Photo Courtesy of Plutus

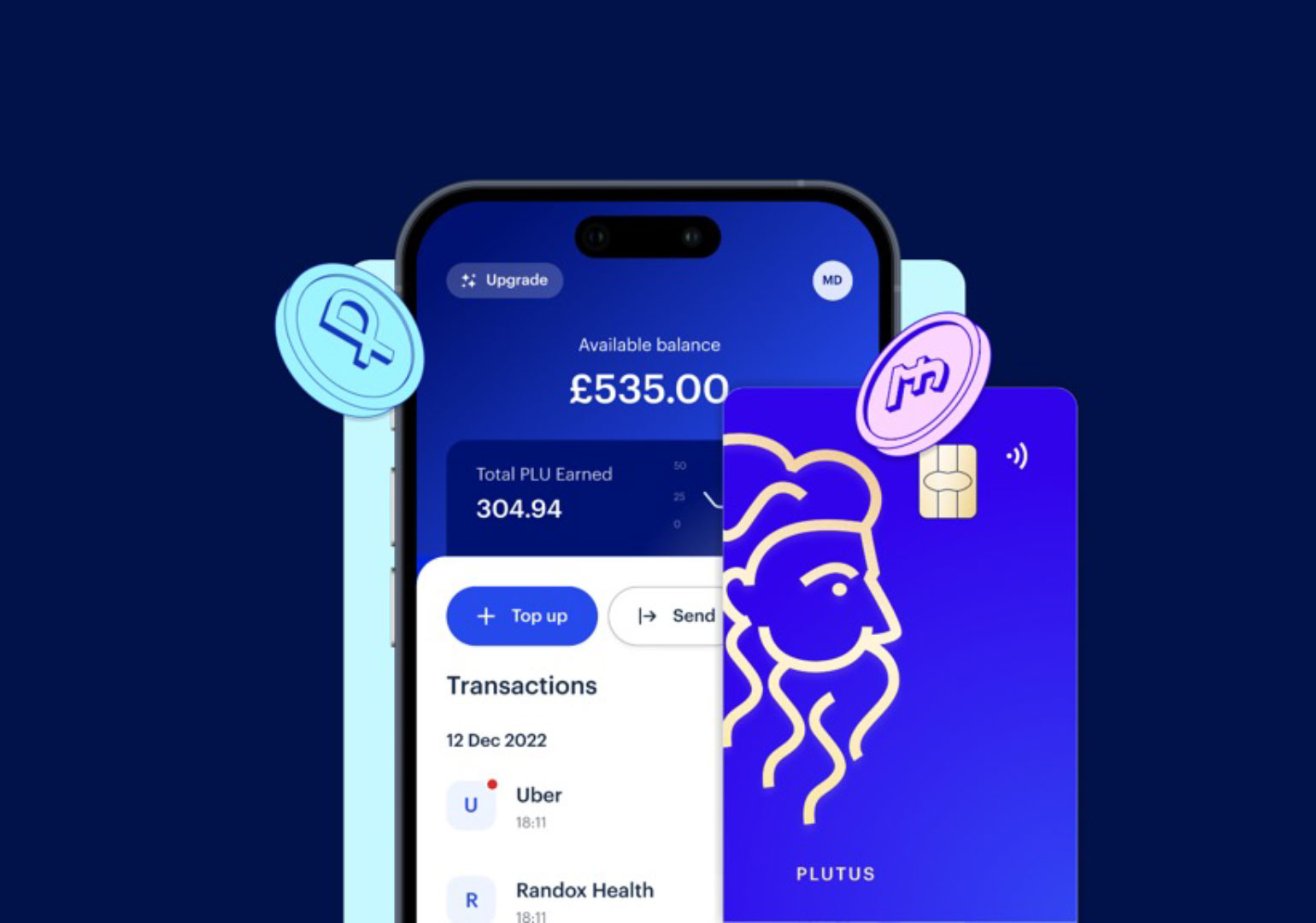

Plutus offers a different outlook on the rewards card industry, giving customers direct control over their rewards. This UK-based FinTech firm uses a non-custodial system, allowing customers to manage and transfer their Pluton (PLU) rewards independently. Plutus combines a traditional bank-like app and card with its revolutionary PLU rewards programme, all on a single platform. With plans to expand globally, Plutus aims to provide its customers with a straightforward and flexible financial experience.

Redefining Rewards: Plutus’ Core Mission of Empowerment

Plutus’ philosophy emphasizes user control. Founder Danial Daychopan explains, “We want customers to manage their own rewards. Our non-custodial model gives customers the flexibility and ownership they need.”

It moves away from centralized systems that restrict user control, allowing customers to store and manage rewards in personal wallets. This setup offers a level of independence not often found in traditional finance.

“Finance should focus on the user, and we designed our platform to give customers real control over their finances,” he states. This strategy matches the increasing demand for more user-focused financial options.

Breaking Boundaries: Flexibility Reimagined

Traditional rewards programs often limit customers with point-based systems and narrow redemption options. Plutus, however, offers a different method—customers can swap PLU tokens for card balance (EEA customers only) to spend on anything, making it easy to use rewards for everyday expenses. This flexibility is a major draw for customers.

“Our customers appreciate the freedom our platform offers. Unlike others, we don’t tie down rewards—they fully belong to our customers,” Daychopan shared.

The focus on flexibility is increasingly relevant in today’s dynamic financial environment. Customers are seeking platforms that provide meaningful control and tangible benefits. The company addresses these needs directly, attracting tech-savvy customers who value earning PLU rewards on their everyday spending. With these options, it becomes more than a financial tool—it’s a lifestyle companion.

Streamlining the User Experience

The platform combines bank-like and reward-focused features, making it accessible to a broad audience. With European IBANs, U.K. Sort Codes, and PLU rewards, Plutus connects conventional and decentralized finance. This system familiarizes customers with a debit card while allowing them to earn and manage PLU tokens. This is akin to American Express, but with a token that is more rewarding and flexible as opposed to air miles.

We want to make everyday shopping more rewarding,” Daychopan says. “With one easy-to-use app, customers can manage their finances and unlock a world of rewards, seamlessly blending traditional spending with crypto benefits.

This emphasis on simplicity distinguishes the company in the FinTech industry, removing obstacles even for those new to PLU rewards. Emphasizing ease of use makes certain that people of all experience levels can interact with the platform.

Building a Community of Advocates

Plutus is committed to fostering a community of everyday shoppers who can earn valuable rewards, even without fully engaging with the complexities of cryptocurrency. By providing an easy-to-use platform that seamlessly integrates fiat and crypto rewards, users can grow their rewards without needing deep crypto knowledge, inadvertently contributing to the wider adoption of digital assets.

Plutus offers users a transparent view of their rewards and finances, ensuring they have full visibility over their earnings and account balances. This openness builds trust, allowing customers to feel confident in managing their finances and knowing they are part of a fair, rewarding system. By making crypto rewards accessible to all, Plutus is creating a network of advocates who experience the benefits of crypto without the steep learning curve.

S