Deputy CEO, is currently responsible for innovative development at SOCAR PETROLEUM, distribution subsidiary of SOCAR in Azerbaijan. Certified Fraud Examiner, a member of ACFE.

Reassembling the strategy

- მენეჯმენტი

- ივნისი 10, 2020

- 8:04 am

In the post-pandemic “era” capacity of companies to create and retain strong brands will let them to skim the cream. The rest will drift in the fairway of trend-setters with the risks of business deterioration and disappearance. It is evident for everybody that material and financial resources as such are not major factor of value. Nowadays, it does not really matter how much money or oil you have. Talent, special skills like adaptability, tolerance to uncertainty, readiness to transformation as well as dedication and integrity of corporate teams is a key. Therefore, business strategies focused on sustainability, innovations, corporate mentality and brand equity will impact markets even stronger than previously. What corporate leadership’s strategic role is under the circumstances?

Elnur Mustafayev*

Sharp and unexpected change of the business environment caused by anti-pandemic quarantine displayed how unsustainable many companies and businesses are. Majority, in the meantime, explains current troubles exclusively by unprecedented disruption of business activities and related decline of demand and therefore is simply waiting for the markets’ recovery evidencing on underestimation of companies’ internal environment issues. The quarantine is indeed has put huge stress to the worldwide economy as a whole, but certain market segments face with fundamental changes as alternative substituting solutions and related offers shift demand significantly. From other turn, the post-pandemic “era” definitely brings a lot of new business opportunities but only those having the right strategy and relevant competencies would likely hit the bullseye. Then what strategy is right for today? How it should be linked to business reality? What leadership’s key challenges are? What is going to affect strategic planning and management to a greater extent?

Brand Is Not a Luxury, It Is Necessity

We are frequently refer to “brand” as if everyone knows what it means. It is assumed that there is a general understanding that brand means something having value. Some brands are perceived as very traditional while others are associated with principally new solutions. In the meantime, “brand” is not a logo, trademark, or slogan. Similarly, it does not necessarily matter if a company is strong and stable financially, larger or smaller in size. Furthermore, sometimes the brand is assumed as something luxury only which is conceptually incorrect. There is also a misunderstanding of quality and price which are not necessarily the highest but rather fair in buyers’ mind. Consumers perceive the brand to be more valuable and preferential than rivals’ offers, and therefore they accept its “price-quality” balance. The brand adds so-called subjective value as a price premium above what the consumer would pay for an unbranded product. Evidently, we observe a consistent misconception of the “brand” and

its role. In fact, many companies, especially at immature markets, still view branding as an image exercise and give it a low organizational priority. But is this all indeed so important for the business?

Awareness and differentiation, unique associations and loyalty, emotional connections and emotional-sensitive perception of qualities are in the center of the brand’s paradigm. Major associations define brand’s «DNA». Consumers do not even need to know detailed specifications of such products, their perception is driven by the brand’s DNA. From other side, loss of the DNA is likely to weakening strategic positioning of the company with further deterioration of its brand. Consistent creating and delivering a trustworthy branded value proposition is the source of sustainable value creation. In fact, brand is not a label or matter of leadership’s opinion but is a matter of buyers’ choice interconnected with company’s strategic positioning and product’s market fit. Brand therefore is a kind of bridge connecting business strategy with the markets and leadership strategic role is to keep this link visible and measurable.

According to income statement of 1,500 Standard & Poor’s companies, an average product price increase of 1 percent generates an 8 percent increase in operating profit – a 50 percent greater impact than of a 1 percent decrease in variable costs and more than three times greater than provides a 1 percent increase in sales volume provides1. Enhancing the revenues therefore has stronger financial effect as compared to cost cutting. This is where brand’s subjective value plays an absolutely crucial role to be able to command a price premium.

The stronger and healthier brand equity is, a stronger impact to the price brand’s owner may have, and larger revenues and profits may be earned, accordingly. Brand equity is not financial metric, but is an aggregated measure of its strength and health, an overall value of brand in consumers’ mind (see Figure 1).

It Is Time to Replace the Question on Strategy

Sustainable value creation requires a relevant internal strategic environment. Consistent recreation of such sustainable strategic environment is prerequisite of brand management process as a part of sustainable business strategy. In this context, for the time being corporate leadership would be better to reword traditional “what your strategy is” question into more relevant one – “what makes your strategy sustainable and how your brand(s) fits with it”. But in today’s reality majority of leadership today are purely financially driven and focused mainly on cost reduction as well as deeply involved in operational routine, therefore may likely miss this strategic question. Recent studies indicated that about 10 percent of companies don’t even consider sustainability as an issue of strategic importance, while about 40 percent and 75 percent – not yet incorporated sustainability concept into their business strategies and business models, accordingly2. Although no specific data is available for emerging markets, the degree of companies ignoring sustainability concept and giving no priority to brand management at strategic level is likely to be considerably higher.

Refocusing of Major Measurements

While all business matters are important, leadership’s priority is developing and reestablishing of a clear strategy. Thus, one of the related challenges for leadership is to find out relevant balanced reference points to make sure that the strategy is focused in a right manner.

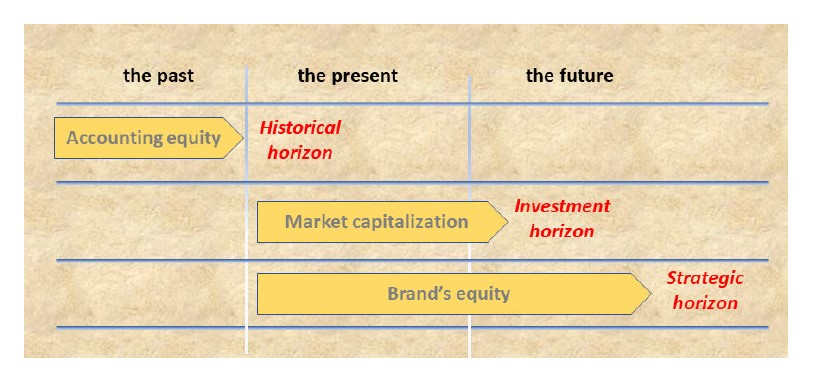

Historically, many companies assessed their business performance in term of accounting numbers, particularly in term of revenues and equity. Revenue, profit and accounting equity, as major performance metrics, are continuing to play an exclusively significant role in leaderships’ decisionmaking processes including strategic ones. Being informative and important, these metrics, however, have basically nothing to do with the future. In fact, these metrics display what company has done so far, rather than what it is doing for the time being and nothing to say about the future. Accordingly, business strategy is not likely to be sustainable and adaptive if it is based purely on financial strength of the company and is purely financially oriented.

On the other hand, market capitalization traditionally is serving to mainly investment goals. Being inherently volatile and speculative, market capitalization sometimes erroneously treated as indication of the future performance of the business and evidence of company’s ability to create value in a long run.

Business strategy is not a matter of particular interest for consumers while the brand is. Being an aggregated measurement of consumers’ experience brand equity has definite advantages as reference point and KPI comparing to purely financial metrics. From that point, brand value, as monetary estimate of brand equity, is relevant but not single reference point measuring the future business performance.

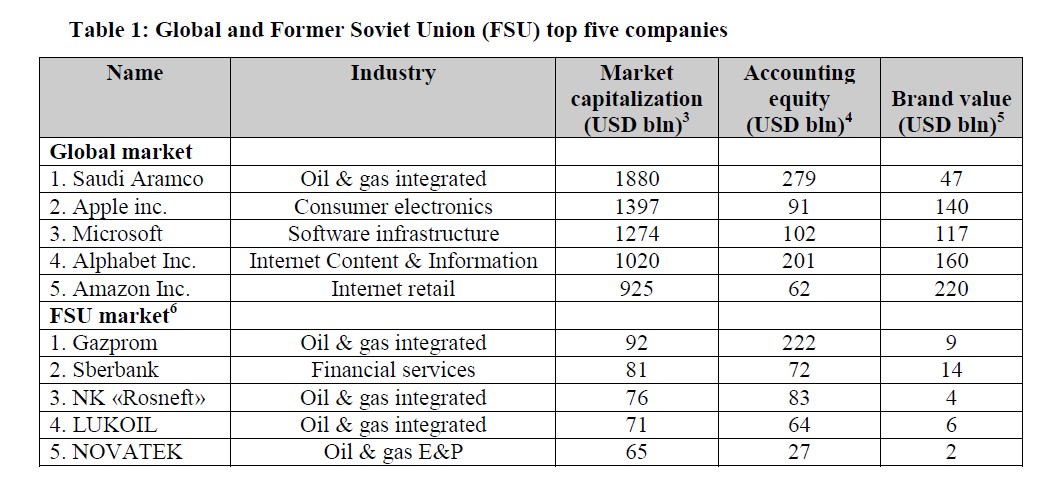

Saudi Aramco’s market capitalization and accounting equity are significantly larger than any others. Gazprom is the second largest company in term of accounting equity just after Saudi Aramco. But does it mean that these companies have a stronger business performance and, more importantly, ability to create and deliver value on a long-term basis? And whether the strategic sustainability is out of question?

Figures in the Table 1 show that Saudi Aramco’s brand value comprises only 2,5 percent of its market cap and 17 percent of its accounting equity, while Gazprom’s – 10 percent and 4 percent, respectively. These companies’ position in terms of brand value is much weaker comparing to global tops since their business models and value chains are based on mineral resources exploitation. Severe drop of oil prices caused Saudi Aramco’s and Gazprom’s market cap decline in May 2020 by 10 percent and 35 percent, respectively, displaying direct dependence on the resources value and related unsustainability of their business strategies and models.

Brand value of global top companies, except for Saudi Aramco, is varying from 10 to 25 percent of the related market capitalization but consistently equaling or above of accounting equity. The difference of value creation sources explains huge gap between brand values of companies employing such unlike business strategies.

As may be observed in Table 1 above, brand value is not dominated by accounting equity in any way and not directly connected to the companies’ market capitalization while there is a definite linkage between branding and shareholder value creation. Evidently, material and financial resources are not major factors of brand value. In fact, brand value is defined by the brand equity strength and health, in particular terms, by its ability to command consumers’ purchase decisions and thus generate net cash-flows and profit. While brand valuation techniques and methodologies may still be subject to discussions and improvements, brand-related considerations clearly should play a much stronger role in leadership’s strategic decision-making and planning. Using the right metrics to measure brand equity, value and related activities are crucial – as such KPIs provide information about business performance going forward and indicate strategic adjustments needed.

In a Need to Reassemble the Strategy

Simply put, incorporation of brand and sustainability concepts into the business strategy is a priority for those wanting to lead and successfully perform in today’s dynamically changing and uncertain business environment. Although strategy refocusing is not a simple exercise, relevant strategic transformation efforts look like a matter of absolute importance for corporate leadership nowadays.

It is only by treating brand and sustainability as central elements of the business strategy and investing in it accordingly companies can meet the true challenge to competitive growth in the future. In the meantime, for the businesses exploiting material resources-based value creation sources, brand and sustainability might not be matters of particular importance. Others, wishing successfully deliver the value for a longer period of time definitely shall struggle with the related transformation challenges, and shall be ready and able to revise, rethink or may be even completely reestablish business strategies and rebuild business models. Key stakeholders like owners, investors and regulators shall accept strategic transformation initiatives as priority in order to make sure they share business strategies set by corporate leadership and appreciate related challenges. In this context, the major high-level directions of strategic transformation that corporate leadership would better to comprise:

a) Business strategy transformation focusing on:

- Incorporation of sustainability and brand equity concepts;

- Interconnection of strategic positioning and brand equity;

- Treatment of brand as “a bridge” channeling value to the markets;

- Alignment of brand equity based KPI and financial metrics;

- Consistent improvement of brand valuation techniques and methodologies;

- Reconsideration of strategic planning horizons to cover of periods longer than a single planning cycle as indicated in the Figure 2 below.

b) Treatment of innovation activities as major strategic initiative promoting knowledge-based value creation. Leadership should simply accept that innovation environment and higher innovative capabilities are prerequisite for maintaining and enhancing business sustainability and stronger brand equity, while lower – catalyze technological, operational and strategic risks for the business.

c) Corporate mentality transformation, i.e. reorientation of corporate and individual mindsets to refocus working teams from formal execution of job description-based tasks to consistent execution of business strategy presuming sharing of its values in individual activities and in day to day decisions. It is generally accepted that talented people are becoming major intangible asset of companies and their fully scaled and dedicated involvement into execution of business strategies is major contributing factor of “knowledge to value” transformation.

——————————————————————————————————————————————————————-

* SOCAR PETROLEUM, Deputy CEO on innovations, Certified Fraud Examiner.

1 Martin Roll, “Branding by the numbers – measuring brand value, equity, and marketing activity”, MartinRoll Business & Brand Leadership, May 2014, p.2.

2 Knut Haanaes, “Why all businesses should embrace sustainability”, IMD, November 2016, p.3.

3 https://fxssi.com/top-10-most-valuable-companies-in-the-world, www.value.today/headquarters/russia 4 Saudi Aramco annual report 2019; Apple Inc. reports fourth quarter results ended 28 September 2019; Microsoft annual report 2019 for the year ended 30 June 2019; Alphabet’s report for the fiscal year ended 31 December 2019; Amazon.com, Inc, FORM-10K for the fiscal year ended 31 December 2019; PJSC GAZPROM IFRS consolidated interim condensed financial information for the period ended 30 September 2019; Consolidated financial statements Sberbank of Russia and its subsidiaries for the year ended 31 December 2019; Consolidated financial statements Rosneft Oil Company for the year ended December 31, 2019; PJSC LUKOIL consolidated financial statements 31 December 2019; PAO NOVATEK IFRS consolidated financial statements for the year ended 31 December 2019. 5 “Brand Finance’s annual Global 500 report” for 2019, “Brand Finance’s Russian 50” for 2019. 6 The figures originally presented in Russian rubles are translated to US Dollars according to the Bank of Russia rate as at the appropriate reporting dates.

გააზიარე

ავტორის სხვა მასალა

- on ოქტომბერი 2, 2020

- on ივნისი 10, 2020