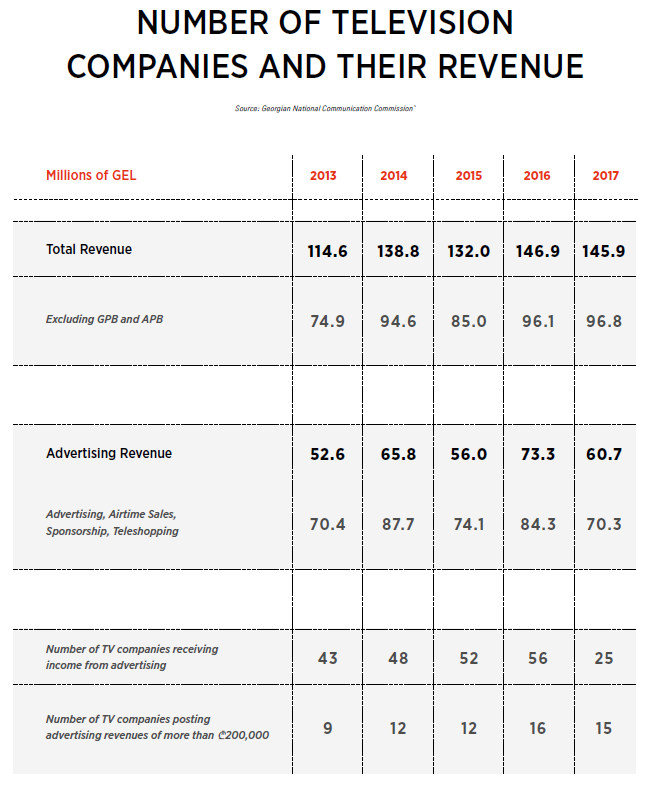

During the 2013-2017 period, up to 70% of the recorded revenue by television companies (with the exception of the Georgian Public Broadcaster) came from advertising. This figure rises to approximately 85%, if we include sponsorship, airtime sales and teleshopping revenue.

The total revenue posted by Georgian television companies in 2017 was ₾145.9 million, of which, ₾49.1 million was accounted for by the Georgian Public Broadcaster (GPB) and the Adjarian Public Broadcaster (APB). Consequently, private television companies accounted for a total of ₾96.8 million in revenue, compared to H96.1 million in 2016. With regards to advertising revenue, they amounted to ₾73.3 million in 2016 and ₾60.7 million in 2017, representing a 17.2% decrease. Against the background of dwindling advertising revenue, the increase in the overall revenue figures was conditioned by the ₾16 million in non-broadcasting revenue received by GDS TV in December.

According to the Georgian National Communication Commission (GNCC), the decrease in advertising revenue in 2017 was a result of advertising agencies retaining 27-33% of the amount paid by clients for advertising, compared to 5-7% prior to 2017. Consequently, the GNCC concludes that the reduced funds collected by television companies do not reflect a shrinking of the advertising market.

This issue may have gone largely unnoticed, had it not been for the changes made to the Law on Public Broadcasting, which afforded GPB broader rights to commercial advertising.

Private television companies and nongovernmental organizations resisted the move to enhance GPB’s advertising rights. One of their main arguments was that the Public Broadcaster receives generous funding (H52.5 million) from the state, and it is therefore unfair to allow GPB to compete with private companies for advertising.

The President of Georgia vetoed the amended Law on Public Broadcasting on 15 January. However, the ruling Georgian Dream party managed to overcome the veto on 21 February. The government argued that due to the growth of the Georgian television advertising market, GPB’s placement of a certain amount of advertising would not harm other television companies significantly. Against this background, the 2017 television advertising revenue figures, which were released by the National Communication Commission one day after the veto was repealed, were of particular significance. Prior to February 22, the revenue of Rustavi 2, Teleimedi, GDS and Maestro – constituting 82% of advertising income – were unknown. Furthermore, the GNCC’s clarification regarding the reduction in advertising revenue strengthened the state’s position. Nevertheless, some private television companies do not agree with the GNCC’s methodology and approach, insisting that the advertising market is shrinking.

Compared to 2016, the number of television companies that received income from advertising in 2017 shrunk by 55% (31 units). The number of companies posting annual advertising revenue of more than H200,000 fell by one.

Precisely how large a share of advertising will be afforded to the Public Broadcaster will become clear later, since it depends not only on the broadcaster’s rights, but also its ratings. At present, GPB’s ratings are quite low.

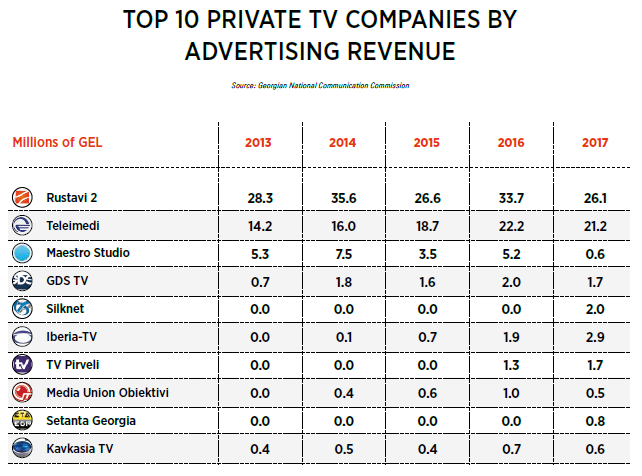

The following table shows the top 10 private television companies in terms of revenue. Rustavi 2 leads the list with H194 million in revenue between 2013 and 2017 (an average of H39 million per year), followed by Teleimedi with an average of H24 million annually.

Rustavi 2 is also in the leading position with regards to advertising revenue, with an average of H30 million per annum. Teleimedi is second with an average of H19 million per year. Between them, these two companies accounted for 78% ofall advertising revenue in 2017. They were followed by Iberia TV with H2.9 million.

Six of the top 10 television companies in terms of revenue in 2016-2017 saw their advertising revenue decrease for the year 2017, while two companies recorded an increase. The remaining two companies only began receiving income from advertising in 2017. The two companies which posted an increase in advertising revenue were Iberia TV and TV Pirveli – 54% and 35%respectively.

The bottom line is that the advertising market in Georgia is quite small, which is primarily due to the size of the economy. Against this background, the Georgian Public Broadcaster receives almost as much money out of the state budget as the total combined revenue posted by the two largest private television companies – Rustavi 2 and Teleimedi. Nevertheless, GPB’s ratings do not even come close to those of Rustavi 2 and Teleimedi. It is evident that the statefunds directed towards GPB are being spent ineffectively. Within the context of a results-oriented state budget that is truly based on the principles of the program, the Public Broadcaster’s public funding would either be cut completely, or decreased to a minimum.