On January 17 de-dollarization program was implemented together by Government and National Bank. Individuals who had real estate bank loans in foreign currency had a chance to convert it into national currency. Following this, loans of $75 million were converted to GEL by the end of March.

At the end of February Government decided to return Finance Sector Supervision functions to National Bank of Georgia (NBG).

In March, 2017 Georgian government with support of World Bank has approved legislative amendments for introduction of deposits obligatory insurance system. The law is planned to be adopted this year and will come into force on January 1, 2018.

In March NBG issued a banking license to JSC Credo Bank, which has been operating on Georgian market since 2007 as a microfinance organization.

In March Netherlands Development Finance Company (FMO) has sold its own shares in TBC Holding. Institutional investors of UK, USA and Europe have bought the shares under accelerated deal managed by Barclays and Renaissance Capital.

By the end of March the accounts of Bank Republic clients had been tied to TBC Bank and Bank Republic cards were replaced by TBC Bank cards. Merger has successfully finished in May.

In March Minimum Capital Requirement for banking license applicant was increased up to GEL 50 mln, in turn, for the banks licensed by NBG before coming into effect of official order, supervisory capital should be not less than GEL 30 million (by December 31, 2017), not less than GEL 40 million (by June 30, 2018), not less than GEL 50 million (by December 31, 2018). To note, Silkroad bank, Finca bank and Ziraat bank will have to grow their capital by the end of 2018.

On May 2 announcement was made that Turkey’s state-run Ziraat Bank will offer services in neighboring Georgia under a new institution called JSC Ziraat Bank Georgia.

On May 15 the official ceremony of signing declaration, concerning founding of Georgian development bank was held in Beijing, China. The declaration was signed by Vice Prime Minister, Dimitri Kumsishvili. The founders of the bank are largest Chinese corporations: „CEFC China Energy Company Limited’’ and the company „Eurasian Invest LLC”.

The Minimum Requirement Of Liquidity Coverage Ratio will be established for the Commercial banks from September. The LCR ratio will be calculated as High Qualified Liquid Assets / Net cash outflow (Net outflow represents difference between cash inflow and cash outflow over a 30-day stress period). The aim of the new limit is to ensure that banks have sufficient high qualified liquid assets to survive the stress period.

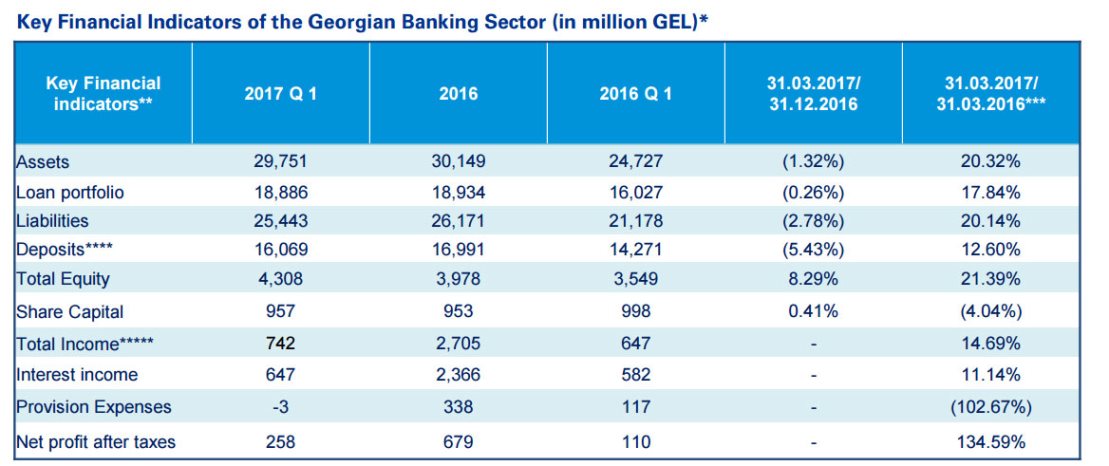

As of 31 March 2017 the banking system total liabilities grew by 0.2%, compared with the same figure as of 31 March 2016, to reach GEL 25.44 billion, of which 68.3% are deposits.

As of 31 March 2017 non-bank deposits represented 63.2% of the total liabilities of the banking sector (GEL 16.1 billion). As of 31 March 2017 70.0% of the deposits were placed in foreign currencies, while the remaining 30.0% in national currency. 44.2% of the total deposits were time deposits, while current accounts and demand deposits represented 32.4% and 23.4% of the total deposits respectively. Around 80.0% of the time deposits were placed in foreign currencies, while 62.1% of total of current accounts and demand deposits were placed in foreign currency.

At the end of the Q1 2017 the total equity to total assets ratio was 14.5%, which is slightly higher compared to the same ratio of 2016 (14.4%). As of 31March 2017 TBC Bank had the highest level of equity – about GEL 1.48 billion, which is 34% of the total equity of the banking system. Ziraat Bank had the lowest level – GEL 0.022 billion (0.5% in total equity). 76% of the total equity of the banking system belonged to the top five banks (ranked by the equity) as of 31 March 2017.

For the period the interest income amounted to GEL 0.65 billion. Eleven banks out of the seventeen increased their interest income compared to the same period of 2016.

Financial performance of the sector was positive during the first quarter of 2017. Comparing with the same period last year, interest income, holding the highest share in the total income, rose by 11.1% and reached GEL 0.65 billion. Total fee and commission income increased by 46.7% and amounted to GEL 0.95 billion, while net profit of the banks for the first quarter was GEL 0.26 billion, 134.6% higher when compared with the same period of 2016. During the first quarter of 2017, 16 banks operating in Georgia were profitable. Only one bank incurred loss after taxes.

Author: KPMG