Dr. Dariusz Edward Prasek – International Expert in Circular Economy, ESG and Sustainable Finance Areas, Member of the Executive Board of Georgian Society of Nature Explorers “Orchis”, Former Director of Operations in Environmental and Sustainability Department of the European Bank for Reconstruction and Development

Dr. Mariam Kimeridze – Expert in ESG and Sustainability Areas, Chairperson of the Executive Board of Georgian Society of Nature Explorers “Orchis”

Abstract:

In the face of global challenges such as climate change, inequality, and transitioning to a circular economy, the importance of Environmental, Social, and Governance (ESG) frameworks for sustainable growth has grown significantly. This paper explores the key pillars of ESG and their implications for businesses. It identifies the components of ESG—social goals, ESG risks and opportunities, and sustainability performance—and delves into the specific criteria under each pillar. The paper emphasizes the importance of identifying material ESG issues relevant to specific industries and aligning with regulatory frameworks. Furthermore, the paper examines the significant drivers for ESG, particularly focusing on the regulatory push, notably from the European Union (EU). The EU Taxonomy, Sustainable Finance Disclosure Regulation (SFDR), and Corporate Sustainability Reporting Directive (CSRD) are highlighted as key regulatory instruments shaping ESG integration and disclosure practices. The EU Taxonomy, in particular, sets criteria for environmentally sustainable economic activities, impacting disclosure obligations for both financial market participants and non-financial companies. The paper also discusses the implications of these regulations for Georgia, an EU Candidate Country, highlighting the importance of supporting Georgian businesses in ESG integration and compliance with international commitments. It suggests strategies such as educating businesses on ESG requirements, promoting EU ESG policies, and facilitating consistent ESG reporting across economic entities and financial products. Finally, the paper underscores the benefits of ESG adoption for Georgian businesses, including improved risk management, portfolio performance, environmental impact, innovation, talent attraction, regulatory compliance, and contribution to global sustainability goals. Ongoing initiative of the Government of Georgia and Georgian Society of Nature Explorers “Orchis” (GSNE “Orchis”) in the areas of circular economy and ESG supported by the UNDP’s Governance Reform Fund (GRF) funded by Sweden is also presented to the readers. Overall, the paper advocates for the practical implementation of ESG principles to foster sustainable development in Georgia.

Introduction

Our world faces a number of global challenges: climate change, transitioning from a linear economy to a circular one, increasing inequality, balancing economic needs with societal needs. Investors, regulators, as well as consumers and employees are now increasingly demanding that companies should not only be good stewards of capital but also of natural and social capital and have the necessary governance framework in place to support this as well as to disclose their performance from the Environmental, Social and Governance (ESG) point of view and report on ESG factors associated with their operations.

As countries explore new investment strategies to accelerate economic development, build resilience and balance competing environmental, economic and social pressures, the concept of Environmental, Social and Governance (ESG) as a framework for sustainable growth has gained new relevance. The goal of ESG is to capture all the non-financial risks and opportunities inherent to a company’s day to day activities.

ESG investing focuses on companies that follow positive environmental, social, and governance principles. Investors are increasingly eager to align their portfolios with ESG-related companies and fund providers, making it an area of growth with positive effects on society and the environment. More and more investors are incorporating ESG elements into their investment decision making process, making ESG increasingly important from the perspective of securing capital, both debt and equity.

There are many benefits of implementing ESG into your business. Perhaps the most obvious benefit is that it can help your business be more sustainable and environmentally friendly. Additionally, ESG can help improve communication and transparency within your organization, as well as build trust with stakeholders.

In this article, the authors support the notion that good ESG performance starts by identifying relevant ESG risks, supports ESG performance through management systems, and facilitates financing through consistent and reliable ESG reporting.

What are the key pillars of ESG

The United Nations Principles for Responsible Investment (UN PRI)[1] identifies three core components which provide the path to comprehensively understanding an entity’s ESG risks and opportunities, environmental and social performance, and contribution to wider outcomes: (i) Social goals and planetary thresholds – nationally, regionally, or internationally recognised environmental and social targets, norms and responsibilities within which entities operate from a sustainability perspective; (ii) ESG risks and opportunities – ESG factors likely to impact the financial condition or operating performance of an entity; and (iii) Sustainability performance – how an entity’s operations and products impact, both positively and negatively stakeholders and the environment.

What falls under the Environmental Pillar

Under this pillar our main concerns are emissions such as greenhouse gases and air, water and ground pollution emissions, as well as resources use such as whether a company uses virgin or recycled materials in its production processes and how a company ensures that from cradle to grave the maximum material in their product is cycled back into the economy rather than ending up in a landfill. Similarly, companies are expected to be good stewards of water resources. Land use concerns like deforestation and biodiversity disclosures also fall under the Environmental Pillar. Companies also report on positive sustainability impacts they might have, which may translate into long-term business advantage. From a reporting perspective this is the most complex pillar.

What falls under the Social Pillar

Under the Social Pillar companies report on how they manage their employee development and labour practices. They report on product liabilities regarding the safety and quality of their product. They also report on their supply chain labour and health and safety standards and controversial sourcing issues. Where relevant companies are expected to report on how they provide access to their products and services to underprivileged social groups.

What falls under the Governance Pillar

The main issues reported under the Governance Pillar are shareholders’ rights, board diversity, how executives are compensated and how their compensation is aligned with the company’s sustainability performance. It also includes matters of corporate behaviour such as anti-competitive practices and corruption.

What is relevant from all this for your Company

Of course, not all sectors of the economy face the same ESG issues. For example, in the case of banks, greenhouse gas emissions are not as important as they are in the case of energy. These differences in what matters to a particular sector from an ESG perspective is called materiality. Companies report on issues that are material to them. Typically, materiality is determined based on what ESG issue is considered financially material in a given industry. Financially material issues are those that can impact a company’s financial performance (e.g. unexpected surplus costs, fines, loss of brand value, loss of revenues due to consumers choosing more sustainable alternatives). Increasingly double materiality is being recognised as an important concept in choosing what is considered material by a company. Double materiality means that alongside financially material issues, socially material issues are also treated as material.

What are the key drivers for ESG

One of the strongest drivers for ESG is a big regulatory push, both from individual national governments and central banks as well as supranational like European Union. Over the recent years the European Commission has adopted new strategies and regulations in order to tackle climate and sustainability challenges and opportunities. They include adoption of the EU Taxonomy Regulation 2020/852[2], adoption of the Sustainable Finance Disclosure Regulation (SFDR) 2019/2088[3] and revision of the Non-Financial Disclosure Regulation and introduction of the Corporate Sustainability Reporting Directive (CSRD).

EU Taxonomy is a driving force for EU companies for further ESG integration and disclosure. The EU SFDR and the CSRD are both requiring EU Taxonomy alignment on top of the ESG Key Performance Indicators (KPIs). It is essential to apply EU Taxonomy performance criteria, especially for projects in GHG intensive sectors and sectors with highest GHG reduction potential (e.g. the low carbon technologies).

The EU is introducing ESG reporting requirements for financial companies under the EU SFDR and updating ESG reporting for non-financial companies under the CSRD[4]. EU Taxonomy and CSRD will have a direct impact on companies’ ESG reporting obligations while SFRD is aimed for the financial market participants, with an indirect impact on companies’ reporting.

Why is the EU Taxonomy so important

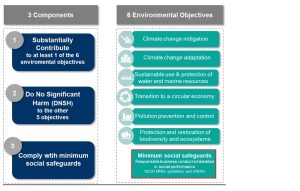

The EU Taxonomy on Sustainable Finance (EU Taxonomy) is a classification system, establishing a list of environmentally sustainable economic activities. At present, EU Taxonomy includes a list of economic activities from approximately 70 sectors, with technical screening criteria (TSCs) for their contribution to six environmental objectives and required compliance with minimum social safeguards (OECD Guidelines in Multinational Enterprises[5], UN Guiding Principles on Business and Human Rights[6], and ILO Core Labour Conventions).

To be considered a sustainable activity and aligned with the Taxonomy, companies should follow an assessment process outlined below. TSCs further explain what it means to contribute or harm one of the environmental objectives.

Picture 1. EU Taxonomy Methodology

EU Taxonomy imposes a number of disclosure obligations for financial market participants under the scope of the SFDR and companies under the scope of the CSRD. The EU Taxonomy requires companies such as large public interest entities as defined by the CSRD to disclose whether and to what extent, their economic activities are aligned with the EU Taxonomy. Companies should disclose the proportion of their turnover, capital expenditures (CAPEX) and operational expenditures (OPEX) that are aligned with the EU Taxonomy.

The EU Taxonomy requires financial market participants offering “environmental” or “sustainable” financial products and services in the EU to disclosure how, and to what extend the economic activities are in line with the EU Taxonomy. This includes the type of environmental objectives it contributes to and the share of investments (such as turnover, CAPEX and OPEX) associated to Taxonomy-aligned activities.

Are there any other significant ESG drivers in addition to the EU Taxonomy

The Sustainable Finance Disclosures Regulation (SFDR) introduces transparency requirements to publish on websites policy on integration of sustainability risks in decision-making, how Principal Adverse Impacts (PAI) are considered, processes and standards in place, and information on remuneration policies. SFDR applies to both EU based market participants and non-EU market participants that have business within the EU. SFRD will impact non-financial companies indirectly through increased investor demand for detailed ESG disclosure.

The SFDR introduces transparency requirements to publish on websites:

- For all financial products it requires to disclose how sustainability risks are integrated in investment decisions, how adverse impacts are considered applying obligatory PAI indicators plus 4 PAI indicators for sovereigns and real estate assets, how and to what extent the EU Taxonomy is used and % alignment;

- For financial products promoting environmental and social objectives details on how these are met with reference to methodology and benchmarks (to avoid greenwashing), and EU Taxonomy alignment.

- For products with a sustainable (green) investment objective disclose benchmark information, or explanation how the objective is met. Where the objective is carbon reduction, disclose the alignment with the Paris Agreement. For activities contributing to the Taxonomy, requirement to disclose the details.

How do all these regulations align

The Corporate Sustainability Reporting Directive (CSRD), together with the Sustainable Finance Disclosure Regulation (SFDR) and the Taxonomy Regulation, are the central elements of the sustainability reporting regime that underpins the EU Sustainable Finance Strategy[7]. SFDR governs how financial market participants (including assets managers and financial advisers) should disclose sustainability information towards end investors and asset owners. To meet the requirements of the SFDR, financial market participants need adequate information from investee undertakings. The Taxonomy Regulation creates a classification system of environmentally sustainable economic activities with the aim of scaling up sustainable investments and combatting greenwashing of sustainable financial products. It required companies under the scope of the CSRD to disclose the extent to which their activities are environmentally sustainable according to the Taxonomy. The EU driven changes will require organisations to report on sustainability strategy, targets, the role of the board and management, its principal adverse impacts, intangible, and how companies have identified the information that they have to report; facilitate digitalisation by requiring organisations to prepare financial statements and management report in a single electronic reporting and machine-readable format; and require and facilitate assurance on the organisation’s sustainability reporting. In addition, building on the successful Task Force on Climate-related Financial Disclosures (TCFD)[8], the Informal Working Group initiated a Task Force on Nature-related Financial Disclosures (TNFD)[9], which includes 74 organisations, including 49 financial institutions and corporates from five continents, as well as eight governments, regulatory bodies, think tanks and consortia. The Taskforce is tasked with the development of recommendations for more effective nature-related disclosures across both impacts and dependencies on nature, and the associated financial risks.

Why ESG is important for Georgia and what could be done in the nearest future

Georgia is an EU Candidate Country and as such has the obligation to support various economic entities in the country in the process of efficient ESG integration and ESG disclosure in line with its candidate status and 2023 Communication on EU Enlargement policy as well as various international commitments such as the Paris Agreement[10], UN PRI and related European regulations and expected reporting recommendations.

This support could entail:

- Educating Georgian businesses on recent ESG requirements around ESG strategy, management, reporting and disclosure in order to support their alignment with relevant ESG commitments and where relevant ensure compliance with required European regulations;

- Promoting European Union ESG policies; and

- Enabling consistent ESG reporting across economic entities and finance products.

ESG investing focuses on companies that follow positive environmental, social, and governance principles. Investors are increasingly eager to align their portfolios with ESG-related companies and fund providers, making it an area of growth with positive effects on society and the environment, therefore in addition to the integration with the European Union, the adoption of practical implementation of the ESG principle can result for Georgian businesses in improved risk management; enhanced portfolio performance; making a positive impact on the environment; greater innovation and adaptability; attracting and retaining talent; strengthened regulatory compliance and contribution to global sustainability goals.

What is happening in Georgia to Integrate ESG in Policy

The Government of Georgia (GoG) is committed to achieving sustainable, green, and inclusive economic growth, and enhancing environmental governance. Recognizing the essence of sustainable development lies in the broad consideration of ESG factors and transition to a circular economy across various sectors, the GoG in partnership with the think tank civil society organization Georgian Society of Nature Explorers “Orchis” has launched a one-year initiative – Supporting the Government of Georgia in Enhancing Governance and Policies for a Transition to a Circular Economy – in the frames of UNDP’s Governance Reform Fund (GRF) funded by Sweden. This initiative envisages participatory development of the National Roadmap to a Circular Economy for Georgia and capacity building thematic seminars for the key governmental agencies and policy makers in the areas of circular economy, ESG and green public procurement (GPP). To familiarise key stakeholders with the ESG framework, two targeted seminars have been arranged that were focused on ESG risks, supporting ESG performance through management systems, facilitating financing through consistent and reliable ESG reporting, as well as on cross-cutting and sector specific EU standards governing the ESG area. The thematic seminars are used as a knowledge transfer tool to inform policy makers how to better align with relevant EU regulations and promote circular economy, ESG and GPP at a policy level in Georgia. S

[1] https://www.unpri.org/

[2] https://finance.ec.europa.eu/sustainable-finance/tools-and-standards/eu-taxonomy-sustainable-activities_en

[3] https://finance.ec.europa.eu/sustainable-finance/disclosures/sustainability-related-disclosure-financial-services-sector_en

[4] https://finance.ec.europa.eu/capital-markets-union-and-financial-markets/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en

[5] https://www.oecd.org/investment/mne/

[6] https://www.business-humanrights.org/en/big-issues/un-guiding-principles-on-business-human-rights/

[7] https://finance.ec.europa.eu/publications/strategy-financing-transition-sustainable-economy_en

[8] https://www.fsb-tcfd.org/

[9] https://tnfd.global/

[10] https://www.un.org/en/climatechange/paris-agreement

Dr. Dariusz Edward Prasek

Dr. Mariam Kimeridze