As Georgia regained independence and began its transition to a market economy, the first steps the country took were towards the development of capital markets – a necessary component of a healthy, growing economy. In this article, we will focus on the history and prospects of fixed income securities in Georgia.

There are two distinct bond categories in Georgia – government securities and corporate and IFI bonds.

Government Securities Market

Regulations regarding government securities were established in 1997. The very first issuances were short-term papers, with maturities of 7 to 91 days. Six-month Treasuries were introduced in 2002, followed by one-year Treasuries in 2004. After no issuances from 2006-2008, the market reopened in 2009.

Georgia has made significant progress in developing the Treasury securities market. Today Georgian government securities include short-term (one-year) Treasury bills, as well as medium and long-term (2, 5, 10-year) Treasury note s issued by the Ministry of Finance. Certificates of deposit with maturities of 3 and 6 months, issued by the National Bank of Georgia (NBG), were added to the government securities market in 2006.Market development resulted in more frequent issuances and higher respective volumes of government paper, supporting an increase in the volume of secondary market trading and repo transactions.

Corporate and IFIBond Market

While the government was focused on developing the Treasury market, it did not have a concrete strategy in place to stimulate the Georgian corporate bond market. The first corporate bond issuance took place in 2005 when Bank of Georgia issued a₾2 million, two-year bond. Procredit Bank was next, with a two-year,₾5million issuance. Both of these issuances were public offerings and were listed on the GSE.

The first non-financial sector bond issuances were by Elit Electronics LTD ($300,000) and Auto Finance JSC ($400,000) in 2007 and 2008 respectively. It is noteworthy that after the 2008 financial crisis, Georgian Railway was the first company to tap debt capital markets, issuing a ₾25 million, two-year bond in 2009. The period of 2009-2014 was characterized by little or no activity on the corporate bond market, largely due to the scarcity of companies willing and or/able to issue bonds and the lack of government support of bond market development.

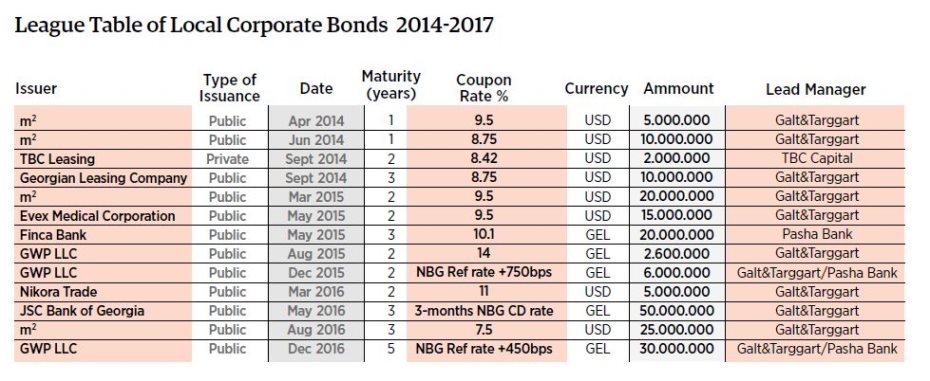

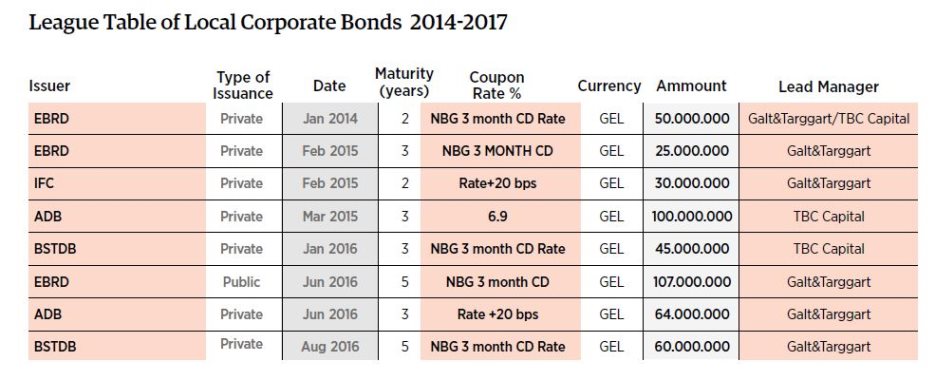

There was a notable change in the government’s and NBG’s attitude towards the bond market starting in 2014.To spur the development of the IFI bond market, NBG established a list of “acceptable” IFI issuers (mainly AAA-rated institutions) who could issue bonds in GEL, simplify IFI bond issuance procedures. They also made these bonds eligible for repo transactions. Largely as a result of these measures, since 2014, ADB, EBRD, IFC and the Black Sea Development Bank have issued ₾8-denominated bonds for a total of around ₾480million. Government support was also reflected in the corporate bond market. From January 2014 through May 2017, there have been13 successful offerings of corporate bonds, totaling approximately $140million, of which, five placements were in the national currency.

2014 can be viewed as the start of a new wave of development of the corporate bond market in Georgia. One of the major milestones that triggered this new era was NBG’s decision to allow the issuance of securities and the payment of coupons in foreign currency. This was an important message for investors. The Georgian economy is characterized by a high dollarization rate (68% of total deposits are in USD) and investors prefer to invest in USD. Decreasing rates on USD deposits also positively impacted the development of the corporate bond market, creating an incentive for investors to search for alternative dollar investments. The third and most important factor was the readiness of a number of big Georgian corporations to diversify their financing sources through bond issuances.

The development of the corporate bond market carries significant benefits for the aforementioned stakeholders. First, the debt market offers issuers an alternative to bank financing, enabling them to reach a wider group of local and foreign investors. Moreover, companies seeking to tap the bond market must have solid financial reporting standards and transparent corporate governance. It is noteworthy that for companies of a certain size, a local bond issuance can be the preparatory stage on their way to international debt or equity capital markets. Second, investors benefit as they gain access to high-yield fixed income products as an alternative to deposits. Lastly, for the government, a developed bond market helps attract and retain foreign investors – both individual and institutional – who are willing to invest in the Georgian economy. Moreover, the growing number of reporting companies with good corporate governance and the ability to tap local or international debt or capital markets underpins the prospects of future economic growth.

Since 2014, Galt & Taggart, the leading investment bank in Georgia, has played a prominent role on the corporate bond market. We were the first investment bank to see the potential of the corporate bond market and guide a number of leading Georgian corporations in the bond issuance process.

Our initial strategy was aimed at gauging investor appetite for corporate bonds by offering them notes of companies which were best equipped to tap the local debt market – they had dominant market shares in their respective sectors and had high reporting standards and transparent corporate governance. In order to access a sizable number of various types of investors and offer them liquidity on the secondary market, a decision was made to undertake public offerings and to list these bonds on the GSE. Moreover, once listed, these bonds could be eligible for tax exemptions related to freely negotiable securities (securities with more than 25% free float are exempt from interest, dividend, and capital gains tax).

The first of these transactions were closed in April 2014. M2, the leading real estate company in Georgia, issued $5 million one-year bonds with a coupon rate of 9.5%. Soon after the first successful issuance, Galt & Taggart assisted M2 on its second issuance ($10 million, one-year, 8.75% coupon rate). Both of these bonds reached maturity and were successfully repaid by the company. These two transactions were followed by bond issuances of TBC Leasing, Georgian Leasing Company, M2 Real Estate, and EVEX (the leading healthcare group in Georgia). All of these issuances, except for TBC Leasing, were public placements and were listed on the Georgian Stock Exchange. March 2016 marked another significant milestone, as Galt & Taggart advised Nikora Ltd, the leading supermarket chain in Georgia, on a two-year, $5 million bond issuance with a coupon rate of 11%.In August we managed to place $25 million bonds of M2. The bonds had a maturity of three years and a coupon rate of 7.5%.

Another key direction to be developed is local currency-denominated bonds, which are more favorable for Georgian companies with revenues in Georgian lari. There is significant demand for GEL financing on the market. Up until now, most GEL financing was completed through bank loans at high interest rates. In 2016,NBG established a set of regulations aimed at supporting GEL bond market development. These regulations enable banks to use GEL corporate bonds (these issuers should have rating from at least one international ratings agency) as collateral for repo transactions. Eligibility for repo transactions provides a significant boost to GEL bond market development, enabling commercial banks to use bonds in Georgia’s national currency as a liquidity management instrument and incentivizes them to become active investors on the market. Furthermore, companies can benefit from alternative GEL funding, which enables them to reduce their exposure to foreign currency risk (corporate loan book dollarization is at 75%). Hard currency exposure endangers company solvency, especially during periods of economic downturn and currency devaluation. In recent years, there have already been five corporate bond issuances in the national currency, for a total of ₾110 million.

Corporate Bond Market Development Prospects

The pro-business and corruption-free environment in Georgia, the supportiveness of government and regulatory authorities, the existence of a growing number of potential issuers willing and able to tap local debt capital markets, and the growing presence of resident and foreign investors willing to invest in local corporate bonds, create significant potential for further development of the local corporate bond market and capital markets in general. The presence of experienced local investment banks that can assist companies in the debt issuance process is another positive factor.

Another important related development is the government’s plan to launch a new pension scheme in 2018. Once implemented, the pension fund will be a major source of demand for liquid fixed income instruments on the local market. The government is also working on implementing regulations regarding investment funds. This would be yet another milestone for the market’s development. In this regard, there are certain steps that we deem are necessary for furthering the corporate bond development process.

Regulatory authorities, in consultation with market players, should improve the regulatory framework, simplify issuance procedures and create incentives for issuers, in order to implement solid reporting standards and complete public and listed placements. Such a regulatory framework should also create favorable conditions for the development of pension and investment funds.