Vakhtang Partsvaniya – PhD, Professor of Management, Caucasus University

Erekle Pirveli – PhD, Professor of Accounting and Finance, Caucasus University

Georgia’s delicate geopolitical positioning presents a dual challenge: balancing the economic benefits derived from trade with Russia against the need to align with Western sanctions policies. While Georgia has declared full compliance with U.S. and EU sanctions, it has not imposed its own sanctions against Russia, the most-sanctioned country globally. This has led to suspicions that Georgia may serve as a transit point for sanctioned goods, with car re-exports being one of the most visible examples of this activity.

In the immediate aftermath of Russia’s full-scale invasion of Ukraine, major global car manufacturers suspended their activities in Russia. They sold their assets, ceased importing cars, and withdrew from the market. In addition, the G7 and EU countries imposed a ban on the supply of luxury goods, including high-end cars, to Russia. This was soon followed by a broader ban on the export of all new and used passenger cars with engine capacities of more than 1,900 cc, as well as electric and hybrid cars, regardless of their value.

Despite these restrictions, the sanctioned cars continued to reach the Russian market via legalized parallel imports. The Russian Federal Customs Service even declared that the economic blockade of Russia had been “broken” through Verkhny Lars, the sole land checkpoint between Russia and Georgia. As a result, in 2023, KIA, Hyundai, and Toyota ranked among the top-selling brands of new passenger cars in Russia, while sales of luxury vehicles also increased year-on-year.

These trends might lead some to conclude that sanctions do not work and are ineffective. However, instead of abandoning sanctions, Western authorities have focused on refining and strengthening compliance mechanisms. This includes closer scrutiny of third countries that may be involved in circumventing sanctions, with the threat of secondary sanctions imposed if such violations are uncovered.

In the first half of 2023, cars were Georgia’s third-largest export to Russia, generating substantial revenue. According to Geostat data, 3,786 cars, with an average customs value of USD 14,000, were transported to Russia, amounting to over USD 53 million – a 274% increase year-on-year. This surge underscores Georgia’s role in Russia’s efforts to mitigate the effects of Western sanctions through third-country channels.

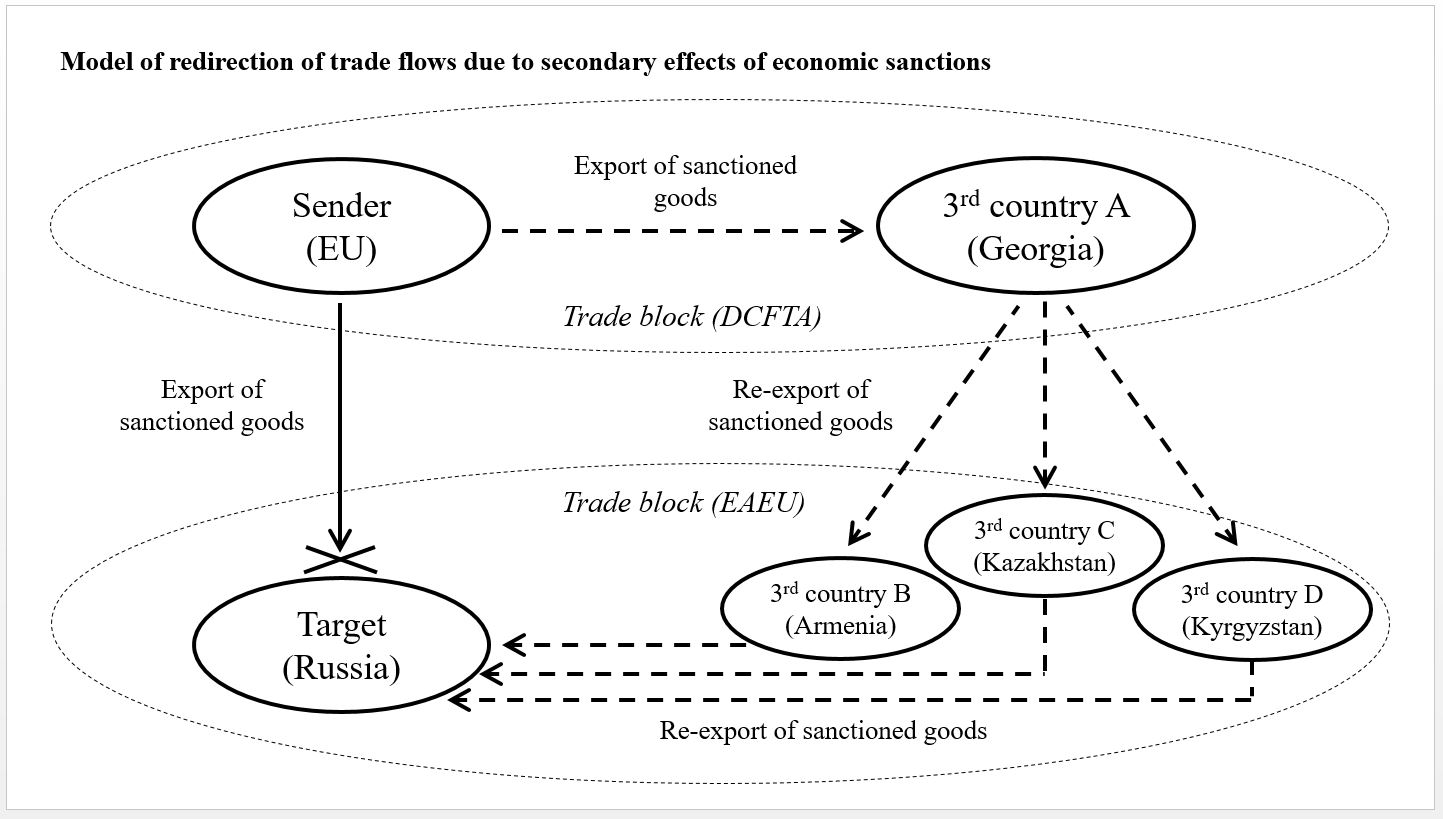

Following the adoption of the 11th package of EU sanctions in June 2023 – primarily aimed at countering sanctions evasion – Georgia banned the re-export of all categories of sanctioned vehicles to Russia. This regulation discourages direct trade with Russia and redirects trade flows from Georgia – a participant in the EU’s Deep and Comprehensive Free Trade Area (DCFTA) – to other third countries within the Eurasian Economic Union (EAEU). Kazakhstan, Kyrgyzstan, and Armenia, members of this customs-free trade bloc along with Russia, become key channels for the re-export of sanctioned cars from Georgia. The theoretical model of trade flows of sanctioned goods, adjusted for the potential impact of secondary sanctions on third countries, is presented below:

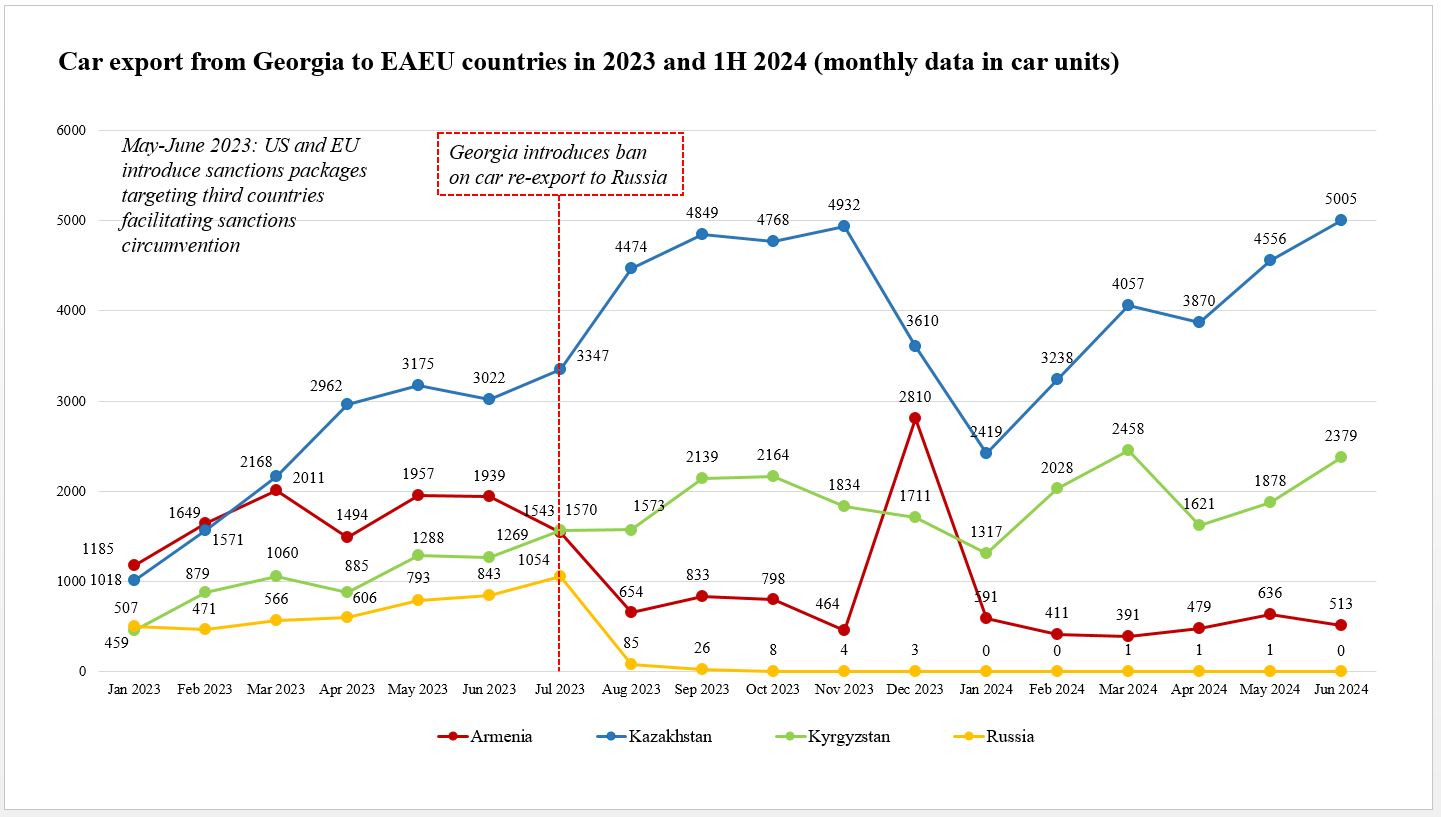

The immediate effect of Georgia’s ban on the re-export of vehicles to Russia is evident. According to Geostat data, the re-export of cars from Georgia directly to Russia decreased dramatically: in August 2023, only 85 cars were re-exported, a steep decline from 1,020 in July 2023. In the following six months, the number of re-exported cars dropped to zero. In contrast, re-exports from Georgia to Kazakhstan, Kyrgyzstan, and Armenia surged by 47% in the second half of 2023 compared to the first half, reaching 44,073 cars. Comparing the annual 2023 data with 2021 reveals a staggering growth rate of 1,240%. The first half of 2024 also showed significant numbers, with 37,847 cars redirected to these countries – a 26% increase compared to the first half of 2023. This data indicates that, while Georgia has terminated its direct car export to Russia, it continues to play a key role in supplying the Russian market through third countries.

Furthermore, despite the official ban on re-exporting sanctioned vehicles to Russia, investigations by journalists have uncovered “grey” channels used to deliver cars directly from Georgia to Russia. A sophisticated scheme involving Russian businessmen residing in Georgia facilitates the movement of cars across the Georgian-Russian border without customs clearance. These cars, often hidden from official export statistics, are transported into Russia under temporary registration and subsequently sold on the Russian side.

In conclusion, the re-export of cars from Georgia to Russia via EAEU countries and the use of grey channels for direct exports pose significant concerns for Georgia’s geopolitical alignment. While these trade channels offer short-term economic benefits, their persistence risks undermining Georgia’s international reputation and damaging its relations with the West. This creates a critical policy dilemma for Georgia as it pursues EU candidate status. On the one hand, the economic gains from maintaining these flows are attractive. On the other, perceived non-compliance with international sanctions could jeopardize its long-term alignment with EU policies and standards. To secure its strategic future within the EU, Georgia must strengthen its alignment with the EU’s Common Foreign and Security Policy. The continued existence of re-export channels for sanctioned goods from Georgia to Russia particularly undermines this alignment. This requires improved customs controls, greater transparency in trade practices, and a crackdown on sanctions evasion networks, ensuring Georgia remains on a clear path toward EU integration.

Methodology

This research examines car trade patterns using monthly import/export data from January 2018 to June 2024, covering 78 months, at the 4-digit Harmonized System (HS) level (HS 8703: Motor cars). We applied the gravity model of international trade, controlling for macroeconomic parameters such as GDP in current prices, inflation, and currency exchange rates. The analysis is based on both the number of car units and the value of cars exported in USD. Hypotheses are tested through regressions, supplemented by the difference-in-differences estimation technique, which allows us to observe changes in car re-export volumes triggered by the threat of secondary sanctions on third countries for facilitating sanctions evasion.

Note: The full version of the scientific article is available at: Link

Partsvaniya Vakhtang and Pirveli Erekle (forthcoming), ‘Western Sanction Evasion Through Third Countries: The Case of Sanctioned Cars Re-Export to Russia’. NISPAcee Journal of Public Administration and Policy.

Forbes Georgia: სარედაქციო გუნდი