Most of the GR’s revenue (about 60 percent in 2017) is derived from freight transportation. Thus, the Group’s results are particularly sensitive to cargo flows, which mainly comprise transit shipments, which accounted for about 63 percent of freight transportation revenue in 2017. The transit transportation volume mainly comes from trade between Europe and Central Asia.

The majority of GR’s freight traffic was transported from or to Azerbaijan and Armenia (about 28 percent and 23 percent of transportation revenue in 2017, respectively). Other significant trade partners for the Company in 2017 were Russia, Kazakhstan, and Turkmenistan (together generating 38 percent of transportation revenue in 2017). Only about 6 percent of total transportation revenue in 2017 was generated by domestic transportation.

The Group’s freight transportation revenue consists of liquid and dry cargoes. The split between liquid and dry cargo revenue in 2017 was about 44 and 56 percent, respectively.

one important issue in analyzing the performance of the Group is the fact that most of its tariffs are denominated in USD. As the Group reports its revenue in GEL, the changes in the GEL/USD exchange rate can have a significant impact on the Group’s profitability, as most of its expenses are denominated in Georgian Lari.

One of the key drivers of liquid freight traffic is the production of oil and oil products in the Caspian region, which has large oil reserves. In 2017, about 68 percent of crude oil and oil products were transported from three Caspian region countries (Kazakhstan, Turkmenistan, and Azerbaijan) mostly to European countries and Georgia. Most of the Group’s liquid cargo revenue comes from oil products.

Revenue from the transportation of oil products for Q4 2017 decreased by 4 percent, compared to Q4 2016, but increased by 6 percent, compared to Q3 2017.

Oil products currently are the main component of liquid cargo (93 percent of the transportation volume of liquid cargo in 2017). They are mainly transported by rail, as there is practically no competition from pipelines. Oil products transported by the Group during 2017 mainly originated from Azerbaijan, Turkmenistan, Russia, and Kazakhstan, with significant changes in transportation direction mix compared to the same period of 2016. The share of Azerbaijan was down to 19 percent from 36 percent, while Kazakhstan’s share was up to 34 percent from 11 percent in total oil products transported by the Group.

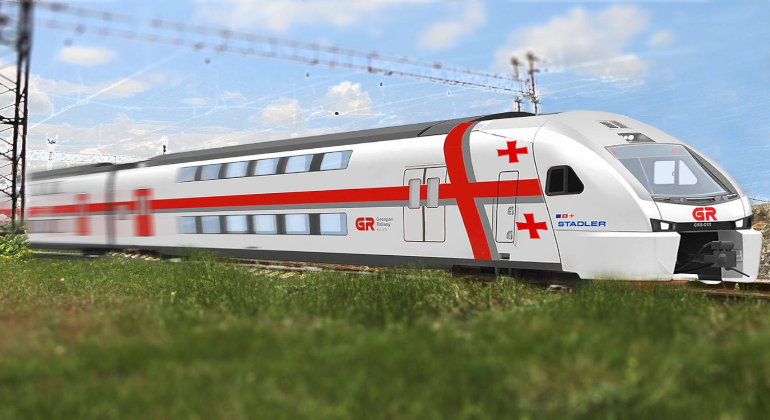

Revenue from passenger transportation increased by 27 percent (GEL 4.8 million) in 2017, compared to 2016, while the number of passengers has increased by 9 percent. The higher increase in revenue was driven by increased share of number of passengers on the main line (as a result of increased number of passengers by 191,000 caused by introduction of two more double-decker trains in 2017 in addition to first two, operating since summer 2016) in total number of passengers transported, which is relatively more profitable direction. The average loading rate of the trains on the main line in 2017 was 67 percent, compared to 65 percent in 2016.

"Forbes Georgia-ის სარედაქციო ბლოგპოსტების სერია "როგორ გამდიდრდა“ და "საქართველო რეიტინგებში".