Global Travel and Hospitality: America and Europe lead, the Republic of Georgia rises as the next international luxury All-Inclusive destination

The luxury hospitality sector, particularly with all-inclusive services, has demonstrated remarkable resilience amid global crises, conflicts, and natural disasters. This resilience is underscored in the latest report Luxury Hospitality in Georgia and Global Trends from the Global Investment Group.

Analyzing the outcomes of 2023 and examining market trends and future prospects, the report identifies several key dynamics within the luxury hospitality space. Notably, the report highlights the surge in luxury hotel properties offering all-inclusive services, alongside increased profitability and occupancy rates in this niche.

“Despite the global financial downturn and heightened military tensions in regions such as Ukraine, Azerbaijan and Armenia, Israel and the Middle East, and hotspots like Kosovo and Taiwan, in 2023 the global hospitality sector already surpassed pre-pandemic levels. The industry is on track to continue its recovery and accelerate growth into 2024,” the report indicates.

A significant trend is the rise in online bookings, which are increasingly favored by high-net-worth travelers, the analysts noted. The investment firms and private investors are also gravitating towards the all-inclusive segment, recognizing the format’s growing popularity among affluent consumers. This is expected to be a long-term trend, bolstered by the continued importance of loyalty programs from international hotel brands.

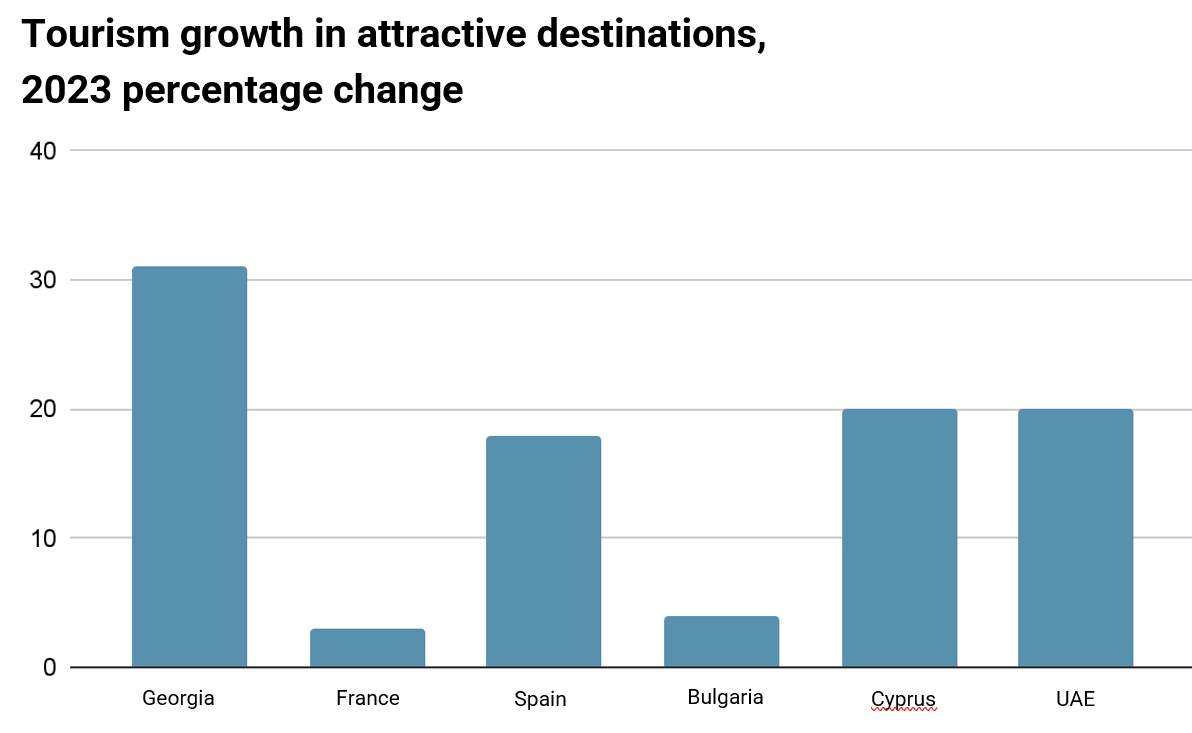

The regions leading this growth include North America, Western Europe, the Middle East, and the Caucasus, with Georgia emerging as a standout. The impending arrival of luxury all-inclusive hotels under international brands is projected to position Georgia as a key player, potentially outpacing current Black Sea-Mediterranean leaders like Turkey, Egypt, Bulgaria, and Russia over the next decade.

Georgia’s vacation real estate market currently faces an oversupply in the economy segment, contrasting sharply with a significant deficit in the premium and luxury segments. This imbalance is shaping the market’s mainstream.

The premium segment, already present in Georgia though limited in scale, is expected to see rising accommodation costs. Prices in this segment are projected to range from $100 to $400 per night. Meanwhile, the luxury hotel segment, particularly those under international brands, is just beginning to take off in Georgia. Prices here are set to start from $450-600 per night, with top-tier offerings reaching $5000-6000, depending on the level of service and exclusivity provided to VIP guests.

Georgian tourism statistics indicate a consistent increase in average spending per visitor. The composition of inbound tourist traffic is also evolving, with a growing proportion of high-spending tourists from Israel, the European Union, and Arab nations. Moreover, Georgia is attracting more visitors with annual incomes exceeding $500,000, who are drawn to elite offerings and top-notch service.

These trends point to substantial development and investment opportunities in Georgia’s premium and luxury vacation real estate market. The country is well-positioned to establish itself as an international luxury all-inclusive resort and a leading tourist destination in the region.

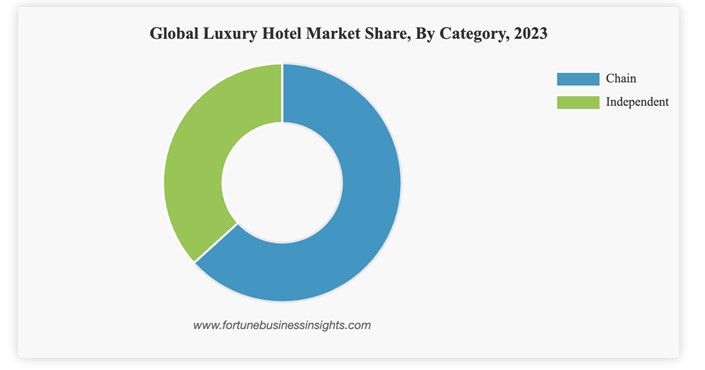

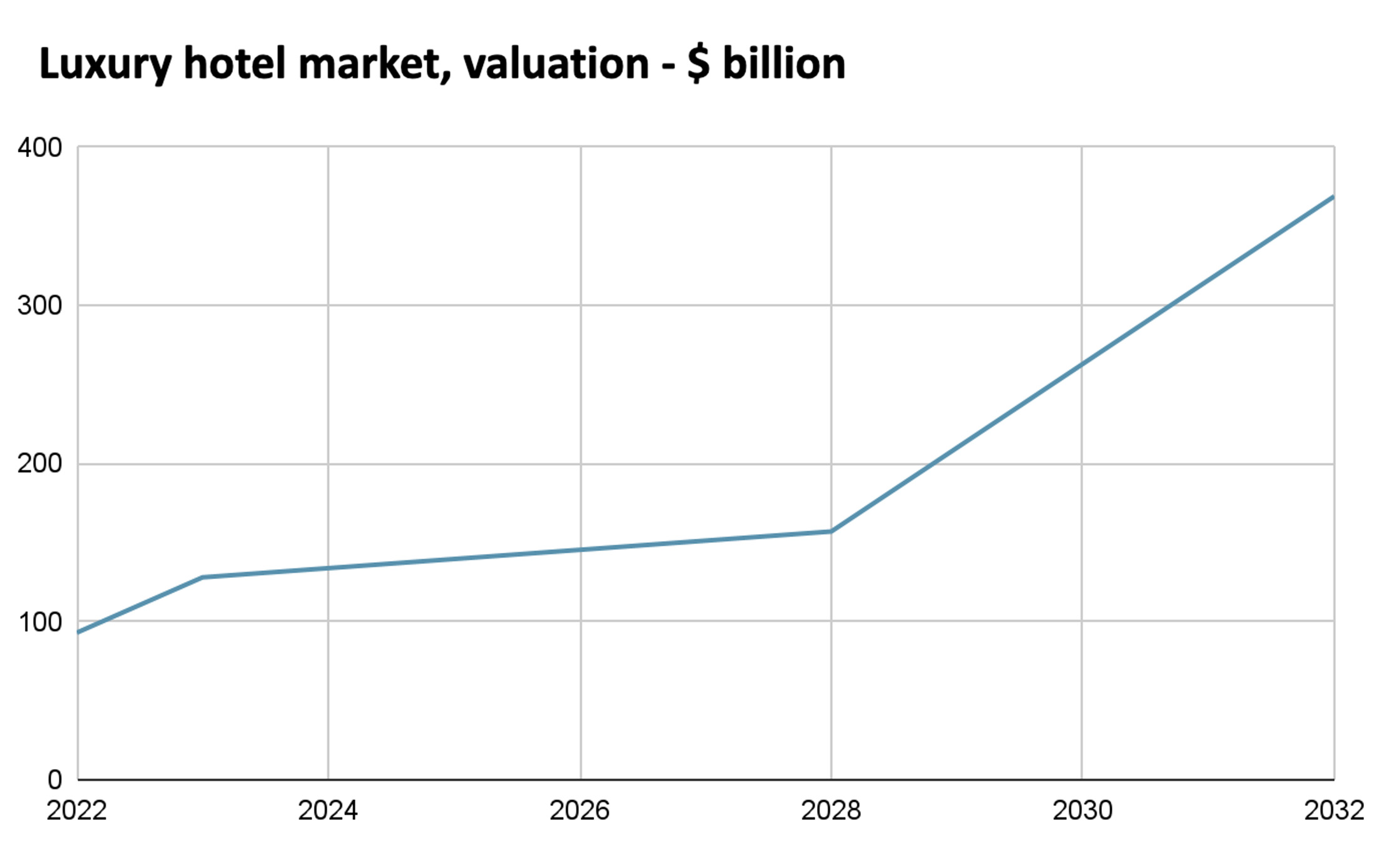

The key takeaway from the report is that three trends are set to dominate the global hospitality industry with the strongest long-term growth potential: all-inclusive resorts, branded hotels, and luxury properties. This is particularly true in micro-segments that combine all three. These segments are far more profitable than city hotels or standard resorts, let alone unbranded apartment rentals. According to the study, the global luxury hotel market is expected to grow at an average annual rate of 11.5% between 2024 and 2032.

Fortune Business Insight projects even more significant growth for the global luxury hotel market, forecasting a surge to $369.36 billion by 2032, with an estimated CAGR (Compound Annual Growth Rate) of 11.5% between 2024 and 2032.

For the full report, click here.