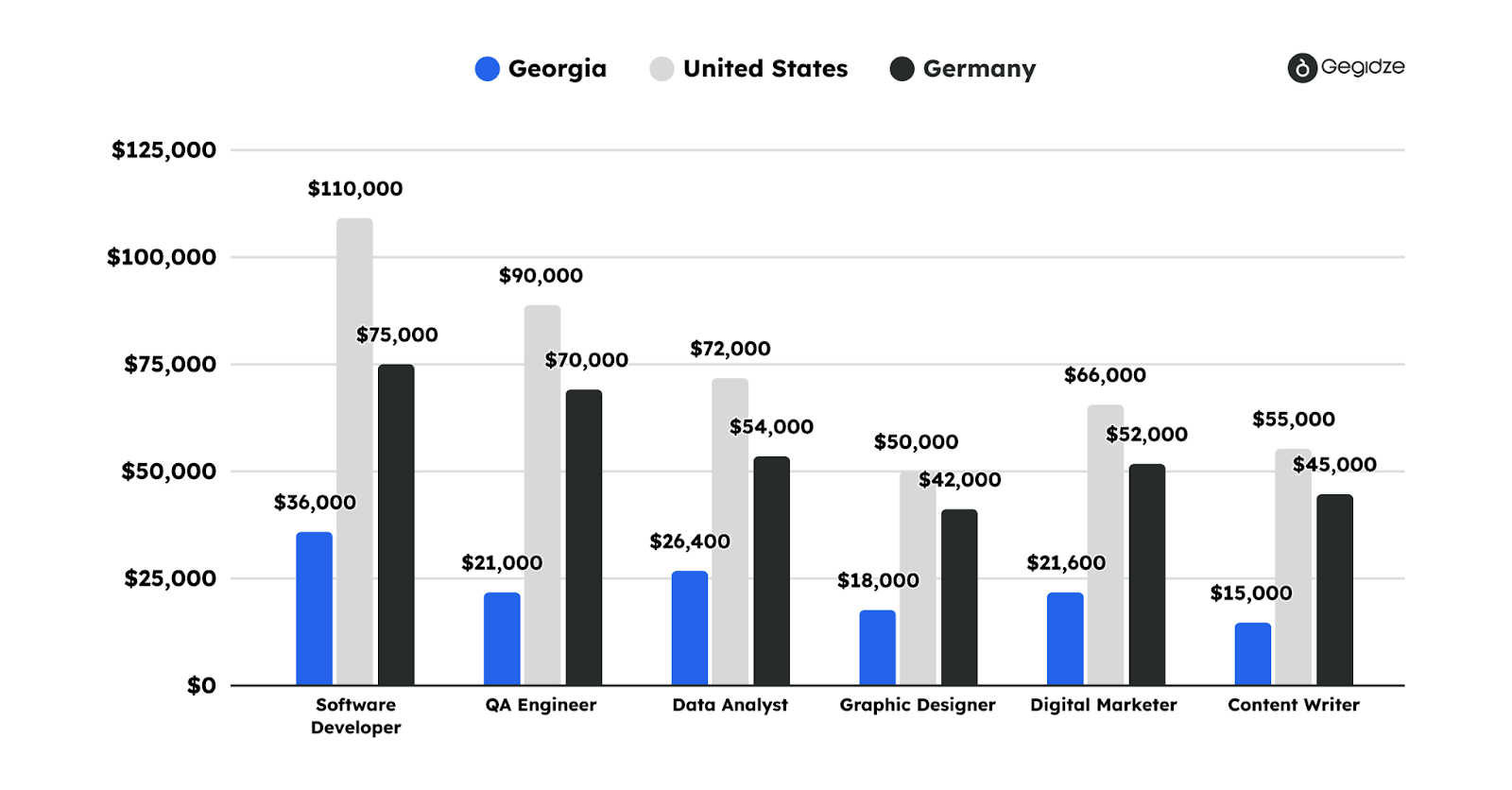

Discover the cost-saving advantage of staffing in Georgia. You could dramatically reduce your hiring expenses compared to the U.S. and Europe – potentially cutting costs by half or more.

For instance, a software developer who might cost $110,000 in the U.S. or $75,000 in Europe can be hired for around $36,000 in Georgia while maintaining the same quality.

Do you want to hire in Georgia and don’t know where to start? We know International hiring, with its unique regulations and logistics, can give you a serious headache. Tax regulations, payment logistics, residency rules. One wrong move can cost you big time.

But, don’t worry – we handle the full scope of HR services. We find the right talent and manage onboarding, payroll, taxes, and all the boring stuff. With our Employer of Record (EOR) service you don’t need to set up a whole new company there. Hire fast, stay legal, and focus on what you do best – growing your business. All for a simple flat rate of just 199 €/per month.

Employer of Record

Simplify your entry into the Georgian market. As your Employer of Record, we manage all employment responsibilities — from payroll to compliance — so you can focus on your business without setting up a local entity.

Talent Marketplace

Discover Gegidze’s Talent Marketplace, your premier destination for hiring vetted freelancers and employees. Specializing in startups and SMBs, we connect you with top developers, designers, marketers, and more from Georgia and other cost-effective talent hubs. Start building your dream team today!”

Staff Augmentation

Harness the power of Georgian talent without the complexities of hiring. Our Staff Augmentation service allows you to quickly scale your team up or down, matching your project demands with skilled professionals managed under your direct control.

Dedicated Team

Build a full-time, dedicated team tailored to your business needs. We handle the recruitment, administration, and integration, ensuring your team is set up for success from day one.

It Outstaffing

Expand your IT capabilities with highly skilled Georgian tech professionals. Our IT Outstaffing service provides the talent you need on a flexible basis, helping you keep pace with technology demands without the overhead of hiring.

Nearshoring

Position your business closer to European markets while benefiting from lower costs and high-quality service. Nearshoring to Georgia offers a strategic advantage with its favorable business environment and skilled workforce.

Gegidze’s Legal Services

Tax rules are only part of the challenge when doing business in Georgia. There are also legal requirements to meet when setting up a business. Gegidze makes this easier. We offer a full range of legal services to ensure your business gets set up quickly and correctly.

Company Incorporation

Start your business in Georgia with ease. We guide you through the entire process of company incorporation, ensuring compliance with local laws and regulations, making setup quick and straightforward.

I.E Registration

Individual Entrepreneur Registration – Ideal for solo entrepreneurs, our service facilitates the registration process, helping you establish your business presence in Georgia swiftly and efficiently.

IT Company Status

Gain recognition as an IT company in Georgia to benefit from significant tax incentives. We assist in obtaining the IT company status, positioning you to maximize profit and operational efficiency.

Virtual Zone Status

For businesses operating in the tech and export services sectors, acquiring Virtual Zone status in Georgia can lead to substantial tax benefits. We manage the application process to help you achieve this advantageous status.

Apostille & Notary

Ensure your documents are legally recognized in Georgia and abroad with our Apostille and Notary services. We provide swift and accurate processing to meet your international business needs.

Translation Services

Navigate the language barrier with professional translation services in Georgia. From business contracts to legal documents, our expert translators ensure accuracy and compliance with Georgian and international standards.