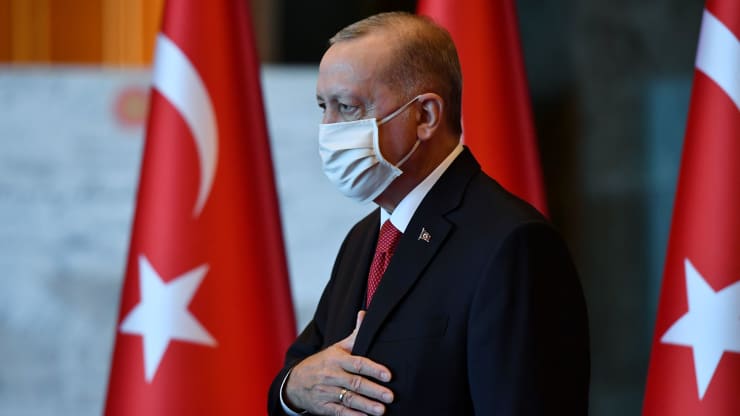

Inflation, a currency drop and rapidly depleting foreign exchange reserves: These are among the risks investors and emerging market economists are warning of following Turkish President Recep Tayyip Erdogan’s firing of his hawkish former central bank chief over the weekend.

The move, which represented the third such sacking in two years, sent the Turkish lira’s value plunging — but Erdogan maintains that the economy is just fine, telling his ruling AK Party members in a speech Wednesday that this week’s market volatility doesn’t reflect Turkey’s economic reality, according to a Reuters translation.

In the same speech, however, he urged Turks to sell their foreign exchange assets and gold and buy lira-based financial instruments, in an effort to stabilize the beleaguered currency that’s lost 10% of its value since Friday.

“The return of volatility,” read the headline of an analyst note from Barclays on Monday. “Risk of currency crisis grows,” wrote London-based firm Capital Economics. It described how former central bank Governor Naci Agbal, who had set out to tackle Turkey’s double-digit inflation by raising its key interest rate by 875 basis points since taking the job in November, had imbued confidence in investors.

But Erdogan has long been of the unorthodox view that higher interest rates cause inflation and are “evil.” Analysts say it was only a matter of time before Agbal was replaced with someone more malleable to Erdogan’s views, stoking investor fears over the central bank’s lack of autonomy and a coming inflation and currency crisis.

Agbal’s replacement, Sahap Kavcioglu, many Turkey experts say, lacks experience in the field and has a history of criticizing interest rate hikes, sparking worries of uncontrolled inflation.

“It looks like the central bank’s efforts to fight the country’s inflation problem may come to an end, and a messy balance of payments crisis has become (once again) a real possibility,” Jason Tuvey, senior emerging markets economist at Capital Economics, wrote. Turkey’s inflation is at 15%, youth unemployment is at 25% and the dollar is up more than 10% on the lira since the firing.

“The summary dismissal of Agbal ranks among the most counterproductive government actions in Turkey’s recent history,” Erik Meyersson, senior economist at Handelsbanken Macro Research in Stockholm, told CNBC. “It will instantly erode any credibility built up during Agbal, increase the risk premium on Turkish financial assets, and force the remaining policymakers to walk an even more difficult tightrope going forward.”

The Office of the Turkish Presidency did not reply to a CNBC request for comment.