A year ago, I foresaw a notable decrease in inflation, a forecast that aligned with the actual outcome. This shift was influenced by the elevated inflation observed in 2022, which can be attributed to the base effect. The cost of already expensive products did not increase further, however, nor did they decrease. The expectation that the National Bank would soften monetary policy was also met. The exchange rate of GEL fluctuated throughout the year, but on average, it remained at the same level as in the second half of 2022.

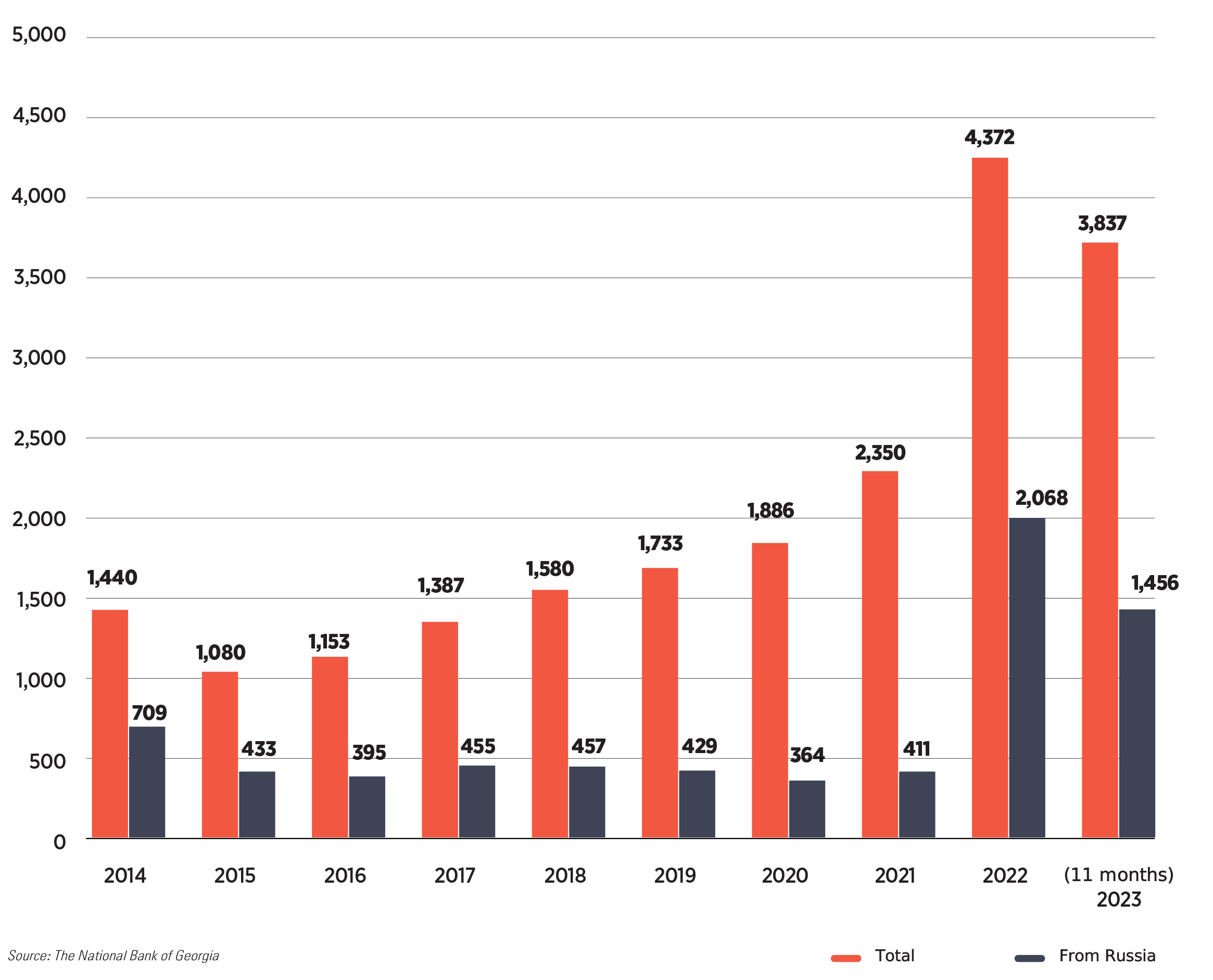

As expected, there was a decrease in remittances from Russia, which led to a fall in total remittances.

At the end of 2022, the Georgian government predicted the economy would grow by 5% in 2023 but revised the forecast to 6.5% in autumn 2023. Economic growth was aided by the continued effects of the Ukraine-Russia war, especially in the first half of the year.

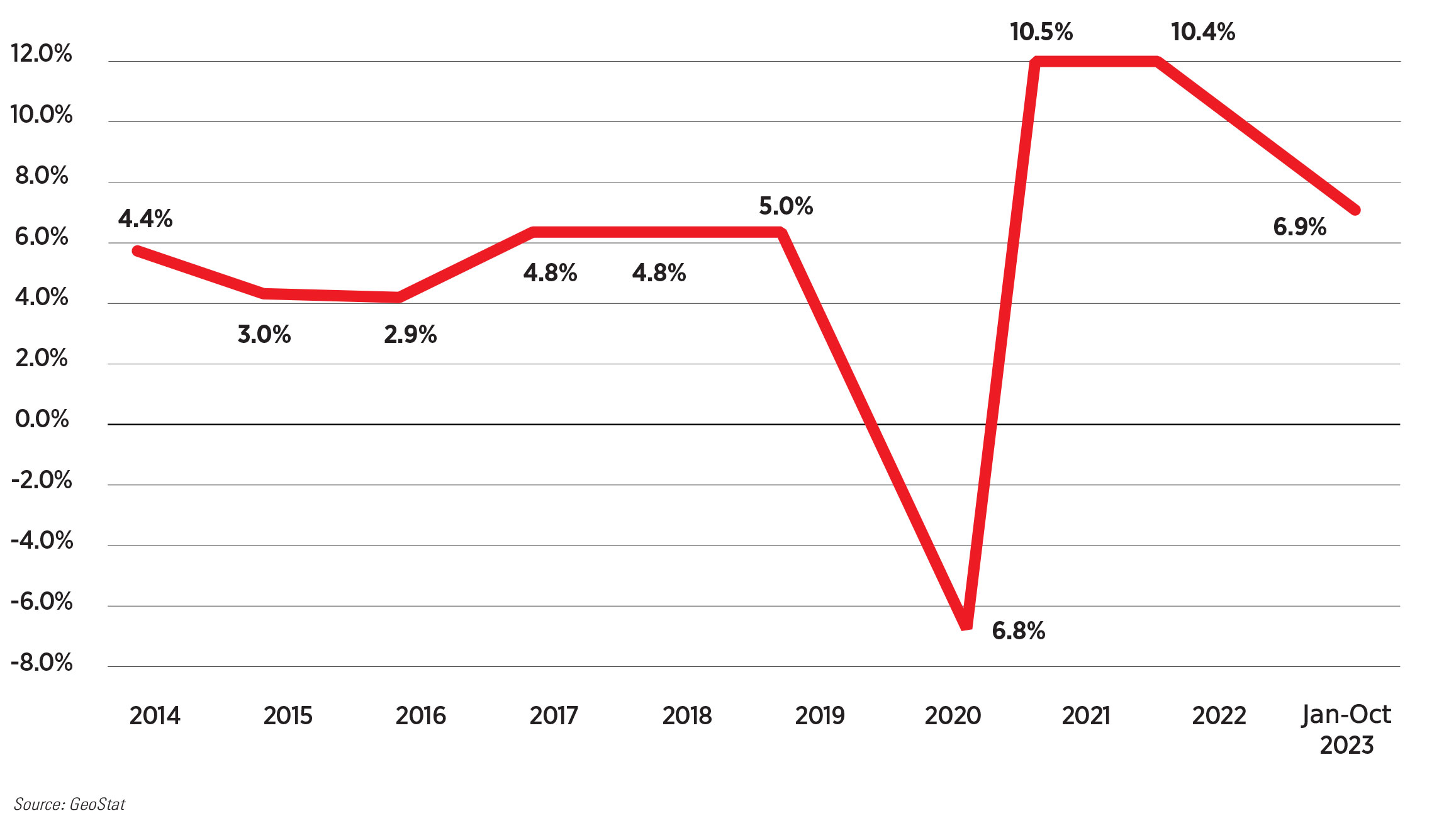

ECONOMIC GROWTH

The Georgian economy grew by 6.9% from January to October 2023. The economy grew by 8% in the first quarter, 7.8% in the second quarter, and 5.7% in the third quarter. The annual figure is still unknown but should be close to 6.5%.

In 2022, the Georgian economy grew by 10.4%, mainly because of the Russia-Ukraine war. Up to 100,000 Russian migrants came to Georgia due to the conflict. Remittances from Russia increased fivefold to $2.1 billion. Demand for real estate shot up, and Georgia’s transport sector grew. The changes brought about by the war in Ukraine significantly boosted Georgian economic growth.

Georgia’s Economic Growth Figures

The effects of the war and Russian money were still at work in the first half of 2023. For example, remittances increased by 50%. From the second half of the year, remittances from Russia and trade with Russia began to decline. The factors that had boosted Georgia’s economic growth after the start of the war in Ukraine began to weaken. As a result, the rate of economic growth fell below 6% in July.

In January-September 2023, the highest economic growth was recorded in the following sectors: IT and communications (22%), construction (18%), professional, scientific and technical activities (17%), education (16%), and trade (13%). The healthcare sector shrunk by 12%, manufacturing by 4%, and real estate by 2%.

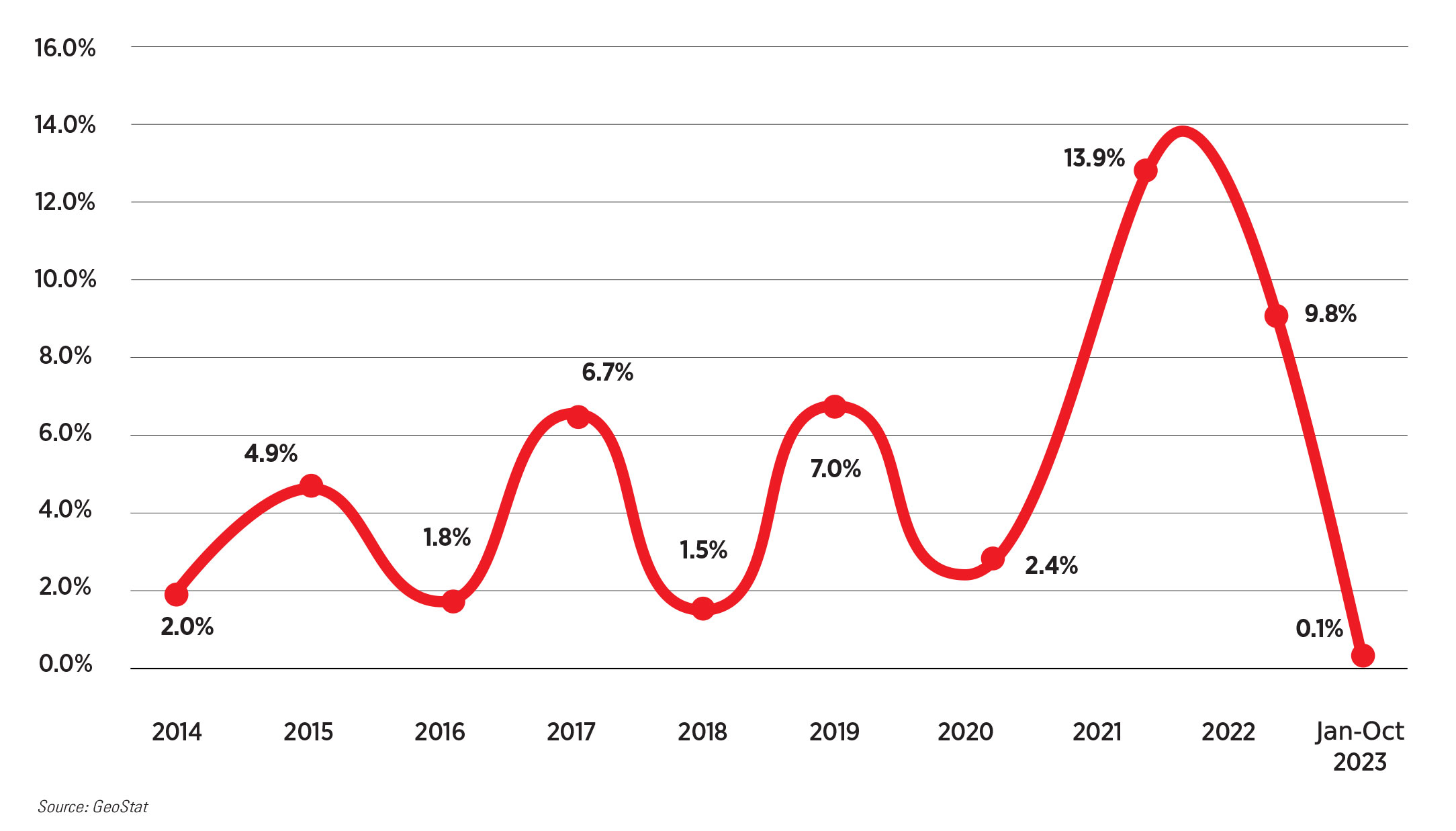

INFLATION AND THE EXCHANGE RATE

The annual inflation rate in January-November 2023 was 0.1%, meaning the average price of basic consumer goods and services barely changed in the last year. Such low inflation was last recorded in November 2016.

According to GeoStat data, the highest price increase in the period January to November 2023 was recorded in hotel and restaurant services (6.6%), alcoholic beverages and tobacco (5.1%), and education (3.6%). The price of healthcare fell by 4.3% (due to a decrease in the cost of medicine), household items by 3.5%, and food by 3.1%. If we break the data down by individual goods and services, the price of grapes increased the most (by 62%), followed by the price of peaches (37%), beef (14%), and coffee (10%). Buckwheat became cheaper by 45%, and sunflower oil by 34%.

Georgia was not the only country affected by inflation in 2021-2022. It has become a problem for virtually every country across the world. Globally, the leading causes of inflation were the pandemic-related state budget deficits and the subsequent loose monetary policies. Since 2022, monetary policies have been tightened virtually everywhere, the market shock caused by the war in Ukraine has subsided, and inflation has begun to fall in most countries.

Annual Inflation in Georgia

At the beginning of 2023, the exchange rate of the lari against the U.S. dollar was 2.70. By May, the lari strengthened to 2.48 against the dollar and would have strengthened even more had it not been for the intervention of the National Bank. From January to May, the NBG purchased $938 million and slowed down the strengthening of the national currency. The lari began depreciating in June and stabilized around the 2.60 mark. In September, the NBG changed the rules regulating commercial banks, as a result of which the banks were restricted from joining Western sanctions. This caused a panic in the financial market, and the lari depreciated. The National Bank had to sell $110 million to stop the downward spiral. The exchange rate finally stabilized around the 2.70 mark.

Ultimately, the balance of foreign currency inflow and outflow in the country has the most significant impact on the exchange rate of the lari, which deteriorated in the second half of the year.

Low inflation and the relative stability of the national currency allowed the NBG to ease the tight monetary policy gradually. The refinancing rate was 11% at the start of 2023, falling to 9.50% by the end of the year.

Between January and November, the National Bank sold $167 million and purchased $1,459 million. This shows that in terms of foreign currency inflows, 2023 had a significantly positive balance (mainly due to the first half of the year).

FOREIGN TRADE

In January-November 2023, Georgia’s foreign trade turnover increased by 32.2% year-on-year. Exports increased by 11% and amounted to $5.6 billion, while imports increased by 16% and amounted to $14 billion.

The increase in exports was mainly driven by the following products: passenger vehicles (an increase of $1.2 billion), alcoholic beverages ($52 million), non-alcoholic beverages ($44 million), and electricity ($17 million).

In terms of specific countries, the largest increase was in exports to Kyrgyzstan (an increase of $556 million), Kazakhstan ($449 million), Armenia ($215 million) and Azerbaijan ($192 million). The increase in exports to the countries mentioned above was mainly due to the re-export of cars.

The increase in imports was mainly down to passenger vehicles, whose imports increased by $1.4 billion to $2.9 billion. The import of medicinal products increased by $129 million, food by $96 million, and clothes by $73 million.

In terms of specific countries, the most significant increase was in imports from the U.S. (an increase of $882 million to $1.8 billion). The increase was mainly due to the import of automobiles. Imports increased by $723 million from the European Union, $297 million from Japan, and $218 million from China.

Georgia had a trade deficit of $8.4 billion in January-November 2023, which is $1.4 billion more than during the same period in 2022.

TOURISM AND REMITTANCES

In January-September 2023, 5.6 million visitors came to Georgia, 43% higher than in the same period in 2022. Out of the 5.6 million visitors, 3.7 million were tourists (people who stayed in Georgia for at least 24 hours). The number of tourists in the first nine months of 2023 was 8% less than in 2019, meaning we have not managed to return to pre-pandemic figures.

The most visitors in January-September (1.1 million) came from Russia – 47% more than in 2022 and 5% less than in 2019. Turkey came next with 1 million visitors, followed by Armenia with 736,000, Israel with 183,000, and Azerbaijan with 147,000.

Although the number of visitors in January-September 2023 did not return to the 2019 level, the revenue received from visitors still exceeded the 2019 figure. In the first nine months of 2019, Georgia’s revenue from visitors totaled $2.6 billion, while in the first nine months of 2023, it totaled $3.3 billion, representing a 26% increase. This revenue increase was caused by inflation, with tourists spending more money. In the first nine months of 2023, the largest amount of money was spent by Russian citizens ($767 million), followed by citizens of Turkey ($484 million) and EU countries ($428 million).

In the first 11 months of 2023, $3.8 billion was remitted to Georgia – 1% less than in the first 11 months of 2022 but 80% more than in 2021. The decrease from 2022 came from a 17% fall in remittances from Russia. Average monthly remittances from Russia amounted to $221 million in May-November 2022 and $88 million in May-November 2023.

Remittances From Abroad (Million USD)

Despite the decrease, Russia still ranks first in total remittances with $1.5 billion. $1.2 billion was remitted from the EU, $410 million from the United States, and $194 million from Israel.

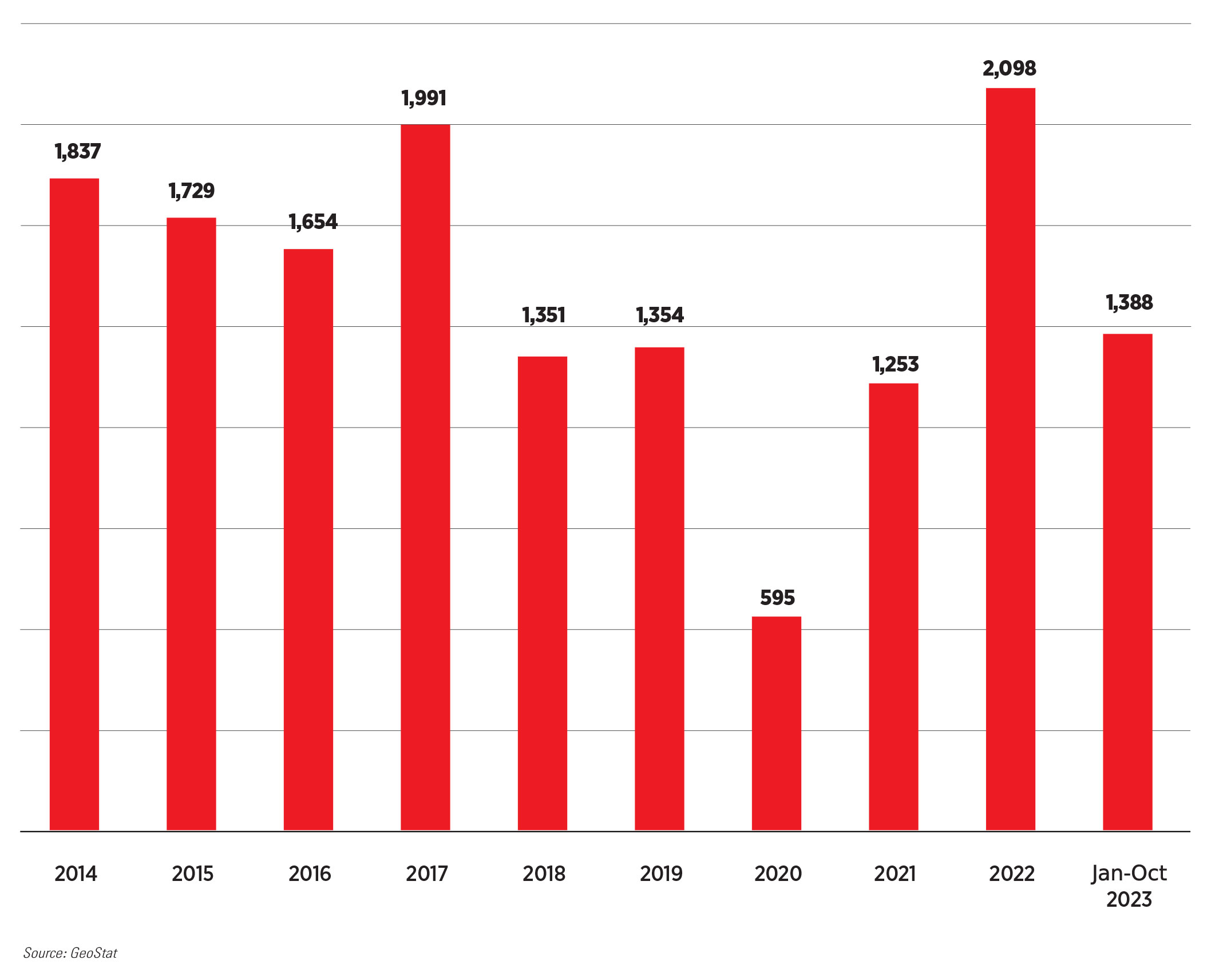

FOREIGN DIRECT INVESTMENT

Foreign direct investment statistics are known only for the first three quarters of 2023 (January-September). According to this data, foreign direct investment in Georgia amounted to $1,388 million, representing a 22% decrease year-on-year.

The largest increases in investment were from the Netherlands (an increase of $207 million) and Turkey ($59 million). In comparison, the most significant decreases were from Spain (a reduction of $337 million), Ireland ($120 million) and the United Kingdom ($93 million).

In terms of specific industries, the financial sector accounted for the most significant amount of foreign direct investment in the first nine months of 2023 ($342 million), followed by manufacturing ($288 million) and energy ($234 million). The smallest investment was made in the mining industry ($1.3 million). The largest decrease in investment (-$313 million) was recorded in real estate, followed by water supply (-$198 million) and the entertainment and leisure sector (-$106 million).

CHALLENGES FOR 2024

As in 2023, this year starts with an uncertain future, as Georgia’s economic development is significantly dependent on the Russia-Ukraine war, and no one knows whether the war will end this year or what the outcome will be. The uncertainty is increased by the parliamentary elections that are due to be held in Georgia in October. An election year is always accompanied by political excitement and an increased risk of destabilization.

Although Georgia received the status of a candidate for EU membership in late 2023, the benefits of this status on the country’s economy in 2024 will not be impactful. One could say that this year, the candidate status will help the Georgian economy most by promoting political stability within the country.

The Georgian government forecasts that the economy will grow by 5.2% in 2024. This is not a big increase, but there is considerable uncertainty. And while last year’s figures so far have shown an increase in Georgia’s economic growth rate, the factors that drove this acceleration might not exert the same influence in 2024.

Trade with Russia and remittances from Russia began to decline in the second half of 2023. If this trend continues in 2024, it will severely negatively impact Georgia’s economic growth and the stability of the national currency.

The expected external shock can be mitigated by the gradual easing of the country’s monetary policy – a process that the National Bank started in 2023. Since high inflation is no longer an issue, the NBG’s priority will be facilitating economic growth.

The Georgian lari strengthened in 2022-2023, but this had a specific reason in the shape of unexpected foreign currency inflows. We do not know how long this trend will continue. We must also consider the growing foreign trade deficit affecting the exchange rate. At the same time, the National Bank’s foreign currency reserves have increased significantly. If needed, these reserves will be sold by the NBG to ensure the stability of the national currency. The government will try to maintain currency and price stability before the elections.