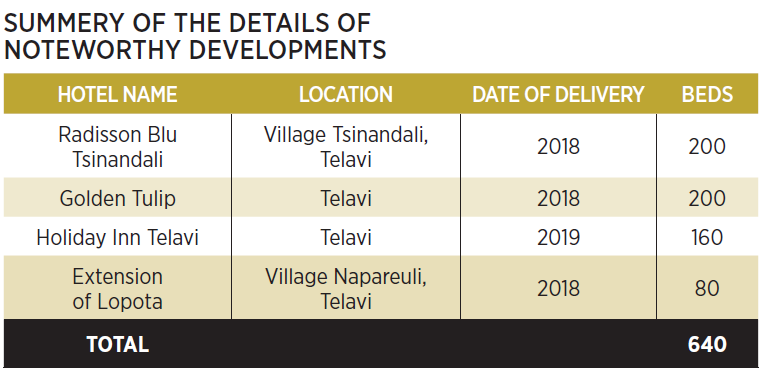

The main Georgian cities (Tbilisi and Batumi) have become expensive terrain. In the hunt for larger profit margins and bigger yields, both operators and investors have started to feel more comfortable with secondary and even tertiary locations. A good example is Adjara Group’s Rooms brand expansion to Georgian rural regions, as well as Best Western’s expansion plans. Other brands, especially international hotel groups, have acted less boldly. However, soon there will be Holiday Inn, Golden Tulip and Radisson hotels opening in Kakheti.

INTERNATIONAL TRAVEL

In terms of tourist attractions, Kakheti is one of the most popular regions of Georgia, and has diverse appeal for travellers. The density of heritage sites, wine cellars, natural resources, cultural attractions and the geographic location of the region provides significant potential for the development of Kakheti’s tourism sector, fulfilment of which largely depends on the improvement of the service sector and related infrastructure. Among tourists visiting Kakheti, both foreign and Georgian visitors are interested in various forms of tourism, including:

- Cultural: visiting historical, architectural and religious sites

- Wine: visiting wine-related sites including wineries, family-run wine cellars and related cultural attractions

- Adventure: visiting national parks like Davit Gareja, Lagodekhi, Tusheti and Vashlovani Protected Areas

- Holiday, recreation, and leisure: weekends tours with at least one night spent at Kvareli Lake, Lopota, Sighnaghi or other sites;

- Visiting friends and relatives: combining visits to relatives and the highlights of the region, usually over two or three days

- Business and professional: different fields, including wine professionals, engineers and employees of construction companies

- Transit: mainly passengers travelling to or from Azerbaijan

- Conferences, education, training: small and medium companies organizing short seminars and trainings

- Events, festivals, concerts: includes corporate events, civil and folk festivals and concerts

- Shopping: buying wine and agricultural products at local bazaars

- Employment: Georgians seeking employment at vineyards during the harvest period

- Science & research: archaeologists, ethnologists, art historians, photographers and journalists

Local balneotherapeutic health resorts are located in Gurjaani (Akhtala) and Sagarejo (Ujarma). However, at this stage their potential has yet to be fully realized. Rare micro-climate areas like the village of Mariamjvari and Tsivi and Kodi mountains should also be explored and developed into tourist destinations.

The convenient location of Kakheti, especially its proximity to Tbilisi and its shared border with Azerbaijan, makes the region a transport corridor and provides a sound basis for economic cooperation between the two neighbouring countries.

The only information available regarding foreign tourists in Kakheti is from 2013’s ACT study. Below we present the results of this report and make further assumptions and projections based on this data. Visitor inflow to Kakheti comes mainly from nearby countries whose residents have the advantage of proximity. This is especially true of Azerbaijan, as it borders the region, but considering travel purposes these are mainly daily trips or VFR travel. Russia is the origin country with the second-highest volume of tourists visiting Kakheti, representing 17.62% of travellers. Armenia, Ukraine, Poland and Germany account for between 4.5% and 6% of the region’s tourists.

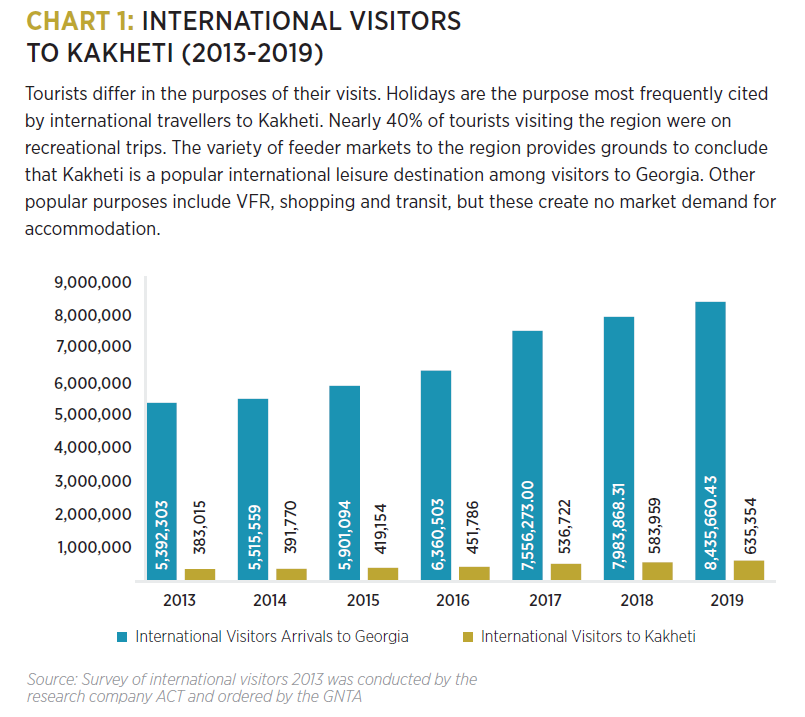

The number of international visitors to Kakheti in 2013 totalled 383,015, or about 18.5% of the total number of tourists (those who stayed longer than 24 hours) and 7.1% of the total visitors to Georgia. As an international visitation survey has not been conducted since this time, C&W assumes the same ratio of guests choose to visit Kakheti, and considering the growth of visitation to Georgia in general, the table below shows these estimates and projects that 635,354 visitors will travel to the region in 2019. This based on the following factors:

- The growth rate of international visitor arrivals to Georgia between 2013 and 2017 was used as the assumed growth rate for international visitors to Kakheti. The figures were as follows: 2.3%, 7%, 7.8%, 18.8% growth.

- In order to project future inflow to both the entire country and the region, we have utilized the compound average growth rate of international visitation to Georgia within the above period, 8.8%.

- Within the reported period the infrastructure and tourism attractions of the region have increased significantly, and it is safe to say that the ratio of travel to Kakheti will be higher than 18.5%, the rate in 2013. However, with no hard data to rely on, the following projections describe a cautiously pessimistic scenario.

DOMESTIC TRAVEL

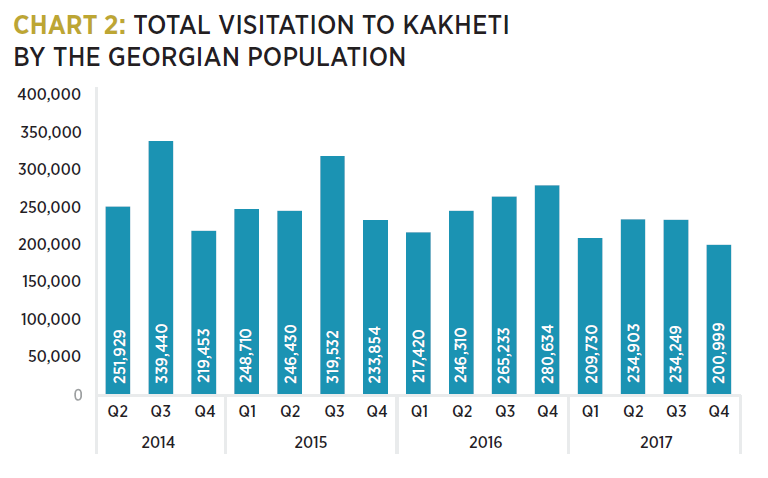

In addition to the demand generated by international guests for lodging facilities, we assume a certain amount of room sales generated by domestic travel. The chart below (chart 2) shows total visitation to Kakheti by the Georgian population; the data is available from the second quarter of 2014 to 2017. Domestic travel in Georgia is relatively volatile, therefore applying a growth rate using the above-described logic and available information is nearly impossible. The existing historical dynamics show a minor decrease in domestic tourism to Kakheti. At this point, to be on the safe side, we will assume the same figures for the following years. Consequently, the visitation number for 2019 should be 879,881 visitors.

The main purpose of domestic visits is usually to visit friends and relatives (accounting for 54.3% of visits) followed by holiday travel, leisure and recreation visits and shopping trips. As is the case in most developing countries, Georgia’s domestic tourists spend much less on travel than international visitors do. In order to identify the size of demand for lodging facilities, we assume the travel purpose ratios stay unchanged.

SUPPLY & DEMAND ANALYSIS – KAKHETI IN TOTAL

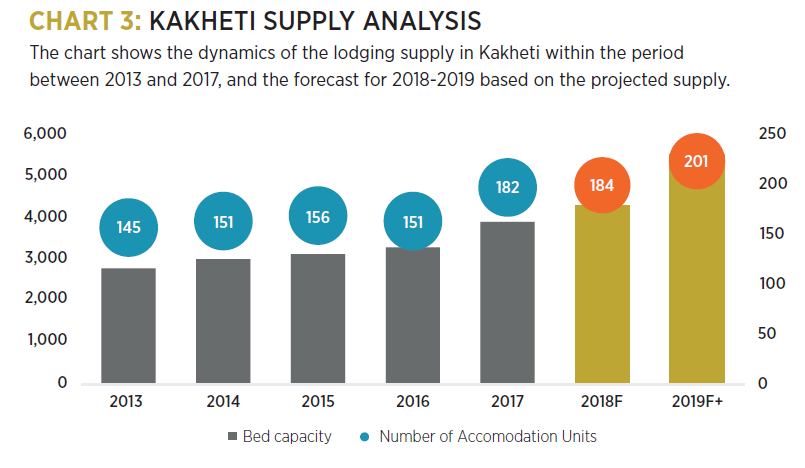

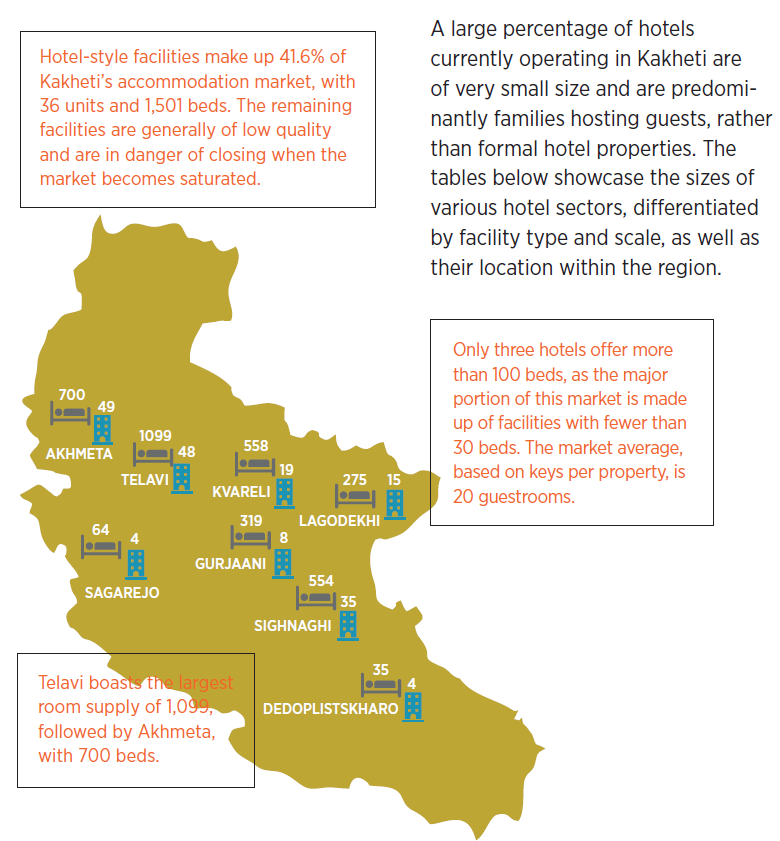

As of the end of 2017, Kakheti offered 185 lodging facilities of various quality (including affluent boutique hotels such as the Ambassador Kachreti, Royal Batoni, Chateau Mere, Kvarlis Tba and Kabadoni), with a total bed capacity of 3,659.

The market is currently made up largely of local operators and brands, some of which are well established. However, some suffer from incorrect positioning (such as Kabadoni) or improper management.

KAKHETI DEMAND ANALYSIS

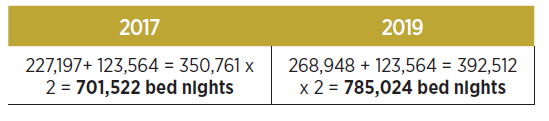

Demand is made up of international and domestic tourists who intend to travel for holiday, leisure recreation, pilgrimage, business or professional reasons. In order to estimate the sales generated from these visitation figures, based on survey responses we assume two nights’ stay per visit. Below is the calculation for bed nights (occupancy for one person on a single night) for 2017, as well as projections for 2019.

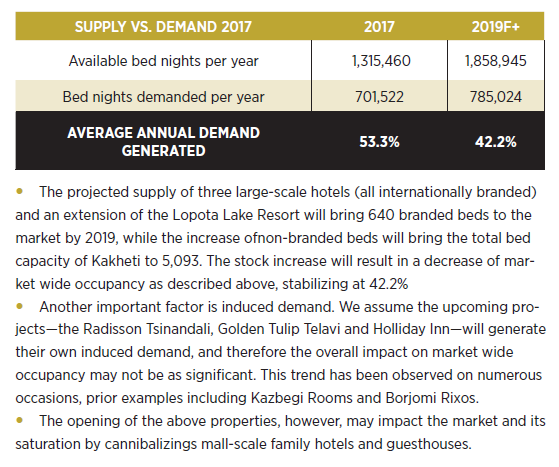

Correspondingly, the correlation between the demand and existing supply, as well as the projected supply is calculated as follows:

Available rooms x 365 days / bed nights

Considering the big picture: market-wide occupancy and average rate often drive the judgment to build a new property. Given the overall Kakheti projected occupancy rate of 42.2%, the predicted vacancy rate would do little to suggest the need for new hotels. Careful review of market specifics, however, can often reveal supply and demand nuances that might indicate potential for a new hotel. With an aging lodging supply and a proliferation of new brands and concepts, market occupancy and rate are no longer the only benchmark for an individual property’s potential performance. As the hotel stock in a market matures, inevitably new hotels achieve stronger operating performances, often at the expense of older properties. Market performance as a whole may not be indicative of an individual property’s potential and occupancy. Individual properties adjust to markets and base their concept development plans on existing market performance indicators and patterns, therefore choosing the correct hotel type and configuration is crucial in cases such as Kakheti’s, where the occupancy follows a typical leisure-led pattern.

Markets that in the aggregate do not seem particularly robust may have niche or latent demand that would provide adequate bed nights for a particular property type or brand. Insight from feasibility experts can help determine the development opportunities in these kinds of markets. One major factors is the type of hotel, in order to target the correct segments of these markets.

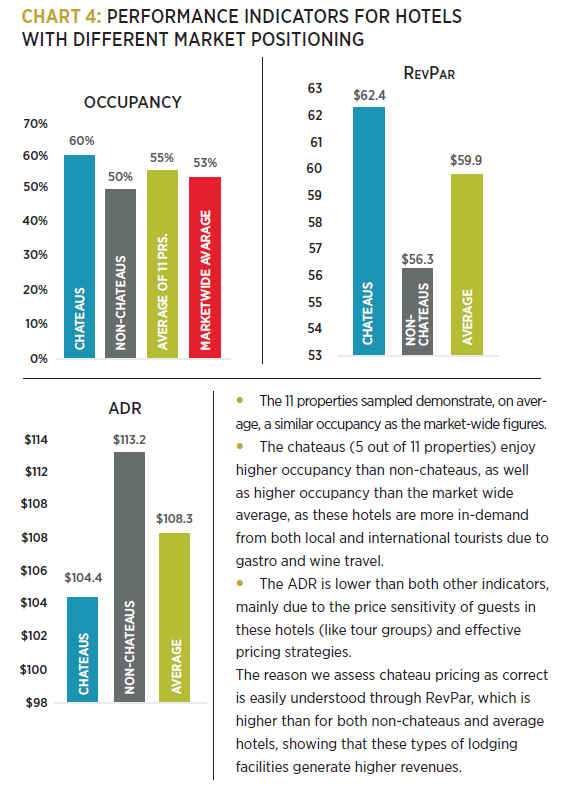

Cushman & Wakefield Advisory have identified and compared two types of hotels evident on the Kakheti hospitality market:

- City center properties: more oriented on corporate and business travelers and tour group visitors. This lodging type offers standard conference facilities, extensive dining options and subcontracted tourist routes with local agencies. No further recreational amenities are present at such hotels (e.g. no swimming pool, spa, gaming or entertainment facilities), which causes neglect from the holiday and weekend retreat visitors who generate a large portion of Kakheti’s tourist flow. Moreover, as group visits are highly seasonal, the occupancy levels of such hotels are lower than the market average and are subject to higher volatility.

- Holiday retreats and rural agro-wine resorts: represented either by boutique hotels or chateaus. Based on consultants’ field work, area analysis and knowledge of the local lodging market, it is felt that the demand for hotel accommodation of this type can be further segmented into:

1. Leisure holiday and weekend retreat demand, considered to be the largest generator of room night demand in Kakheti, is seasonal and most active on the weekends, during the summer months and holidays. However, the flow of visits during shoulder and low seasons continues.

2. The ‘Other/MICE’ segment incorporates demand generated through sports teams, festivals and events, conferences, family reunions, and other large meetings. Taking into account our corporate traveller survey, as well as public sector interviews, Kakheti is the location (due to its proximity to Tbilisi) most often chosen for trainings, seminars, conferences and corporate outings. The MICE segment, similar to the demand generators of the city center hotel business, are also price sensitive and generally enjoy discounted rates from hoteliers. However, holiday and weekend retreat visitors tend to pay rack rates and generate higher revenues for properties during high seasons and holidays, which are peak periods for the lodging market.

Performance indicators for hotels with different market positioning – in this case, chateaus and nonchateaus – are compared in a Chart 4.

UP, UP AND AWAY!

It has been a remarkable year, but was 2017 the peak year for Georgian Hospitality? We don’t believe so.

Georgian hotels and resorts had an impressive year, with high occupancy and a record flow of tourists. However, while 2017 was the latest in a string of record years, Cushman & Wakefield expects 2018 will break records for hotel performance in Georgia. Our review of key indicators shows continued demand for rooms and ADR growth in most markets across the country next year.