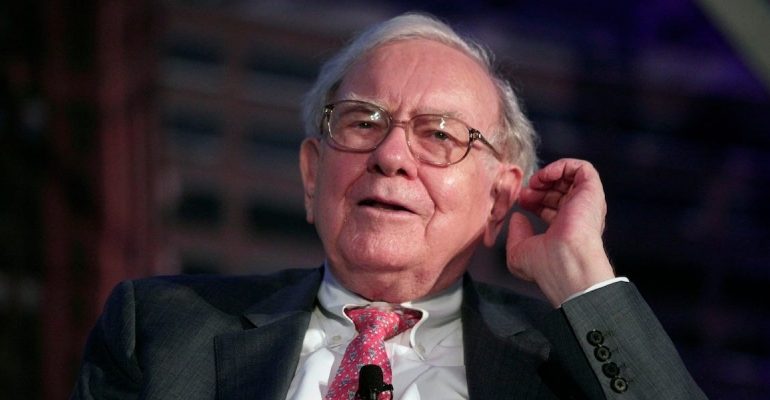

Warren Buffett’s stake in Apple has surged in value to more than $91 billion, and now accounts for a record 43% of Berkshire Hathaway’s entire equity portfolio, according to The Motley Fool.

The famed investor’s conglomerate held 245 million shares in the tech titan at last count, making it Apple’s second-largest shareholder with about 5.5% ownership of the company’s public stock.

Apple stock has jumped 24% this year to close at an all-time high of $374 on Monday, meaning Berkshire has scored an $18 billion gain on its shares in just over six months. Its Apple stake is now worth more than 20% of its $445 billion market capitalization.

“I don’t think of Apple as a stock,” Buffett told CNBC’s “Squawk Box” in February. “I think of it as our third business.”

Berkshire built its Apple position at an average cost of $141 per share, Buffett told CNBC in February 2019.

It has cashed out about 10 million shares since then, while its core holding of 145 million shares has ballooned in value by 150%, or more than $55 billion, since the start of 2019.

"Forbes Georgia-ის სარედაქციო ბლოგპოსტების სერია "როგორ გამდიდრდა“ და "საქართველო რეიტინგებში".