Long-term development is vital for the population and the country as a whole; as a result, the policies of central banks are always focused on medium and long-term goals.

The main principle behind the introduction of the responsible lending framework is to promote a healthy and mutually beneficial relationship between borrowers and lenders, as well as reduce systemic risk. Due to a lack of regulation, much of the population was heavily indebted, and 700,000 citizens were bankrupt. Also, hundreds of thousands of people had inordinately high loans compared to their income, which was the result of irresponsible lending. Let me remind you that before 2017, the maximum annual interest rates reached 3,000%. The introduction of a ceiling on interest rates– initially at 100% of the loan and then up to 50% – has restricted “predatory lending”. In order to avoid a potential financial crisis, stabilize the financial system and encourage healthy lending; in a number of European countries (such as the Czech Republic, Lithuania, Estonia, Hungary, Sweden, Denmark and Switzerland) strict Payment to Income (PTI) and Loan to Value (LTV) ratios have been introduced.

The reason behind this regulation is to ensure that loans (including mortgages) are provided to borrowers who earn enough income to service the loan. Moreover, any loan should not create a significant financial burden on the borrower. A financial institution should not issue a loan if it knows that the borrower will have significant difficulties servicing it. Therefore, the encouragement of healthy lending is based on the best possible international practice, and only limits loans that are deemed to end in default. This initiative ensures the sustainable growth of loans and minimizes systemic risks. This kind of regulation is necessary for the long-term and for sustainable economic growth.

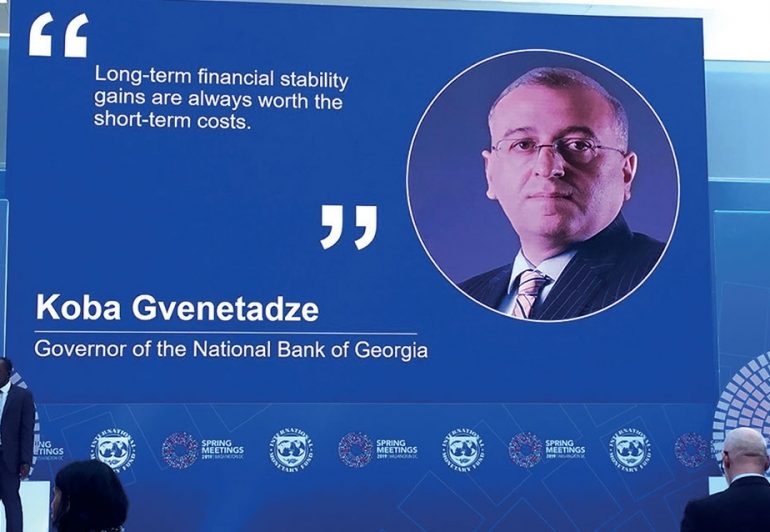

It should be noted that the tightening of the macroprudential policy is unpopular given that it is typically associated with social and economic costs in the short-run, however, the gains (high and stable growth, high employment levels and low fiscal costs) that will far exceed the costs are evident only in the long term. This is the reason why it is often difficult to understand the need for tightening regulation.

The regulator focusing on long-term results should mitigate the risks to financial stability, thereby avoiding significant long-term decline in the economy and an increase in unemployment, which usually follows a financial crisis. In general, the implementation of regulation is most common after a crisis, but if the priority of the government is the sustainable development of the country, then the regulator needs to be proactive.

It is interesting to discuss the effects of the regulation using data from the first quarter of 2019: Mortgages issued to the consumer in foreign currencies

The introduction of responsible lending already had a few positive effects:

• The regulation has reduced lending in foreign currencies;

• We observed a changing trend in the lending behavior of banks; namely increased focus on business loans, which is more productive compared to consumer loans and has a better outcome for employment and economic growth in the long term;

• The interest rates on GEL mortgages have declined significantly and according to the data from March 2019, the annual growth rate of GEL mortgages totaled 50%;

• Terms of lending have also improved; moreover, loans that were inappropriate when compared to the borrowers’ income were no longer issued;

• The bank offered new and innovative products to the market. We should also consider that:

• The regulation does not limit issuing loans to citizens who have informal revenue, which is defined in our principles and lenders procedures;

• The regulation does not limit using a purchased or an existing flat as collateral if the income or a borrower (formal and/or informal) is enough to service the loan;

• Informal revenues are ones that are received through legal means but are not declared to the revenue service;

• Revenues or transfers received from abroad are considered as revenue; as a result, consumers who rely on remittances can also get a loan;

• The PTI ratio in Georgia ranges from 30% to 60%. The latter is one of the highest ratios, even in more developed countries this ratio is much lower (for example in the Czech Republic – 45%, in Estonia and Lithuania- 50%). In addition, unlike other countries, our regulation considers informal income;

• Moreover, for foreigners and Georgian citizens living abroad, proof of income is not required. They only need to provide a down payment equal to 40%.

The media has already announced that international credit rating agencies Fitch and Moody’s have downgraded the ratings of two leading Georgian banks from positive to stable. What was the reason behind this decision?

The main reason behind the decision of the credit rating agencies is the risks arising from the rapid rise in retail loans and the high level of foreign currency lending. These risks have been mitigated by the National Bank of Georgia(NBG) introducing new regulations to strengthen consumer protection and promote healthy credit portfolios in commercial banks. Let me also remind you that during 2018, the Financial Stability Committee repeatedly highlighted these risks both in March and June, indicating that the increase in retail loans was overwhelming, and we made appropriate but unpopular policy decisions.

The sovereign credit rating is the most important indicator that international investors rely on. Fitch positively evaluates the policy of the NBG and expects that these measures will reduce risky lending practices.

According to their estimate, the change in ratings of banks in the near future is unlikely, but if dollarization is significantly lower than before, then it will be positively reflected in the ratings. According to Fitch’s statement from February 22nd 2019, the regulation of January 2019 was one of the factors that contributed to the improvement in the sovereign credit rating of Georgia. It is noteworthy that the International Monetary Fund’s mission assessment states that regulation, which aims to limit the population’s indebtedness will contribute to sustainable financial stability. The credit rating agency S&P also positively assesses the efforts of the NBG to reduce the risks stemming from the high growth of lending.

The NBG continues to monitor the situation by analyzing statistical data, and if necessary, amendments will be made so that the basic principles of the regulation remain unchanged.