Natia Mzhavanadze – Grant Thornton, Payroll lead

Have you heard of International Company Status? Many assume it is automatically granted to foreign companies or businesses operating abroad. In reality, it is a strategic tool designed to provide companies with significant tax benefits while opening doors to the global market.

International Company Status

Since October 2020, Georgia has implemented a special tax regime. Under this framework, Georgian companies operating in the IT or maritime sectors can apply to the Ministry of Finance for International Company Status and gain access to a suite of attractive tax benefits.

Who qualifies for the status?

Before exploring the perks, it’s important to understand the eligibility criteria. While the sector of activity is a key factor, meeting this requirement alone is not enough. Additional conditions include:

- The company must engage in activities specifically approved by the Ministry of Finance.

- At least 98% of its revenue must come from these approved activities.

- Only a Georgian enterprise can be granted the status; operations must be based in Georgia.

- While the company must operate domestically, its services should primarily be delivered abroad.

- Applicants must demonstrate at least two years of experience in the relevant field. This experience can be accumulated by the company itself or by a foreign company of which it is a branch or subsidiary, provided that entity holds at least a 50% stake in the Georgian company.

- The company must not be located in a Free Industrial Zone.

- The company must not hold the status of a virtual zone enterprise.

What makes the status attractive?

Meeting these requirements and navigating the application process is no small feat. So, what makes International Company Status such a strategic advantage?

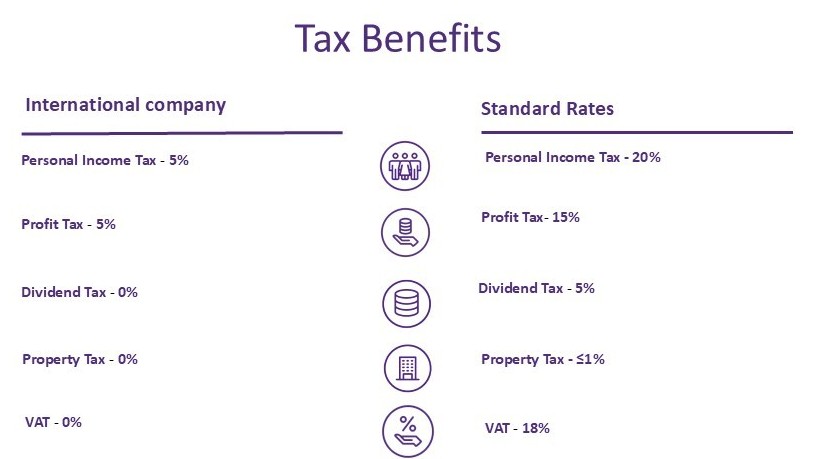

- Income earned through employment by an international company is taxed at only 5%, compared to the standard 20% in Georgia. For instance, a company with the status would withhold just 5 GEL from an employee earning 100 GEL, instead of 20 GEL.

- Dividends distributed by an international company are exempt from dividend tax and are not included in the recipient’s total income. Under the Tax Code, the standard rate is 5%.

- Profit tax for international companies is reduced to 5%, instead of the standard 15%.

- Companies may further reduce their taxable income by salary expenses paid to Georgian resident employees or for scientific research expenses approved by the Ministry of Finance. This can significantly reduce—or even eliminate—the effective tax rate.

- Property tax is largely waived for companies holding this status, with taxable land being the only exception.

- While International Company Status holders are technically subject to VAT, most are effectively exempt, as their services are primarily delivered abroad.

Challenges for status-holding companies

While the benefits are significant, they come with equally important responsibilities.

Companies must ensure that their primary business activities align with the approved list, as at least 98% of revenue must originate from these activities. Failure to comply can result in status revocation.

Additionally, while services must be delivered abroad, products or services must be created in Georgia. Authorities may also verify whether the company’s employees actually reside in the country—a challenge in today’s globalized, remote-friendly work environment, particularly in IT.

Although the status does not restrict a company’s operational diversity, there is a revenue cap from “non-status” activities. Companies must therefore continuously monitor revenue sources and carefully plan service delivery and client selection.

Reporting requirements are also more stringent. Companies must maintain accurate accounting records, closely follow legislative updates, and remain fully compliant with tax laws.

When and why can the status be revoked?

The status can be revoked either at the company’s request or due to violations discovered during inspections.

It is clear that every benefit offered by the state brings significant responsibility. We have already discussed the requirements for obtaining the status and the challenges companies face afterward; violating any of these requirements can serve as grounds for revocation.

Why must companies with the status be even more diligent in following rules and regulations? Every company is required to maintain proper accounting records, monitor tax updates, and comply with legislation. For status holders, this is even more critical, because if the Ministry of Finance identifies violations, the status is revoked retroactively from the date of granting. This automatically subjects the company to standard taxation, not only for future periods but also for past periods, resulting in significant financial loss—including taxes, penalties, and surcharges—alongside potential reputational damage.

Global Trends and Georgia’s Experience

Over the past decade, countries worldwide have increasingly implemented special tax regimes to attract global operations, develop innovative sectors, and encourage high-value service exports. These regimes are typically sector-specific and governed by clear criteria, with technology, maritime, and research sectors most commonly targeted.

In Georgia, roughly 160 companies currently hold International Company Status, most operating in the global technology sector. In 2025 alone, six companies were granted the status, while one had it revoked—demonstrating that the regime is dynamic, closely monitored, and actively functioning.

At Grant Thornton Georgia, we have been supporting companies seeking or holding International Company Status for many years. Our extensive experience allows us to guide founders through bureaucratic challenges and streamline the application process. Securing the status is only the first step—maintaining it requires strict regulatory compliance. Leveraging our deep practical knowledge, we continue to successfully collaborate with numerous status-holding companies.

S