The development of any real estate market is closely related to its investment attractiveness. It is the presence of investment-attractive objects on the market that determines the dynamics of its development. Batumi, the second most significant city of Georgia, is no exception, the real estate market of which has been developing at an accelerated pace over the past five years.

The situation in the Batumi housing market has changed due to the pandemic

The active construction of standard apartments and apartments in Batumi has led to record levels: before the pandemic, the municipality of Batumi annually issued building permits for an average of 1,200,000 square meters. For comparison, in all of Lithuania, on average, up to 300,000 m2 were built per year, that is, 4 times less.

Of course, such a record pace of construction led to the fact that supply exceeded demand. Demand growth was lower than supply growth, which led to pressure on the market. This, in turn, led to a shortage of capitalization and a surplus of offers for rent and resale. Good indicators of income from rent and capitalization began to be demonstrated by those properties, the demand for which is consistently higher than supply.

However, this is a common feature of all world real estate markets: those objects that are in demand and scarce in a particular market become more expensive and bring the maximum rental income. For example, in Batumi, there are luxury real estate and villas located in tourist locations.

The investment potential of real estate consists of many factors: the location of the object, the quality of construction, the fame and reputation of the developer, the development of infrastructure, and resort real estate – also proximity to the sea.

But for an investor who is new to this market, it is often difficult to understand the nuances. For such investors, a significant advantage is the availability of guaranteed rental income offered by the developer or the delegated management company.

In the Batumi real estate market, guaranteed income as a concept appeared quite recently and became especially relevant during the pandemic due to the reduction in tourist flows.

Investors are showing an increased interest in real estate ownership conditions in which they will not depend on market turbulence, but will be able to regularly receive passive and high income from renting out housing. Therefore, making a choice in favour of the format of truly guaranteed profitability.

“I swear on my mother’s life!” or legal obligations?

Investors’ estimates of the future profit of the investor are often very optimistic – companies compete in the promises of annual profitability of studio apartments. For example, Alliance palace predicts an income of 10% of the cost of apartments – however, for a limited number of objects. Horizon Deluxe prescribes in the preliminary contract of sale 8% per annum, Seven heaven – 7%, Blue Sky Tower Holiday Inn under the official contract guarantees an income of 8%.

However, it is important to understand that since construction has not been completed to date, it is possible to analyze only the stated proposal, which has not yet become a reality. Alternatively, the company assumes clear legal obligations of guaranteed income.

- How to distinguish real income prospects from optimistic forecasts:

- The contract clearly guarantees the specified percentage of income;

- Yield guarantee obligations are registered with the House of Justice;

- The contract stipulates fines and penalties for non-fulfilment of income obligations;

- The contract is unambiguously drafted, there are no loopholes in it for non-fulfilment of obligations under guarantees of profitability;

- Yield guarantees do not expire one year after purchase. Otherwise, the developer could simply include the amount of guaranteed income in the price of the property. And as soon as the period specified in the contract expires, interest will cease to be paid, and the contract will be renewed.

If, after reading the contract and talking with the developer, you answered negatively to all or most of these points, perhaps the guaranteed income is nothing more than a publicity stunt.

What is in short supply?

In order to guarantee the buyer an income, the developer himself must be confident in the rental success of his property. And for this, it is necessary that, firstly, it be in demand, and secondly, in short supply. The demand for it must exceed the supply.

What kind of real estate is lacking in the Batumi housing market?

- High-quality built luxury facilities. In the pursuit of low-price streaming sales, most developers have chosen to build economy-class housing. As a result, elite offers on the market are minimal. Savings on construction inevitably led to savings on quality. Therefore, luxury real estate is in short supply both on the sales market and on the rental market.

- Low rise building. Batumi has not bypassed the global trend of growing demand for private houses and villas. This trend has been strengthened by the COVID-19 pandemic – due to coronavirus restrictions, the demand for privacy and isolation of spaces has increased. Over the past few years, low-rise construction has been actively developing in Batumi and its suburbs. The problem is that the profitability of this segment is obviously lower for developers than the construction of multi-storey buildings, but at the same time, the profitability for the investor is higher with the right choice of location and product.

The land around Batumi is rapidly becoming more expensive, so most of the low-rise development projects are carried out in locations that are not attractive for tourists – far from the sea, or in environmentally or infrastructurally unfavourable areas – for example, near city dumps, near the airport and sewers. The reason is simple: in such locations, the land will cost much less. This cheapness deprives the object of rental income due to unattractiveness for tourists, and also makes it impossible to capitalize the object, often turning it into illiquid assets.

Only a few Batumi companies build villas and houses in environmentally friendly and infrastructure-friendly locations. Their real estate is much more expensive than their counterparts in illiquid locations. But at the same time, it quickly rises in price, provides high capitalization – some objects rise in price by more than 20% per year. The reason is that such houses are actually piece goods, so they bring a higher income.

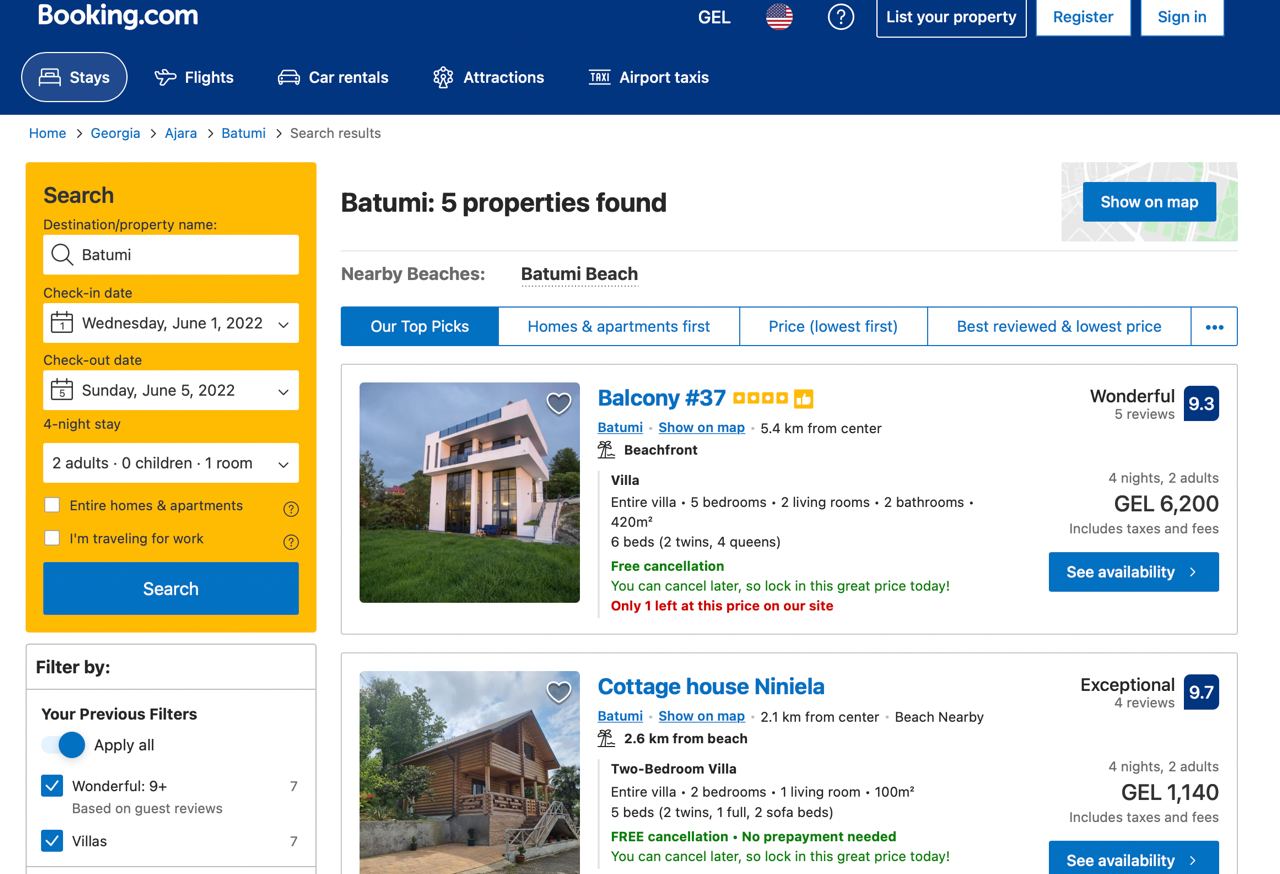

If you go to one of the world’s most popular rental platforms like Booking and try to find a villa in Batumi there, you will immediately understand the real state of affairs in this market segment. After sifting out old houses, as well as those objects that are not a separate house, but a number in a house, and those that are far from the sea, there will remain … no more than 10 objects.

Meanwhile, International Investment magazine experts calculated back in 2018: in order to cover the current demand for villas, about 220-240 villas are required in Batumi and its surroundings close to the sea. And in reality, there are 20 times fewer of them – therefore they are actively filled. Obviously, this is a very narrow offer, so this property is always occupied, and rents are considered expensive.

Criteria for determining the investment potential of private real estate:

- Proximity to the coastline.

- Quality of construction and finishing.

- Own infrastructure.

- Ecological characteristics of the area.

- Service – management and administration.

- Guaranteed profitability.

In this market segment, there are very few developers offering all of the above conditions at the same time. Usually, the proposal corresponds to two or three, and more often to only one of the points. Either the houses are located at a great distance from the sea, or this is an old fund, or the proposal does not imply any related infrastructure. And literally on two fingers, you can count developers offering guaranteed profitability of private low-rise buildings.

Examples of luxury low-rise real estate developers with guaranteed returns

- Kvariati hills complex. Currently, under construction, it offers townhouses with excellent infrastructure, including, among other things, a mini-golf course, a gym, individual rooftop pools, etc. But at the same time, it is located at a considerable distance from the sea, outside the tourist activity zone, along a busy road, and the declared guaranteed income of 8% per annum was not registered in the preliminary contract.

- Projects of the developer European Village. The company specializes in the construction of luxury individual villas in the area of Gonio Kvariati offers private houses in a closed private condominium complex. Unlike townhouses, the villa format assumes a completely separate and equipped personal space, complemented by a common centralized infrastructure. The quality of construction was noted in the publication “Business Georgia” as the best in the country.

The European Village company promises a guaranteed income from the rental of villas in the amount of 8%. This item is spelt out in the official contract of sale, and penalties are imposed for its failure, therefore the buyer is protected as much as possible. In addition, the investor can rent out his villa on his own, and make a profit of 11-15% per year, such a forecast of profitability is provided by the developer. But in this case, the owner assumes all the risks.

The location of the complex is 300 meters from the cleanest beach on the Batumi coast in the Gonio-Kvariati area. The land here is constantly growing in price, the annual capitalization reaches 20-30%. Only in the last 3-4 years, the price of plots has increased 3 times.

What capitalization options exist and can they be guaranteed

There are two types of capitalization:

- Natural price indexation, in which the object at the stage of excavation is cheaper and more expensive as construction is completed. It is worth noting that some Batumi developers do not have this difference – objects under construction and finished objects are sold at the same price.

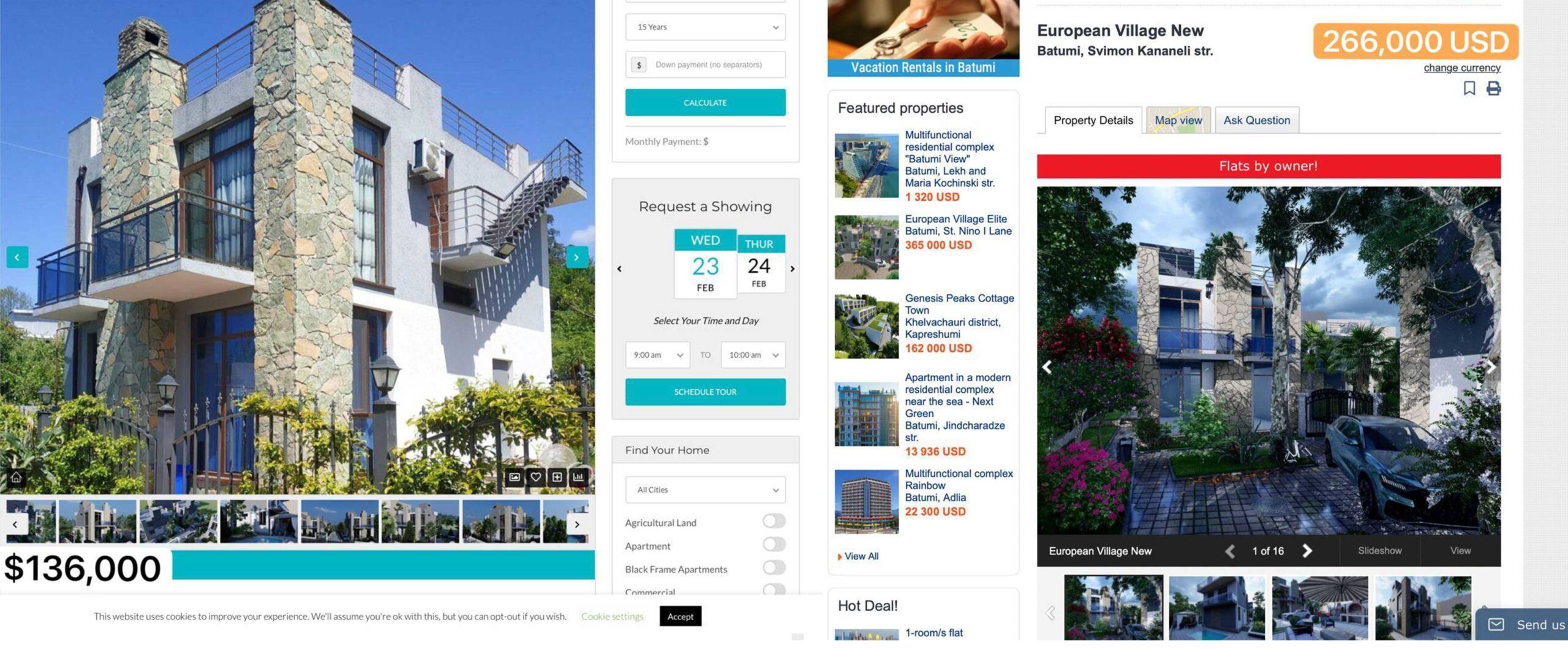

- Capitalization from an increase in the market value of the real estate. It is not typical for all objects. For example, the capitalization of apartments on the market is now showing minimal or even no growth or price declines below the original purchase price. The reason is that the market is overloaded with supply. Buying an apartment with a complete renovation and equipment at a price lower than that of the developer is now not uncommon. A completely different situation with the rise in the price of private houses. The closer to the coastline, the higher the annual price increase, because every year there is less and less land near the sea. In 2018, in the Gonio-Kvariati area, the cost of a three-bedroom villa was about $130-140 thousand, and in 2019 the price increased to $160-170 thousand. At the moment, you can buy such a house from the owner for at least $220 thousand, and from the developer – from $240 thousand.

Can capitalization be guaranteed?

It turns out, you can. A unique offer has appeared on the Adjarian real estate market – the repurchase of the object by the developer with a guarantee in the contract. This means that after 2 years the developer is ready to buy the villa at the original price if the buyer wants to sell it. And after 3 years – to redeem the object at a price 10% higher than the sale price.

So far, only the developer European Village offers such an opportunity. For the company, this is a way to confirm the liquidity of its properties to potential buyers. Such an offer is insurance for the buyer. The developer can afford to offer such conditions, as he is sure that the real rise in the price of his facilities is more than 20% per year. Such a ransom will not only not bring losses, but will also allow you to earn. By the way, no one restricts the right of the buyer to resell the villa at a higher price to third parties.

How to choose a liquid object for buying a home for investment purposes?

We summarize the main criteria for investment attractiveness when choosing a real estate

- The selected type of real estate is in short supply on the market. It can be checked on real estate websites;

- Prices for the selected type of housing have been rising in price over the past few years. You can compare prices from developers and prices for the same objects from private sellers;

- The search for such accommodation on booking and Airbnb gives few results – the main indicator of the success of future rentals;

- Housing has wow factors: proximity to the sea, high-quality construction, common infrastructure, the ability to service the facility by the management company;

- Location – in an ecologically clean beautiful place, close to the sea and an equipped beach.

- The developer guarantees profitability and capitalization and does not just mention it in promotional materials. All guarantees are enshrined in the contract, which you will sign at the House of Justice.