On the 24th of February, Russia initiated a full-scale war in Ukraine, which had an immediate effect on the Russian rouble and on Russian assets, as well as the Georgian lari. On the first day of the invasion, the value of our currency fell by 11 tetri against the US dollar. In the longer term, Russian aggression in Ukraine will negatively affect the Georgian economy in the following ways:

- Both Russia and Ukraine are important economic partners of Georgia, especially in the field of trade, tourism and money transfers, meaning that Georgia will lose significant revenue;

- Georgia is part of the conflict zone, especially in the west on the country’s border with the Black Sea. A region with conflict is obviously unattractive to investors. Additionally, Georgia has been included alongside Ukraine in the ultimatums delivered by Russia to the West;

- A full-scale war and sanctions placed on Russia will have a negative impact on the global economy. The Georgian economy will be one of many that will sustain damage.

Since the war in Ukraine can hurt the Georgian economy in several ways, it is currently impossible to accurately predict the extent of the damage. This can be done post factum once we have the economic figures from this period to hand. Nevertheless, by examining current Georgian-Ukrainian and Georgian-Russian economic relations we can determine the maximum damage that can be sustained by our economy.

RUSSIAN INFLUENCE

Georgia is economically far more dependent on Russia than on Ukraine. Over the past two years, the COVID-19 pandemic has significantly reduced economic relations between the countries, especially in the field of tourism. In 2020, our revenue from service exports (including tourism) fell by $4.8 billion. Consequently, our economic reliance on Russia was also reduced. Money transfers, exports and tourism revenue from Russia amounted to $1.6 billion in 2019 but fell by $700 million in 2020. Economic relations started to recover in 2021, and Georgia received revenue totalling $1.3 billion from the aforementioned three sources. With regards to our dependence on Russia in terms of GDP, the figures are as follows: Money from Russia accounted for 9% of GDP in 2019, 5.7% in 2020 and 6.7% in 2021.

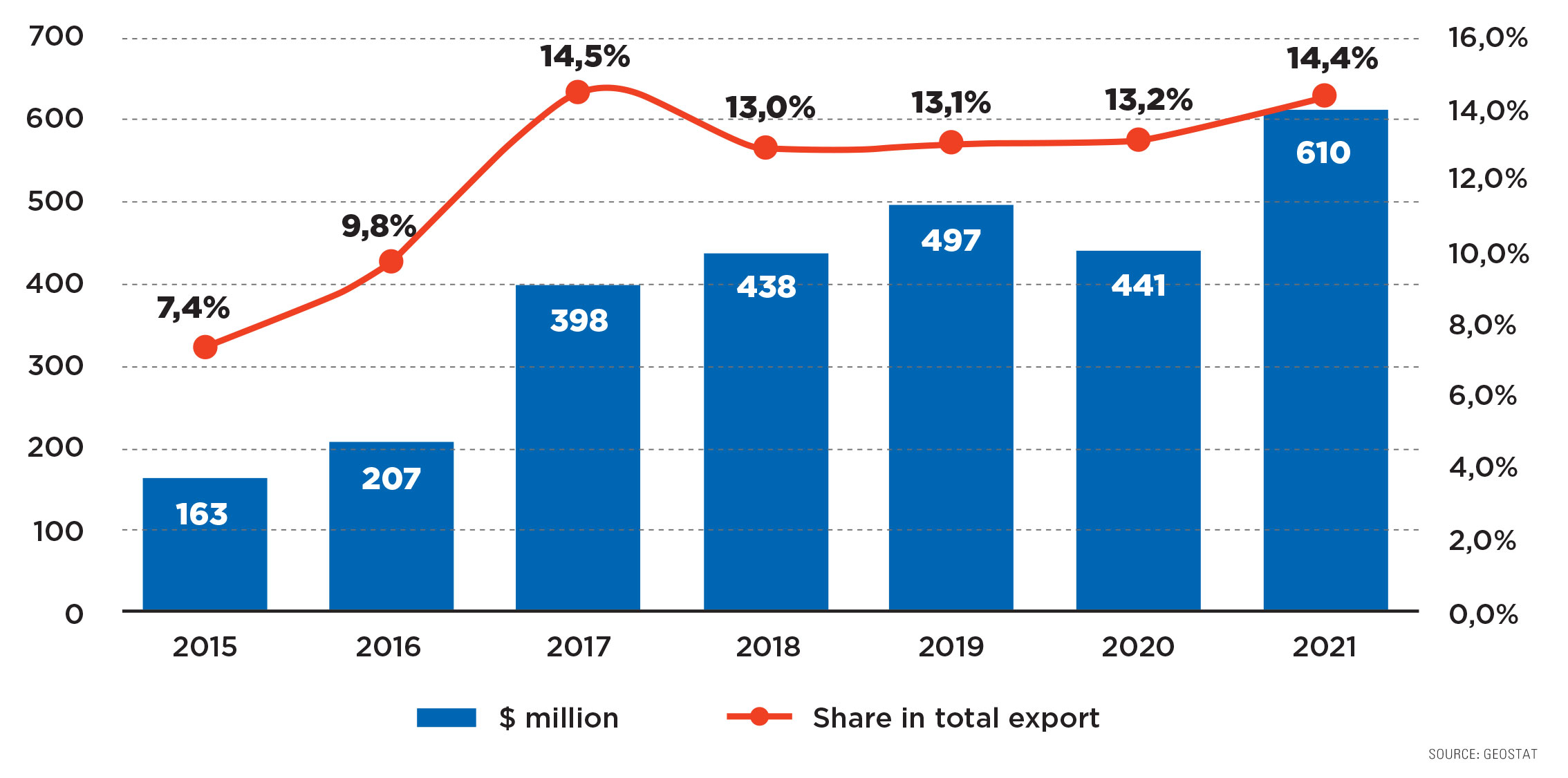

In 2010, Georgia’s export revenue from Russia totalled $610 million. Russia holds a 14.4% share in Georgian exports, which is second only to China. Export of Georgian goods to Russia increased by 38% year-on-year in 2021, with ferroalloys accounting for $172 million in export revenue. Traditionally, the wine sector depends heavily on the Russian market – in 2021, Georgia’s wine exports to Russia totalled $131 million, which was 55% of the country’s total wine exports.

Georgia’s exports to Russia

Georgia has a negative trade balance with Russia, meaning that we import more goods than we export to that country. Imports from Russia surpassed the one-billion-dollar mark in 2021. The share of Russian goods in total imports was reduced to 10.2%, which is second only to Turkey. Vehicle fuel accounted for the largest share of imports from Russia (13%). Georgia’s dependence on Russian wheat is particularly noteworthy. In 2021, we imported 319,000 tonnes of wheat worth $87 million from Russia, which is 94% of all our imported wheat. Russia also accounts for 96% of our wheat flour imports.

The extent of damage sustained by the Georgian economy via Russia will depend on the effect of sanctions on the Russian economy. Complete cessation of exports, while out of the question, would damage our economy to the tune of $600 million. Wine exports are particularly vulnerable, as they have already been used by Russia as a political weapon in recent years. The potential disruption in wine export will have an acute effect on Georgia.

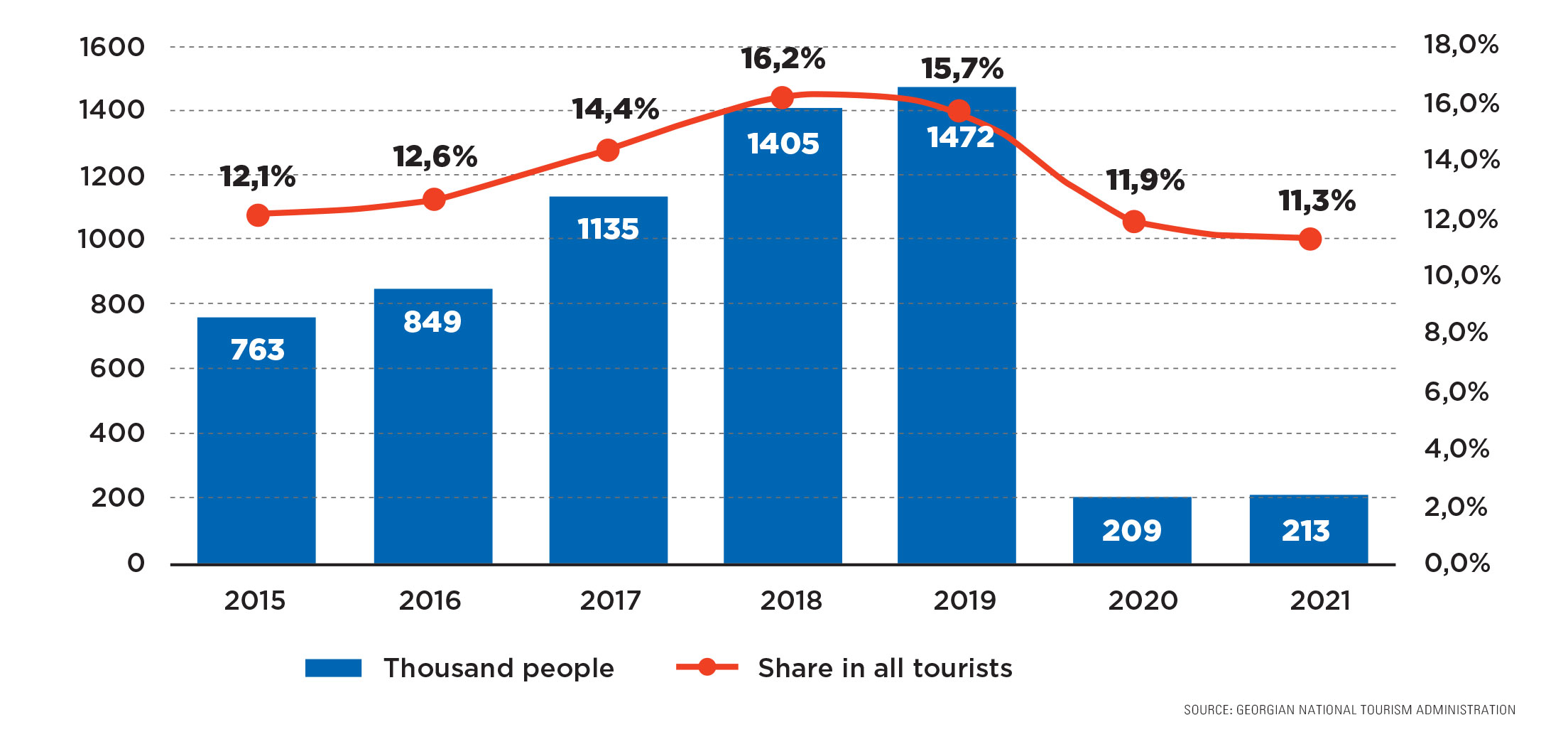

Number and share of Russian visitors to Georgia

Georgia’s dependence on Russian tourists was reduced to a large extent by the pandemic. Consequently, our losses in this field will not be substantial. Russian tourists spent approximately $700 million in Georgia in 2019, but this figure fell by 65% to $240 million in 2021. In 2019, Georgia had around 1.5 million visitors from Russia, but only 213,000 in 2021.

The share of Russian visitors in 2021 was 11.3% of the total number of visitors to Georgia.

Money sent by Georgians residing in Russia has traditionally been an important source of revenue for our country. In 2021, money transfers from Russia to Georgia totalled $411 million, accounting for 17.5% of all transfers. These streams of funds will be the most difficult to curtail, as many Georgians who work in Russia also hold Russian citizenship and are unlikely to face many restrictions on their activities. On the other hand, the economic problems caused by sanctions will also affect Georgians working in Russia. If we look back at the 2015-2016 figures that followed the imposition of significant sanctions on Russia, the amount of money sent to Georgia this year is likely to be reduced by half.

As for Russian investment in the Georgian economy, it has been relatively insignificant to date. From 2016 to 2020, Russian investment totalled $249 million, representing a 3.6% share of total foreign investment in Georgia during that period. In the period January to September 2021, Russian investment totalled $53 million, representing a 7.3% share of foreign investment during that period.

To summarize, Georgia will lose up to $1.3 billion worth of revenue from Russia in the worst-case scenario. However, this would only happen if economic relations with Russia were to cease completely, or if the Russian economy was totally destroyed, the likelihood of which is not very high. More realistically, we are likely to see a repeat of the 2015-2016 scenario, when Georgia’s revenue from money transfers and exports to Russia fell by half. At that time, tourism continued to grow, but visitor numbers have since been hit by the pandemic. Therefore, the most realistic scenario would see Georgia lose between $500 million and $600 million in annual revenue. War in our region and the slowing of the global economy will have additional effects on Georgia that cannot be monetized and expressed in figures at this stage.

UKRAINIAN INFLUENCE

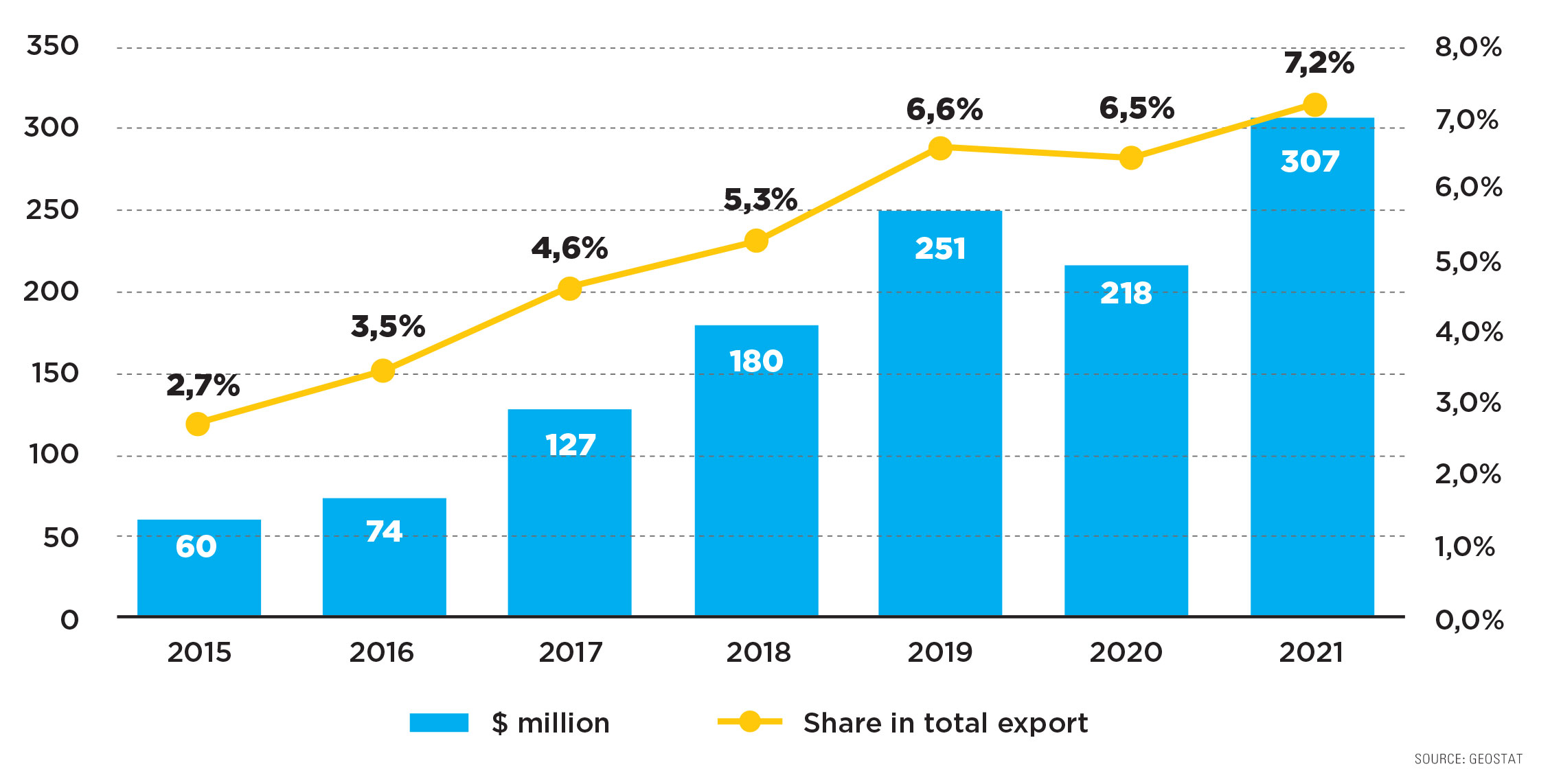

Georgia depends far less on the Ukrainian economy than on the Russian one. Ukraine ranks fifth on the list of export destinations for Georgian goods. In 2021, the total value of Georgian exports to Ukraine was $307 million, representing a 41% increase year-on-year. With regards to imports, Ukraine ranks seventh, with last year’s imports totalling $418 million. With a value of $88 million, re-exported passenger vehicles are the most common single commodity exported by Georgia to Ukraine, followed by spirits ($43 million), fertilizers ($38 million), and mineral water ($26 million) and wine ($26 million). The most common commodities imported from Ukraine are cigarettes ($78 million), metals ($23 million) and medicine ($21 million).

Ukraine ranks fourth in the number of visitors to Georgia. 145,000 Ukrainians visited Georgia in 2021, representing an 8% share of the total number of visitors. Revenue from Ukrainian tourists totalled around $100 million. The record annual number of tourists from Ukraine (208,000) visited Georgia in 2019.

Georgia’s exports to Ukraine

Money transfers from Ukraine totalled $93 million in 2021, representing a 4% share of total transfers.

In total, Georgia received around $500 million in revenue from Ukraine in 2021. Georgian-Ukrainian economic relations will not be threatened unless Russia conducts a full occupation of Ukraine. However, the Ukrainian economy will sustain severe damage, leading to a fall in Georgia’s revenue from Ukraine. Exactly how much money we will lose will depend on the extent of damage to the Ukrainian economy, but the figure cannot exceed $500 million.

In the worst-case scenario, Georgia stands to lose $1.5 billion in direct revenue because of the war between Russia and Ukraine. The more realistic forecast will see us lose between $700 million to $800 million, which represents 4% of Georgia’s GDP. Additionally, the war will have an effect on other countries in the region, as well as the world. Ultimately, Georgia’s economic growth figures could fall to 2% or 3%, as in 2015-2016. The Georgian population will further suffer due to currency depreciation and subsequent inflation. Russia and Ukraine are major sources of food for Georgia. Reduced imports from these two countries will lead to higher food prices on the Georgian market.