The Republic of Georgia offers multiple tax benefits to IT firms registered in Georgia who provide services abroad. In particular, IT companies in Georgia holding the status of a “Virtual Zone Person” (VZP) or the status of an “International Company” (IC) can enjoy various tax incentives.

Based on my experience and knowledge of the Georgian tax legislation, I will briefly explain the pros and cons of VZP and IC statuses, as well as compare them to each other in this article.

“Virtual Zone Person(VZP)”

An IT firm in Georgia, with a VZP certificate can enjoy full exemption from corporate income tax (CIT) on specific types of IT activities performed from Georgia for foreign customers. It is a highly beneficial tax exemption; however, it is not as straightforward as many people (including some accountants) think.

I have highlighted the words “specific types of IT activities” above, as VZP status DOESNOT apply to all types of IT services. Moreover, tax exemption does not apply to all IT firms holding a VZP certificate.

There is a misconception among some entrepreneurs and tax professionals that VZP exemption applies to any type of IT services being provided abroad from Georgia. This view is not entirely correct. In fact, there is an important precondition for qualifying under VZP status, and even if VZP status is obtained, it is not a guarantee of being exempt from CIT.

The precondition for qualifying under VZP status is performing IT activities from Georgia to foreign clients where software products (e.g., software, mobile applications, etc.) are created.

As already mentioned, the above is the precondition for granting VZP status, which, from my point of view, eliminates quite a long list of IT services. Besides, even if an IT firm obtains VZP status from Georgian authorities, it is still not a guarantee of tax exemption (see the citation of the exemption clause below).

In other words, if the IT service performed by a VZP does not create applications, software, or other IT products, then such services do not qualify under the VZP exemption. For example, if your IT company provides website maintenance or other IT support services, or a company already owns a software/mobile application and receives a subscription fee, it is unlikely that this company can qualify for the tax exemption offered to VZP companies (VZP status may still be obtained though).

The IT firm in the example above might have problems obtaining status of a VZP, but even if VZP status is obtained (it is easier than the exemption),the problem of qualifying for tax exemption might remain unsolved.

The Citation of the Definition of VZP (Article 8 of the Georgian Tax Code)

“A virtual zone person – a legal person engaged in IT activities and holding an appropriate status.

Information Technologies (IT) – studying, supporting, developing, designing, producing, and introducing computer information systems, as a result of which software products are obtained (created).”

VZP Tax Exemption Clause (Article 99 of the Georgian Tax Code)

“Profit (distribution of profit) earned from the supply of information technologies (IT-defined above) outside Georgia developed by a legal entity of a virtual zone;”

You see that the definition of “IT” according to the Georgian tax law is narrowed to the activity of creating software products (even here some additional questions exist e.g., does involvement in the creation of software suffice?). Moreover, following the clause of tax exemption of VZPs, the supply of IT developed by VZP is exempt, which does not seem correct tome. In addition, there are other mismatches between different clauses regarding VZP (in the Georgian Tax Code and other laws of Georgia regarding VZPs).

It is not fully clear whether lawmakers intended to provide tax exemption only on profit received from the service of creating software in Georgia. Nevertheless, intentionally or unintendedly, they set the important precondition in the definition and not all IT services are exempt.

Considering all the above, in my opinion, enjoying VZP exemption without a preliminary analysis might be associated with material tax risks. The tax risk exists until at least the tax administration publishes an instruction making all vague wording clear, until the wording is changed or until the advance tax ruling is obtained on that issue by the taxpayer.

On the other hand, a tax inspection might not be initiated in your company for a very long time and even if one is initiated, tax inspectors might not pay attention to the details of what the VZP company actually does. However, in my opinion, this low probability should not be a reason for disregarding existing tax risks. This is what I always recommend to my clients (not to rely on the probability of never having a tax inspection), but as ever the last decision is always the business owners’.

To obtain almost full tax certainty regarding Virtual Zone Person’s tax exemption, in some cases (e.g., if the risk is relatively high and if the turnover of VZP is medium-high) the best way to proceed is applying for an advance tax ruling issued by Georgia’s Revenue Service (GRS), which is a legally binding document for the Georgian tax administration – thereby providing high tax certainty.

Lastly, it is important to note that if you obtain the status of a VZP, no one from the tax administration will immediately come to you and say that you are not qualified for tax exemption in Georgia. You will know exactly whether you qualify for an exemption only if a tax inspection is initiated by the audit department (where I worked for more than seven years) or in case of an advance tax ruling being issued by the GRS for your firm. I am referring

to cases when development of software products is not obvious, for other cases a proper analysis might suffice.

Georgian tax authorities have started requesting information from VZPs regarding total income and the amount of exempt profit due to the VZP clause. It seems they are starting to pay more attention to this topic.

“International Companies (IC)”

Tax benefits applicable for Georgian entities with the status of “International company” are relatively new in the Georgian tax legislation. This status applies to IT and shipping companies and to a quite long list of IT services (that differ from “Virtual Zone Persons”).

The status and tax benefits of “International companies” apply to much more IT services than in the case of “Virtual Zone Persons”. Besides, it is much clearer which IT activities qualify under the incentives granted for ICs (the list of IT activities qualifying under IC status are provided by the law, sometimes together with NACE codes of such business activities).Therefore, higher clarity is provided by the law regarding ICs than regarding VZPs.

Tax Incentives Applicable for “International Companies”

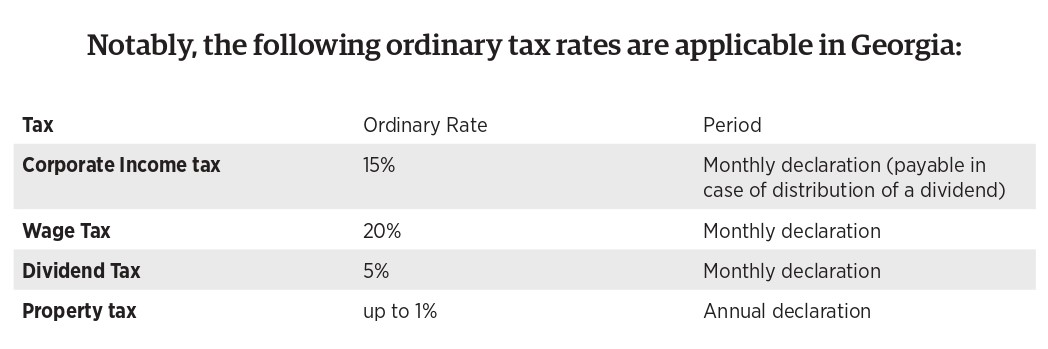

- 5% corporate income tax (instead of 15%)

- 0% dividend tax (instead of 5%)

- 5% wage tax (instead of 20%)

- 0% property tax for assets used in activities performed under “an international company” status (instead of about 1%)

- The possibility to further decrease corporate income tax by taking into account salaries paid to Georgian resident employees and for R&D expenses.

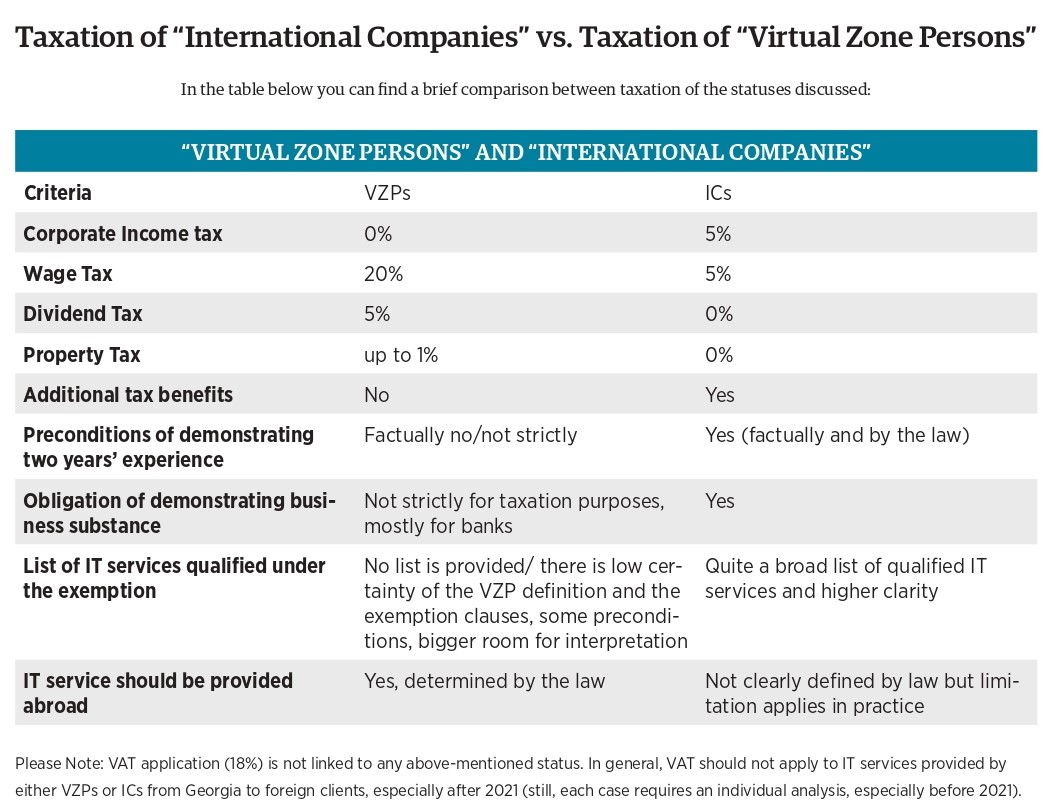

As I have already noted, benefits for “International companies” are applicable to more types of IT services when compared to VZPs. There is much more clarity as well as multiple tax incentives and exemptions for ICs, while VZPs are exempt only from corporate income tax.

Conversely, if a company plans to obtain the status of an international company, it should demonstrate at least two years’ experience in IT (experience of a parent company might suffice). In addition, business substance in Georgia (actual expenses accrued, staff hired, offices rented, and so on) should be demonstrated. These requirements do not apply to the law for “Virtual Zone Persons”.

Please be aware that a status provided by the Georgia Revenue Service (e.g., “VZP”, “Small Business”, “International Company”, or being registered in the “Free Industrial Zone”) is not a full guarantee of tax exemption. Certificates of VZP, IC and other special statuses are not binding by law for Georgian tax authorities. Obtaining the status is relatively easy than actually being qualified under the exemption. So, enjoy the tax benefits, but please do it only after a proper and thorough tax analysis of your case.

Conclusion

Georgian IT firms can either obtain the status of “Virtual Zone Person” or the status of an “International Company”. In both cases, highly beneficial tax benefits apply, however, there are several differences between the two statuses.

The most important difference is that less types of IT services qualify under VZP exemption than under the “International Company” exemptions. Besides, IC is characterized with a higher tax certainty compared to VZPs. Having said this, it is more complicated to receive the status of an “International Company” than to be granted a certificate of VZP, because the former requires two years of experience and business substance in Georgia. Importantly, different tax rates apply for the two statuses.

Gela Barshovi is an international and Georgian tax adviser and a managing partner of the Tbilisi-based accounting/consulting firm TPSolution. Regarding business incorporation, tax consultation, and/or accounting services, you can reach out to him directly at gela.barshovi@tpsolution.ge