Disclaimer: The views expressed in this blog are those of the authors and do not necessarily reflect the views of the Asian Development Bank, its management, its Board of Directors, or its members.

Facing twin crises—climate change and biodiversity loss, corporate actions on climate change are a new norm for business. Multilateral financial institutions function through international treaties and have been quick to respond with their commitment to the Paris alignment.

This blog shares thoughts about valuing carbon as a commodity and developing the currently immature carbon market. It provides insights into how developing countries can recognize opportunities from the carbon market and leverage the support from MFIs in their decarbonization pathways.

Carbon pricing is the act of putting a price on carbon emissions to mitigate climate change. It comprises of carbon taxes, carbon border adjustments, emission trading system (ETS), and carbon crediting. There are currently 73 instruments, most of which are carbon taxes and ETSs in Europe and North America.[1] The People’s Republic of China (PRC) started running its national ETS in 2021.

Carbon prices have hit record highs recently in many markets. The price of an EU ETS credit topped at more than 99 euros in August 2022, while the carbon tax in Singapore stayed at about 17 euros. To prevent carbon leakage, the EU is introducing the carbon border adjustment mechanism (CBAM) to require importers in selected industrial sectors to purchase certificates equivalent to the weekly EU carbon price. Higher carbon prices are necessary to keep global heating to below 2°C—the upper end of the limit agreed in the Paris Agreement. The Report of the High-Level Commission on Carbon Prices identified a USD 50-100/ton range as the price needed by 2030 to keep global heating to below 2°C—the upper end of the limit agreed in the Paris Agreement—as part of a comprehensive climate policy package.[2] Further, more recent estimates indicate even higher prices may be needed to reduce emissions to net-zero by 2050.

Under the new rules of Paris Agreement Article 6, governments can decide on the type of projects in their countries and whether to authorize carbon emission reductions from those projects. These rules can lead to further divergence in approaches, credit types, and prices for carbon.

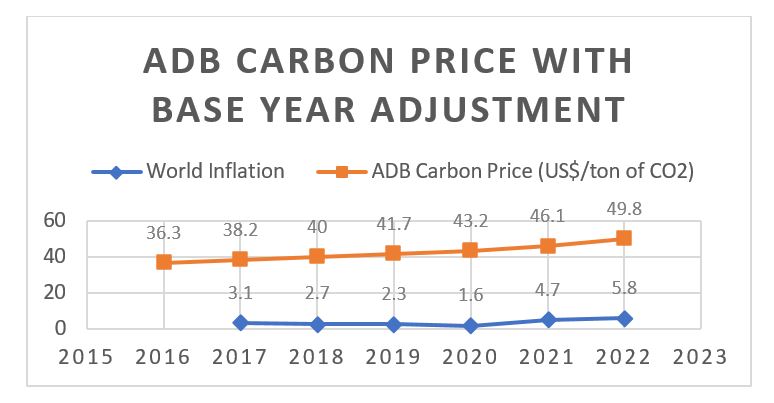

Source: Asian Development Bank. 2023 price is not included because it is subject to change.

Actions that developing countries can take to leverage carbon market opportunities for government revenue enhancement and decarbonization pathways:

- Enhancing the measurement and verification of carbon credits for market opportunities:

ADB is applying carbon price in economic analysis, set at US$49.8/ton in 2022, to quantify the difference in emissions between a with-project scenario and a without-project scenario.

With its huge volume and rising price, carbon has the potential to become the most valuable commodity. The World Bank has begun implementing result-based climate finance programs through the purchase of carbon credits or providing revenue to private sector clients via the carbon markets. For carbon credits to be traded, they must be issued to eligible projects that recognize quantified emission reductions that are real, additional, permanent, and below a baseline scenario.

Developing countries can engage MFIs’ independent role in the measurement and verification of carbon credits issued to domestic and regional projects. Then, governments can ensure that their verified carbon credits are good for trading activities in the market.

- Developing the carbon markets through supporting the convergence of the compliance and voluntary markets

The carbon market is an evolving space and immature market. The Paris Agreement Article 6 enables governments to independently choose projects and whether to authorize emissions reductions in their countries. It is unclear how Article 6 will shape the carbon market, but global climate change ambition can only materialize if governments and MFIs act proactively together.

The components of the carbon market are the voluntary market and the compliance market. The smaller voluntary carbon market, valued at only $2 billion in 2021, enables corporates to offset hard-to-abate emissions to achieve net-zero and carbon-neutral ambitions. The much larger compliance market, valued at $751 billion in 2021 and dominated by EU ETS, is essentially a policy instrument mandating the reduction of greenhouse gas emissions. Currently, compliance and voluntary carbon markets operate largely independently of one another, but the blurring of lines has occurred. There is already a convergence between voluntary and compliance markets. Various compliance schemes, such as the PRC and Republic of Korea ETS, allow for a limited use (i.e., 5%) of carbon offsets. Voluntary programs can also participate in international compliance mechanisms such as Article 6.

By leveraging MFIs’ capacity building resources, developing countries can make the convergence of the voluntary and compliance markets happen sooner through proper institutional framework designs.

Summary

Decarbonization and carbon market development are challenging processes that take place together. They are constantly updated processes as new rules come out. Developing countries can work with MFIs to keep track of the rules and use their own individual climate neutrality targets to effectively cope with the carbon market.

[1] 2023. State and Trends of Carbon Pricing, World Bank. https://openknowledge.worldbank.org/handle/10986/39796

[2] 2019. Report of the High-Level Commission on Carbon Prices, World Bank. http://hdl.handle.net/10986/32419

This article was first published as an ADB blog.

Duc Tran is an economist in the Finance Sector Group of the Asian Development Bank. Before joining ADB, Duc worked at the World Bank, the International Finance Corporation, the National Bank of Poland, and CoinFi. His current work focuses on sustainable infrastructure projects and financial sector development programs in East Asia, Pacific Islands, and Southeast Asia. He holds an M.P.A. in Economics & Public Policy from Princeton University, an M.B.A. in Finance from Quantic School of Business & Technology, and a B.A. in Mathematics and Economics from Brandeis University.