February 12th, 2018 a small group of Georgian startups traveled to Silicon Valley for a week of networking events and the seeds were planted for Georgia’s first international startup exit. This Spring PulsarAI was acquired by US Company Spincar for an undisclosed price in the “tens of millions”.

The group was a mix of Startup Grind organizers (Giorgi Tukhasvhili and I), a few Georgian startups and staff of GITA (Georgia’s Innovation & Technology Agency) which funded some startup travel. There were no corporate sponsors and we organized it as volunteers to help build bridges for the startup ecosystem in Georgia.

The most important actions were not at the official conference. My belief is that at conferences the real value is in smaller, more focused “side events” where you help the right people connect. In this direction we rented an Airbnb overlooking the Pacific Ocean and gathered a small “Diaspora Dinner” with successful Georgians in Silicon Valley meeting startups with the vision of fostering mentorship and investment opportunities.

At the conference we found a low-cost way for Georgia to be highly visible thanks to VRex Immersive which was a top finalist in the startup competition and earned a prime exhibit spot showing virtual reality tours of Georgia!.

We also hosted at the house a party for Startup Grind city directors from around the world. Georgian hospitality became legendary across Startup Grind and parties were hosted in London as well as the US. “The Georgian Party” became a must-attend side-event and included as chapter directors from as many as 150 cities, some VCs and journalists. The “Diaspora & Startups Dinner” also evolved, with great help of the Georgian embassy in the US and the Georgian Association in the USA.

This evolved into partnership with 110 chapter directors for Startup Grind Europe-Asia connect, hosted by Georgia online involving 2000 people from 280 cities in 60 countries. (startupgrind.ge)

THE RIGHT CONNECTIONS

Business relationships are personal relationships and we believed that having founders and successful Georgian Diaspora together in an informal environment would forge connections. We found this to be the case.

As the Georgians from Silicon Valley gathered with the delegation we all shared our vision for a prosperous Georgia and dreamed what we could create together. One Georgian leader in the US was brought to tears with the idea of carrying on the legacy of his late father, and everyone gathered felt a special moment where something new and important was starting.

There were no “pitches” or “decks” or “investors” just people gathering together, learning about each other, and sharing ideas.

This is where the seed was planted for PulsarAI as the Dachi Choladze and Zaal Gachechiladze met with George Arison and Zaza Pachulia who later became investors. George would come to be the first investor in PulsarAI, chair their board, mentor the young founders, share huge amounts of data from his startup to train their artificial intelligence as well as introducing them to investors and customers and partners in the automotive space.

While George was extremely busy he took time out to give the startups attention. As Dachi shares George seemed very distracted as Dachi talked to him, typing on his phone. Dachi was concerned he was not listening and was very surprised. Soon after George revealed that while they talked he had already set up 3 appointments for the talented tech founders and was opening the door to his networks!

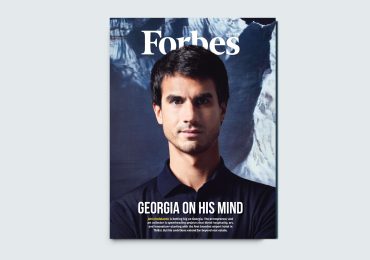

GEORGIA’S STARTUP STAR

One of the most successful Georgian startup founders is George Arison, born Irakli Areshidze. He was born and grew up in Georgia but moved to the US as teenager for school. His resume includes work at Google, founding the startup Taxi Magic, and work with Boston Consulting Group. George was CEO of Shift which at the time had raised $50 Million from investors like Goldman Sachs and Highland Capital. Our mutual friend Mark Mullen had recruited him to tear himself away from the office to come for dinner with Georgian founders though he was ferociously busy growing the company and laying foundation for a new $140 million round of debt & equity which he closed 6 months later. Since then Shift.com has gone public on NASDAQ trading as SFT with a market cap of over $650M.

Dachi and Zaal followed-up quickly with a meeting at Shift’s office and established a working relationship with George. Subsequently George gave them some project activities to demonstrate their capacity and the relationship evolved into active mentorship.

Pulsar had been an AI/ML development shop on the Georgian market and George helped guide them into a more scalable opportunity bringing conversational AI to auto dealerships. Combining the experience, data set, and relationships in the automotive industry George had from Shift Pulsar was able to get a “head-start” on the competition and seize the niche of offering high-quality automated tools for car shoppers.

The company that eventually acquired pulsar, Spincar.com, is “global leader in digital automotive merchandising software and data” and was eager after PulsarAI was only in the automotive market for less than 2 years to acquire them, saying “Pulsar’s team of deep learning specialists, developers, data scientists, linguists and operations personnel have developed some of the most powerful conversational AI capabilities available today”. In the acquisition Spincar is making offers to all existing PulsarAI team members and seeks to expand the Georgian team moving forward.

Availability of qualified AI/Machine Learning workforce is likely a barrier to Pulsar’s growth and an issue Georgia needs to solve to capitalize on the opportunity arising for Georgian companies. Competition for AI/ML talent is already a source of friction for Georgian companies.

A NEW DAY FOR GEORGIA?

While PulsarAI is making the news, there has been a steady development of things in Georgia. We have used the networks from Startup Grind and guests of Georgia’s Innovation & Technology Agency, bringing VCs and other guests to see the sites and fall in love with Georgia.

Georgia’s reputation in the startup world has become significant as it became one of the first regional Startup World Cup competitions, covering the Black Sea region, and hosted the largest Startup Grind online event ever in December 2020 involving 60 countries and 280 cities.

Building on Georgia’s reputation for hospitality we have developed networks with top-tier venture investors from Silicon Valley and many have “fallen in love with Georgia, including Bill Reichert (Garage Ventures, Pegasus Ventures), Marvin Liao (founder of 500 startups flagship accelerator in San Francisco and investor in 400+ companies), Sheel Mohnot (500 Fintech Fund, Better Tomorrow Fund), Zach Coelius (Coelius Capital), Trae Stephens (Founders Fund) and more. The willingness of these investors to participate in activities in Georgia gives the opportunity to more quickly develop early stage investing based in a rational way, based on lessons learned and best practices from these professional VCs.

As national lead in Georgia for the EUfunded Early Stage Investing Launchpad project a couple of years ago I had the opportunity to engage some more open-minded investors in learning about seed investing from some great European angels. These investors have started to form a new culture, not trying to take 51% of a startup (thereby preventing them from being able to raise future capital from VCs) and not trying to grab all of the equity in good deals. They learned about the importance of having a portfolio of startup investments as the math does not work if you only invest in one or two. They have warmed up to the idea of syndication of investments so investors have smaller pieces of more companies, for better portfolio construction. And they have learned that betting on a startup is not betting on the idea or projections but betting on the founders. Seed investing is mostly about having trust in founders and supporting them and allowing them to do their job.

For the Pulsar investment we invited the investors who had taken part in trainings and colleagues we knew and trusted. We wanted to involve people who would have expectations and founder-focused orientation. Georgian investors came in for a low-6-figure-USD investment across several investors, giving several people their first startup experience.

It was a good first experience for those local investors, though it was not a realistic one. Startup investment is a long-term commitment as the best companies will grow for a decade or more. Having a return in less than 2 years with multiple on your money is not typical.

In building an angel/seed portfolio you really want to put in a small part of your investable money (maybe 2% or 5%) and diversify across at least 10 companies if you want the math to work right. Some angels will just do a deal or two which is fine, but most likely you’ll not get a return. Startups are a game of “outliers” so it’s really the top 3% of investments that make returns for seed investors. If you put too much into too few companies your chances of hitting a 10X or 50X return is very low. You can do it for entertainment but angel investing without proper portfolio construction is gambling. The odds are in your favor, but it’s still gambling.

Not every investor has the time or interest to get to know the best practices in seed investing. Very wealthy people cannot afford the time to mess with enough companies to deploy meaningful capital and smaller investors may not have enough to invest to make a well-constructed portfolio.

This is why we are working with some of our VC friends in Silicon Valley to build a modest venture capital fund focused on seed investments in Georgia. Having a professionalized fund with experts in VC allows for good portfolio construction and support of startups as they grow in a way Georgian investors cannot provide.

Many people are talk about doing venture funds without any experience in the field, without deep connections in Silicon Valley with larger VC funds, customers and specialized talent startups need.

The secret is that the majority of funds do not have returns better than the stock market. Investors in these low-performing funds take additional risk without getting additional returns. In contrast, the top-tier funds are extremely high-performing. This is where the money is made in VC and why you’ll never get into a Sequoia or A16Z fund as they are always oversubscribed.

High-performing VC funds make money by attracting the most talented founders and providing alpha from supporting those founders. This support comes in the form of introductions to potential follow-on investors, key customers, and talented specialists in areas important to the founder, sometimes media, etc. While US startups often go with a certain VC because of the doors they open its 100X more important for Georgian founders as most here do not already have connections with VCs, corporations and other key contacts.

I look forward to seeing the Georgian startup and early-stage investing ecosystem develop and hope that vehicles with the right networks and knowledge can be made available to ambitious young founders so they can fuel their growth from Georgian funds not just US, Japanese, Israeli, Dutch and UK investors as is the case now.

Photo Courtesy: Nikoloz Gogochuri

Forbes Georgia: სარედაქციო გუნდი