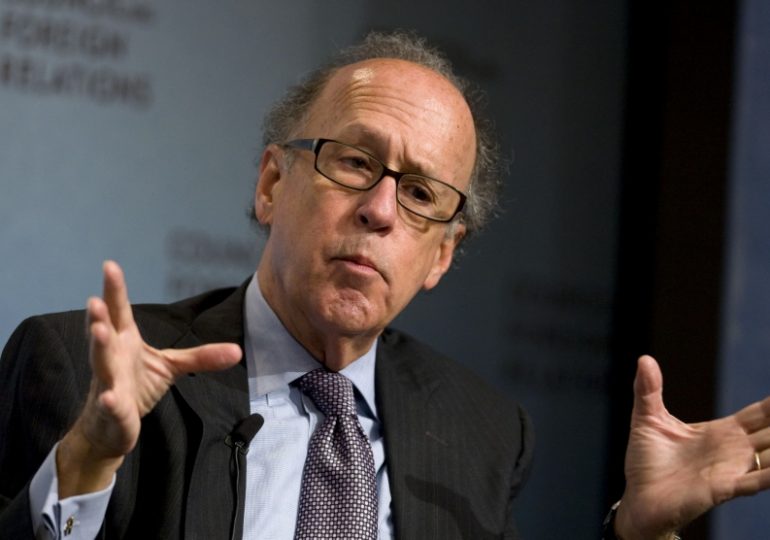

The US dollar’s dominance faces major threats as the post-pandemic global economy emerges, Stephen Roach, former chairman at Morgan Stanley Asia, said Monday.

The currency’s strength survived attacks from President Donald Trump, a trade war, and the start of the coronavirus outbreak. Yet its winning streak has faded in recent weeks as investors prepare for record borrowing to fund trillions of fiscal and monetary stimulus. A sinking national savings rate also stands to drag on the dollar, Roach told CNBC’s “Trading Nation.”

“The US economy has been afflicted with some significant macro imbalances for a long time, namely a very low domestic savings rate and a chronic current account deficit,” he said. “These problems are going to go from bad to worse as we blow out the fiscal deficit in the years ahead.”

Looming shifts in the global manufacturing industry will create a more long-term pressure on the currency, the Yale University senior fellow added. Several experts project the US will promote domestic production and move away from increasingly complex supply chains. Roach sees such a transition taking place over the next couple of years and sealing the dollar’s fate.

“Generally, it’s a negative implication for US financial assets,” he said. “It points to the probability of higher inflation as we import more higher-cost foreign goods from overseas, and that’s negative for interest rates.”

"Forbes Georgia-ის სარედაქციო ბლოგპოსტების სერია "როგორ გამდიდრდა“ და "საქართველო რეიტინგებში".